Technology Due Diligence in M&A

In the rapidly evolving landscape of mergers and acquisitions, the role of technology due diligence (TDD) has become increasingly significant. As companies seek to merge with or acquire entities across borders and sectors, understanding the technological foundations, capabilities, and future scalability of a target entity is paramount. Technology due diligence is not just about evaluating the current technical assets; it’s a strategic exploration into how these assets align with market demands and future trends.

In this blog post, we delve into the essence of technology due diligence, dissecting its importance in M&A decision-making across various industries. From biotech to software, energy to manufacturing, Technology Due Diligence serves as a critical tool in assessing technological innovation, scalability, efficiency, and integration potential. We will explore the intricacies of conducting effective Technology Due Diligence, from defining its scope and role to outlining a practical methodology for its execution, culminating in a comprehensive understanding of its impact on the M&A process.

Technology Due Diligence: Definition and Role

Technology due diligence transcends technical assessment to evaluate the market viability and evolution potential of a target’s technology. Its role in M&A decision-making is crucial across sectors like biotech, software/IT, energy, and manufacturing, influencing valuation and strategic fit.

The Procedure of Technology Due Diligence

Conducting technology due diligence involves a comprehensive bottom-up approach:

- Technology Assessment: Evaluating the target’s technology against market needs and future development plans.

- Team Composition: For scale acquisitions, in-house experts lead the assessment. In scope acquisitions, external specialists offer critical insights.

- Market and Regulatory Analysis: Understanding the target’s position in the market and compliance with regulatory standards.

Assembling the Task Force

Selecting the right technology due diligence team is essential:

For scale acquisitions, where the target’s technology is familiar, the task force should primarily include in-house experts. These professionals are already acquainted with similar technologies, offering valuable insights for a thorough evaluation. The team might consist of internal senior engineers, industry experts, and the product development team.

For scope acquisitions, where the target’s technology is outside the acquiring company’s domain, enlisting external specialists is recommended. This should include technology consultants, IP attorneys, and market analysts, especially those with a proven background in the relevant technology sector.

In M&A transactions, technology due diligence is a key determinant of a deal’s success, offering deep insights into technological capabilities and market alignment. A well-executed Technology Due Diligence process, supported by a diverse team of experts, is essential for informed decision-making in the M&A landscape.

Technology Due Diligence in Key Areas of M&A

The TDD process is crucial for assessing the value and potential of a target’s technological assets. We delve into the steps involved in TDD practice, specifically focusing on product architecture, market alignment, commercial viability, and intellectual property.

Evaluation of Technology and Product Architecture

1. Technology Assessment

Technology due diligence begins with a thorough evaluation of the target’s technology:

- Technical Specifications Review: Analysing the technical aspects to understand functionality and scalability.

- Performance and Operational Functionality: Assessing the technology’s current performance metrics and operational capabilities to determine its intrinsic value.

2. Market Alignment

Understanding how the technology fits within the market:

- Strategic Market Analysis: Examining market trends, customer needs, and the competitive landscape to evaluate the technology’s market relevance.

This facet informs whether the technology is poised to capture market share or is on the brink of obsolescence.

3. Cost and Commercial Viability

Determining the financial prospects of the technology:

- Analysing Production Costs and Revenue Streams: Investigating the cost structure and forecasting future cash flows to assess profitability.

It requires not only scrutinising the current cost structure but also projecting future cash flows in light of the anticipated market expansion and potential pricing strategies.

Real-World Application: AstraZeneca’s Oncology Division

Applying Technology Due Diligence to AstraZeneca’s Oncology division involves a thorough examination of the underlying technology in their oncological products.

- This commences with assessing the precision and efficacy of their biotechnological tools, such as targeted therapy platforms, to ensure they meet clinical needs and offer competitive advantages in precision medicine.

- The assessment would consider the robustness of the tech against stringent healthcare standards and its potential for addressing unmet needs in the oncology market.

- Furthermore, the financial aspect of Technology Due Diligence examines the costs incurred in developing these oncological technologies against their market potential. It scrutinises R&D spending, production expenses, and anticipated market penetration rates to forecast the profitability and long-term market presence of AstraZeneca’s oncology treatments.

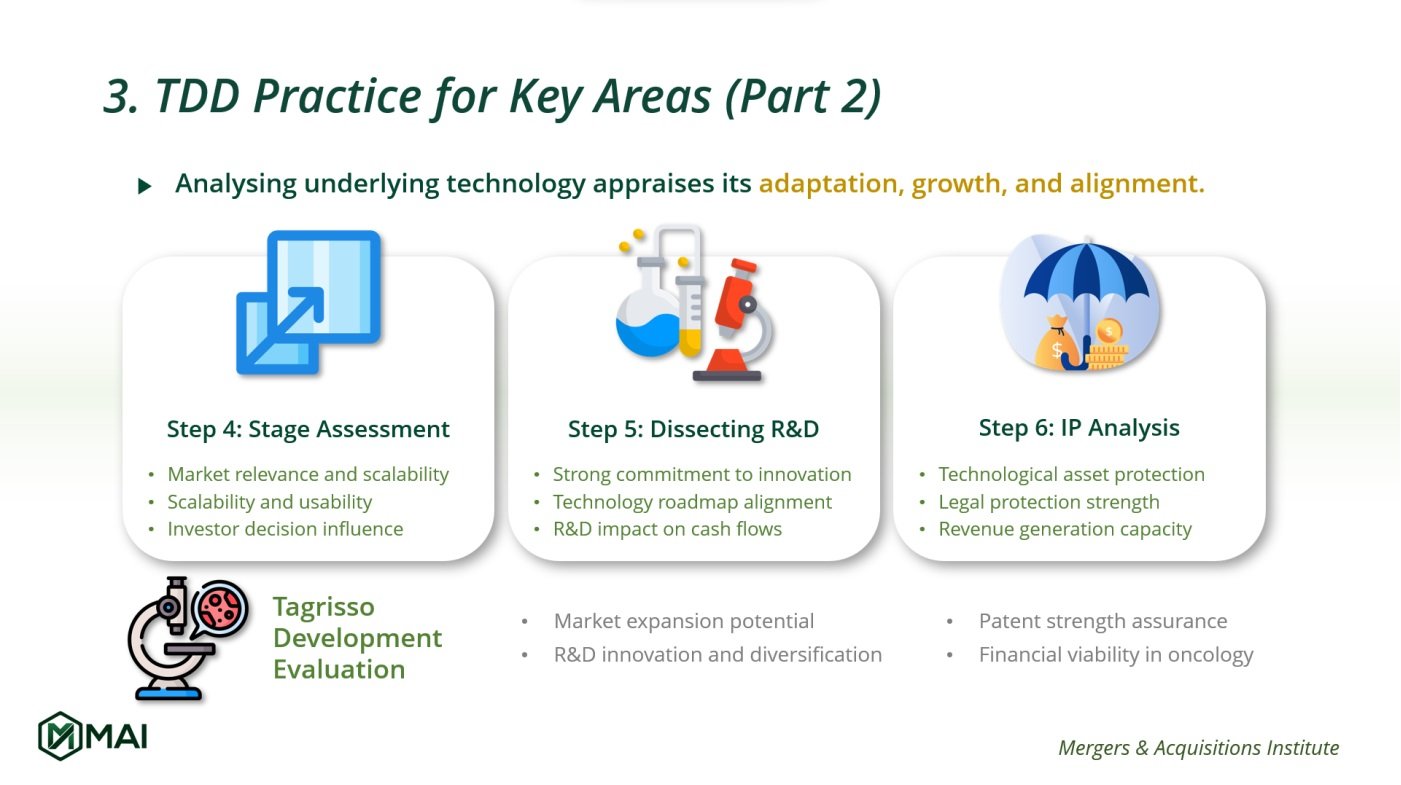

Analysing Underlying Technology

Diving deeper into the technology’s development stage, R&D projects, and IP protection. Analysing the underlying technology is a strategic step to appraise its adaptation, growth prospects, and market alignment.

4. Development Stage Assessment

Evaluating the technology’s current stage and future scalability:

- Tracking Progress: Understanding the technology’s usability and adaptability in the market.

This step charts the progress from conception to deployment, considering usability and adaptability across various applications. It gives investors a clear picture of the technology’s evolution and its readiness for market challenges, directly influencing investment decisions and integration strategies.

5. Dissecting R&D Projects

Understanding the innovation potential:

- Examining Ongoing Research: Assessing the alignment of R&D with the technology roadmap.

By scrutinising ongoing research projects, their progress, and alignment with the technology roadmap, you gain visibility into how R&D efforts could shape future cash flows and impact market presence.

6. IP Protection Analysis

Ensuring the technology is legally protected:

- Evaluating IP Estate: Checking the strength of legal protections around the technology.

This determines the technology’s fortification against market competition and its capacity for revenue generation.

Real-World Application: AstraZeneca’s Tagrisso

In applying these steps to AstraZeneca’s Tagrisso, attention pivots to evaluating its extension from established use in non-small cell lung cancer to potential efficacy in broader oncological treatments.

- The assessment encompasses the developmental progress, including clinical trials and regulatory pathways, to establish its market expansion potential.

- Concurrently, R&D initiatives are analysed for their capacity to innovate and diversify Tagrisso’s application, critically impacting future revenue projections.

- Then, IP review ensures existing patents are robust enough to safeguard Tagrisso’s expanded use, maintaining its market stronghold and financial viability within the competitive landscape of oncology pharmaceuticals.

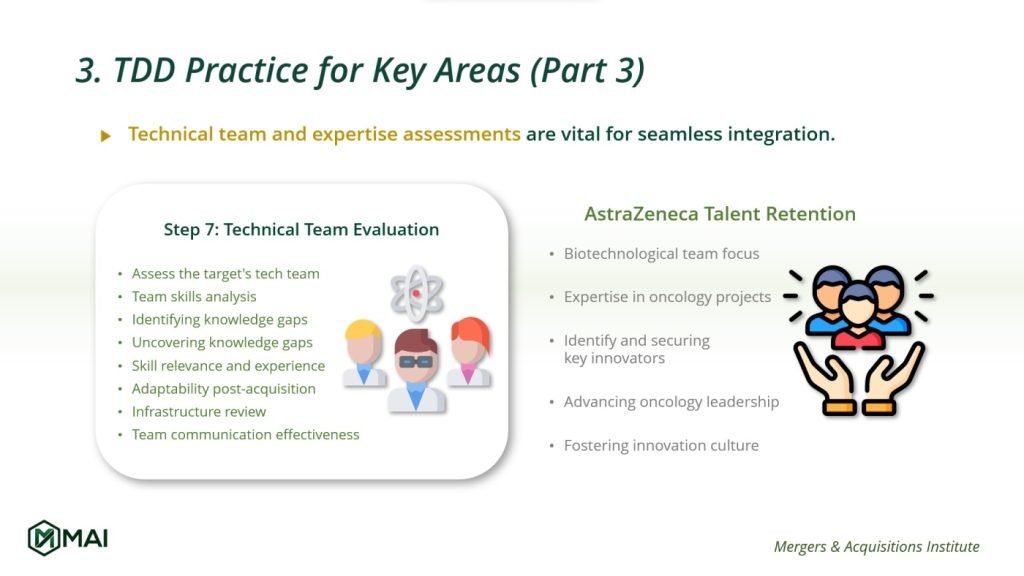

Expertise Assessment in Technology Due Diligence

7. Technical Team Evaluation

The success of technology integration hinges on the capabilities of the technical team:

- Skill Analysis: Assessing the team’s expertise in technology development and data architecture.

- Identifying Knowledge Gaps: Pinpointing areas where additional expertise may be needed.

- Infrastructure Review: Ensuring the team has adequate support, from hardware to communication tools.

Real-World Application: AstraZeneca’s Oncology Division

In the Technology Due Diligence of AstraZeneca’s Oncology division, attention is squarely on the team’s biotechnological mastery. Evaluators dissect how personnel apply their expertise to ongoing and pipeline oncology projects, aligning with the strategic imperatives of AstraZeneca. The process aims to identify and secure key innovators whose skills are central to advancing current treatments and exploring new avenues in cancer care. This ensures AstraZeneca not only upholds but also propels its market leadership in oncology therapeutics. Ensuring the retention of such pivotal talent is not just about maintaining the status quo but about fuelling a culture of persistent innovation.

8. Market Expansion and Regulatory Compliance

Understanding a product’s market reach and financial viability:

- Market Trend Analysis: Employing methods like regression analysis and market segmentation.

- Financial Projections: Assessing the product’s contribution to revenue and growth.

Evaluating a technology’s contribution to a company’s revenue stream often extends into assessing its market expansion and financial feasibility. It is rooted in a meticulous analysis of market trends, competitive landscape, and potential customer base growth and is also involved in assessing a product’s financial viability. Analysts can employ practical methods such as regression analysis, market segmentation, and trend analysis to project market size and growth rates. Should direct data be unavailable, leveraging established market research and synthesising findings from multiple credible sources becomes necessary.

9. Regulatory Framework Evaluation

Navigating regulatory landscapes is crucial:

- Compliance Review: Understanding existing and upcoming regulations.

- Strategic Regulatory Engagement: Collaborating with regulatory experts to navigate market-specific challenges.

Regulations delineate the market’s boundaries and can significantly influence a product’s commercial path. A comprehensive review of existing regulations, upcoming policy changes, and industry-specific compliance requirements is essential. The variety in regulations, from direct product approvals to indirect factors affecting market size, necessitates a thorough understanding of the regulatory landscape. Engaging with regulatory experts, analysing historical precedents, and reviewing similar product journeys provide a roadmap for navigating regulatory hurdles.

Real-World Application: Oncology Market Analysis

- Analysing AstraZeneca’s oncology market involves segment-specific demographic and incidence data. Analysts should estimate growth rates, considering new treatments, generics, biosimilars, and expanding patient demographics. The analysis uses epidemiological studies, healthcare databases, and market reports.

- Assessing its regulations involves tracking product approvals, clinical guidelines, and safety standards. You should monitor regulatory shifts and engage with health authorities. Reviewing regulations for similar products ensures strategic market positioning and the ability to turn regulatory changes into competitive advantages.

Risk Mitigation in Technology Due Diligence

10. Identifying and Mitigating Technical Risks

This step entails the thorough identification of potential technical setbacks and operational challenges.

- Risk Registry Creation: Cataloguing potential risks and their triggers.

- Scenario Planning: Employed to simulate various outcomes and the impact of risk occurrence, allowing for the development of robust contingency plans.

Real-World Application: AstraZeneca’s Oncology Division

For AstraZeneca’s Oncology division, applying a risk mitigation strategy would require a two-pronged approach. Initially, it would involve a comprehensive risk assessment of the division’s biotechnological advancements, where emerging risks such as competitive market shifts, regulatory changes, or intellectual property disputes could be anticipated. Mitigation strategies include:

- Diversifying the research pipeline to reduce reliance on a single technological pathway.

- Enhancing cybersecurity measures.

- Reinforcing IP protocols to protect against competitive infringement.

Additionally, regular dialogues with regulatory bodies would be crucial to stay ahead of policy changes that could affect market strategy.

Conclusion: Comprehensive Technology Due Diligence for M&A Success

In M&A, extensive TDD practice is paramount. Assessing technical expertise, understanding market potential, ensuring regulatory compliance, and effectively mitigating risks are all critical components. A comprehensive TDD sample enables informed decision-making and paves the way for successful technology integration and long-term growth in the dynamic M&A landscape.