Original price was: $199.8.$79.5Current price is: $79.5.

-

D

-

H

-

M

-

S

Category: M&A Transaction and PMI Planning

Our 3-Stage Path to DD Mastery

Transform financial theory into practical, deal-ready expertise

through our structured, application-driven methodology.

Example of the AI-driven Interactive Deal Simulation

Course Content

📖 I. Preparation for M&A Due Diligence

1. Introduction to M&A Due Diligence

You don't currently have access to this content

3. M&A Data Room

You don't currently have access to this content

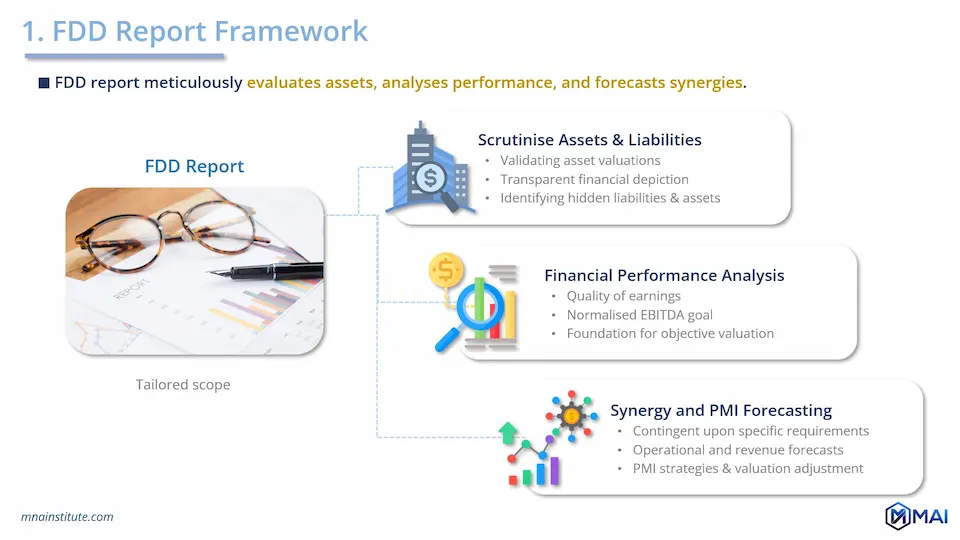

4. NDA and LOI

You don't currently have access to this content

5. Working with M&A Advisors

You don't currently have access to this content

📖 II. CDD, Tech DD, and IT DD

6. How to Conduct Commercial Due Diligence

You don't currently have access to this content

7. How to Write a CDD Report

You don't currently have access to this content

8. Technology Due Diligence in Practice

You don't currently have access to this content

9. IT and Production Technology Due Diligence

You don't currently have access to this content

💡🤖 AI Simulation Exercise for Section I and II

🧭 Strategic M&A Due Diligence Execution

You don't currently have access to this content

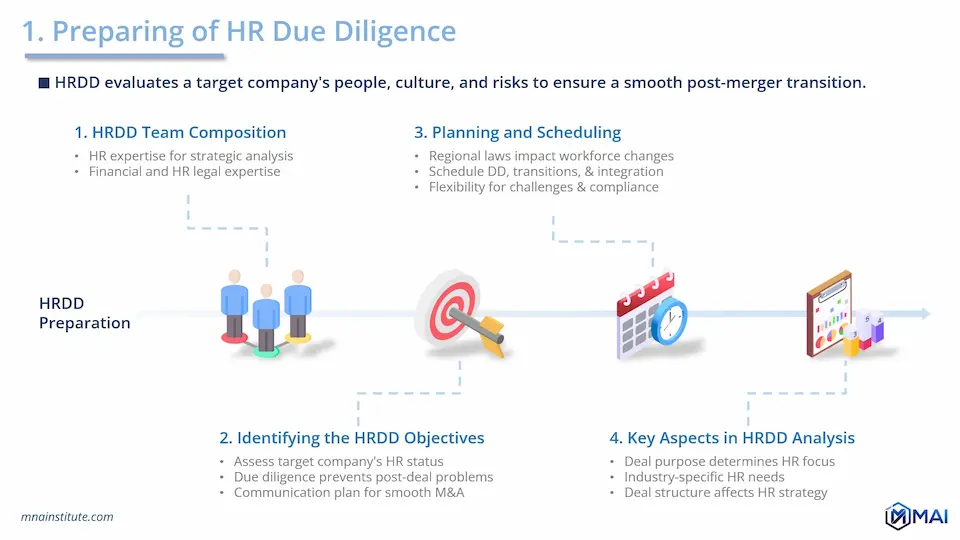

📖 III. FDD, Tax DD, and Pension DD

11. FDD Practical Methodologies

You don't currently have access to this content

12. Strategies for Tax Due Diligence

You don't currently have access to this content

13. Advanced Practices and Reporting of TDD

You don't currently have access to this content

14. Practical Guide to Pension Due Diligence

You don't currently have access to this content

📖 IV. Legal DD, IP DD, and Regulation DD

15. Practical Guide to Legal Due Diligence

You don't currently have access to this content

16. Strategic Approach to IP Due Diligence

You don't currently have access to this content

17. Mitigating Risks with Antitrust Due Diligence

You don't currently have access to this content

18. Environmental Due Diligence for Green Light

You don't currently have access to this content

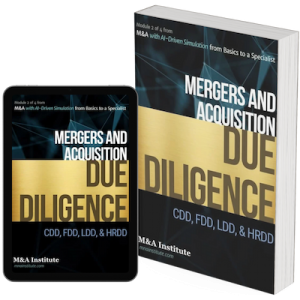

📖 V. HR DD, Culture DD, and Management DD

19. Strategic Framework for HR Due Diligence

You don't currently have access to this content

What You Will Gain from This Module

By completing this M&A Due Diligence course, you will achieve: