Original price was: $199.8.$79.5Current price is: $79.5.

-

D

-

H

-

M

-

S

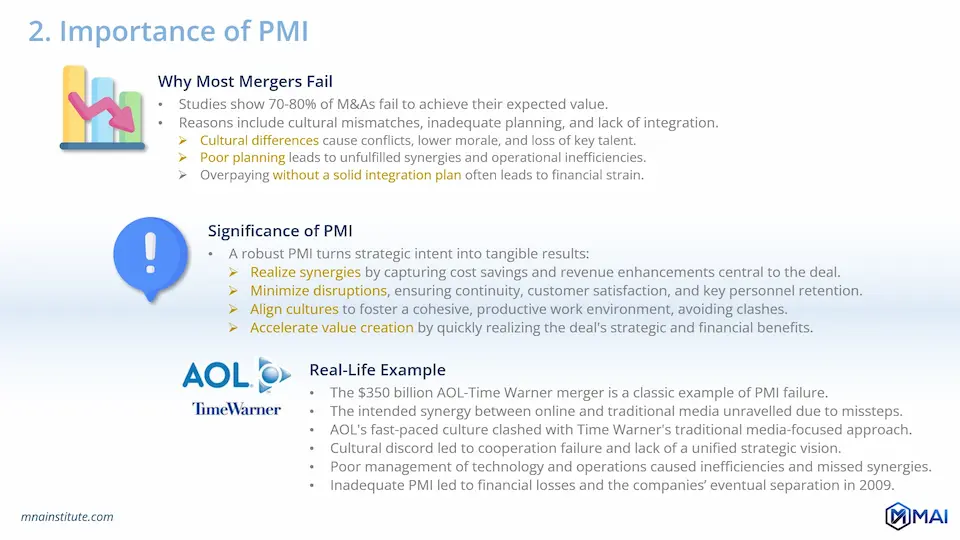

Category: M&A Transaction and PMI Planning

Our 3-Stage Learning Process

Transform theoretical understanding into actionable expertise

through our structured, AI-integrated methodology.

Example of the AI-driven Interactive Deal Simulation

Course Content

📖 I. PMI Pre-Planning and IMO establishment

Ch 2 – PMI Planning in M&A Process

You don't currently have access to this content

Ch 3 – Accelerating Effective Integration

You don't currently have access to this content

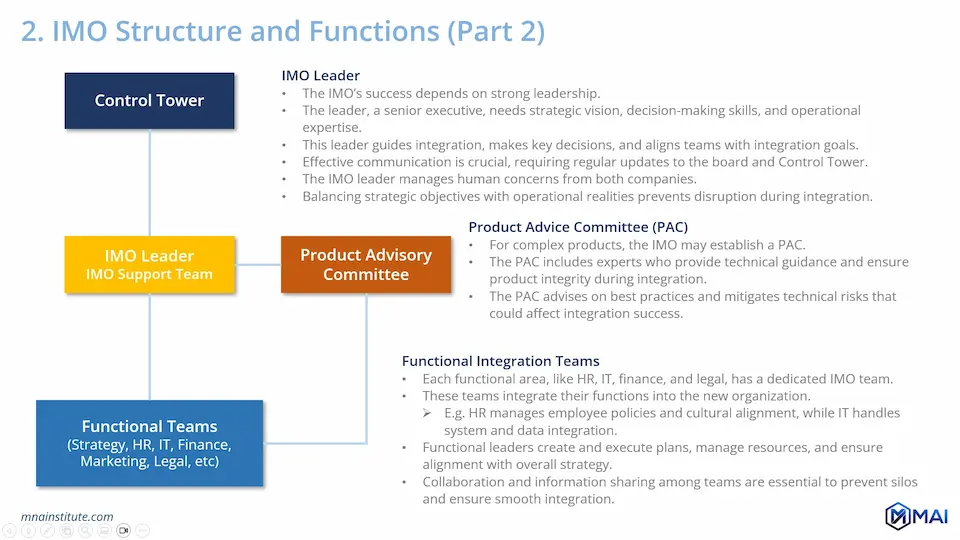

Ch 4 – Establishing an IMO

You don't currently have access to this content

Ch 5 – PMI Pre-Planning Simulation

You don't currently have access to this content

📖 II. PMI Planning and Simulation

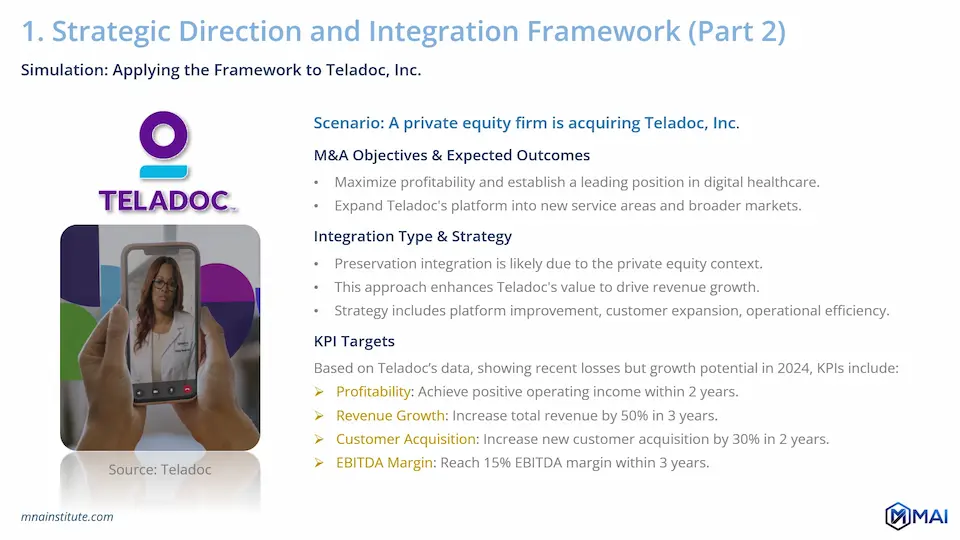

Ch 6 – The Strategy Team’s Role in PMI Planning

You don't currently have access to this content

Ch 7 – Strategy Team’s PMI Planning Practice and Simulation

You don't currently have access to this content

Ch 9 – HR Teams’s Strategic Role in PMI

You don't currently have access to this content

Ch 10 – HR Team’s PMI Planning Practice and Simulation

You don't currently have access to this content

Ch 11 – Finance Team’s PMI Planning Practice and Simulation

You don't currently have access to this content

Ch 12 – Sales & Marketing Team’s PMI Planning Practice and Simulation

You don't currently have access to this content

Ch 13 – Supply Chain Team’s PMI Planning Practice and Simulation

You don't currently have access to this content

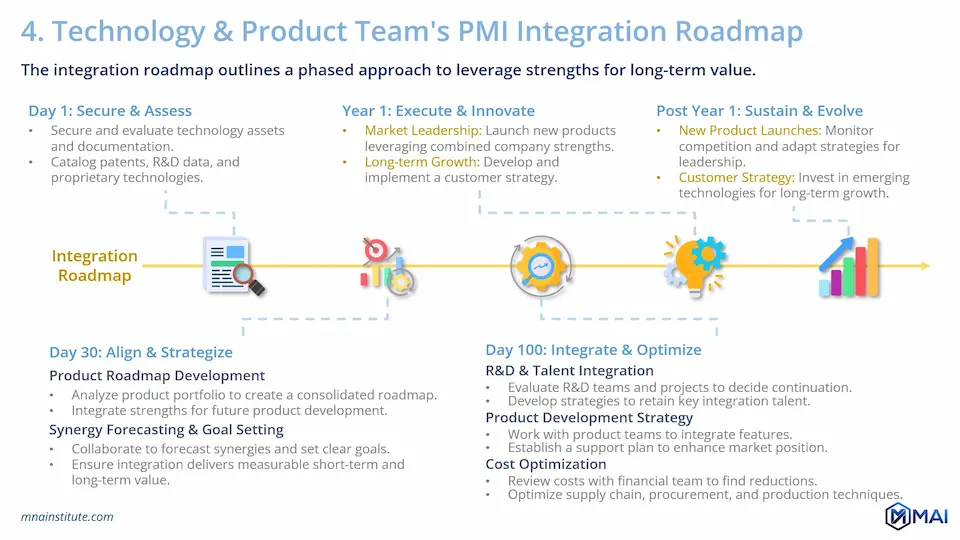

Ch 14 – IT Team’s PMI Planning Practice and Simulation

You don't currently have access to this content

Ch 15 – Legal, Property, and HSSE’s PMI Planning Practice and Simulation

You don't currently have access to this content

💡🤖 AI Simulation Exercise

🤝 PMI Simulation

You don't currently have access to this content

What You Will Gain from This Module

By completing this post merger integration course, you will achieve: