What is an Acquisition?

An Acquisition is a deal transaction in which one company acquires the rights to another company’s assets or the entire business by buying shares.

Shares can be paid for in cash, in a share-for-share exchange, or through a leveraged buyout. An acquisition is a term that describes the transfer of ownership from one party to another.

The main difference between the technical terms ‘merger’ and ‘acquisition’ is that after an acquisition, we will still observe two separate entities, unlike in a merger, when two or more companies combine to operate under one new entity. Even when the acquirer buys most of the target’s shares, hence gaining majority ownership & control, the two companies are still usually kept as separate entities.

A merger may or may not follow the acquisition.

https://youtu.be/m2n2pz-zRBI

Types of Acquisitions

The types of acquisitions we will cover are Asset Purchases, Business Purchases, and Share Purchases.

- In an asset purchase, the target company will transfer the rights of ownership of its assets to the acquirer. These assets can be tangible, as in real and physical items such as property, plant and equipment, or intangible, such as patents and trademarks.

- A business purchase involves purchasing an entire business or division of the target company and the buyer obtaining the rights of ownership of all assets and liabilities of that division. Of course, the acquirer will also obtain the division’s customer base after purchasing, which is one of the key motives for this activity.

- A share purchase is when the buyer acquires a target company’s shares directly from the shareholders in exchange for an agreed-upon payment. The portion of shares that can be purchased lies between 0% to 100%, only if the current shareholders agree to sell.

Suppose a share acquirer holds a level of ownership that allows them to control the company, or they acquire at least 50% of the target company’s shares. In this case, we say they have majority control and therefore have the most power over the company.

Why does a company acquire another?

There are numerous reasons why one company may want to acquire another.

These include overcoming entry barriers, obtaining new resources, reducing competition and as a high-profit investment opportunity.

- Many industries have entry barriers to overcome to enter a new market, such as planning, research, costs, legal issues and competition. These entry barriers can be eliminated or overcome by acquiring a company or business division that already resides within the market you want to enter. The entry time will become much shorter and usually much cheaper than if you were to overcome these obstacles yourself.

- Being able to pool together resources is another incentive behind acquisitions. Asset or business purchases give the acquiring company the right to ownership of the target’s assets, which may be helpful to them in the long run. These assets may not necessarily be tangible but can include items such as human capital, intellectual property rights or a particular customer base.

- Seizing market dominance and hence reducing market threat is a primary motive behind an acquisition. Upon acquiring a business, the acquiring company will have access to the target’s customer base, therefore, an increase in market share. Post-acquisition, the brands can either remain separate or merge into one large brand.

- An acquisition can also be utilised as an investment opportunity. Think of venture capital or private equity firms as an example. They aim to acquire and own target companies when they are in a very early start-up stage. The deal prices are usually relatively low, and the targets have the potential for mass growth over time. Venture capital or private equity firms will have an exit strategy for their investments, such as an IPO or selling to an institutional investor, allowing them to sell their company ownership and realise their financial gains.

Companies may find that acquiring another company may not be practical. Joint Ventures can help two businesses to work more collaboratively instead. Companies choose to be involved in Joint Ventures instead so they would not have to pay an excessive premium for acquisition.

Case study of Google’s Acquisition of Android

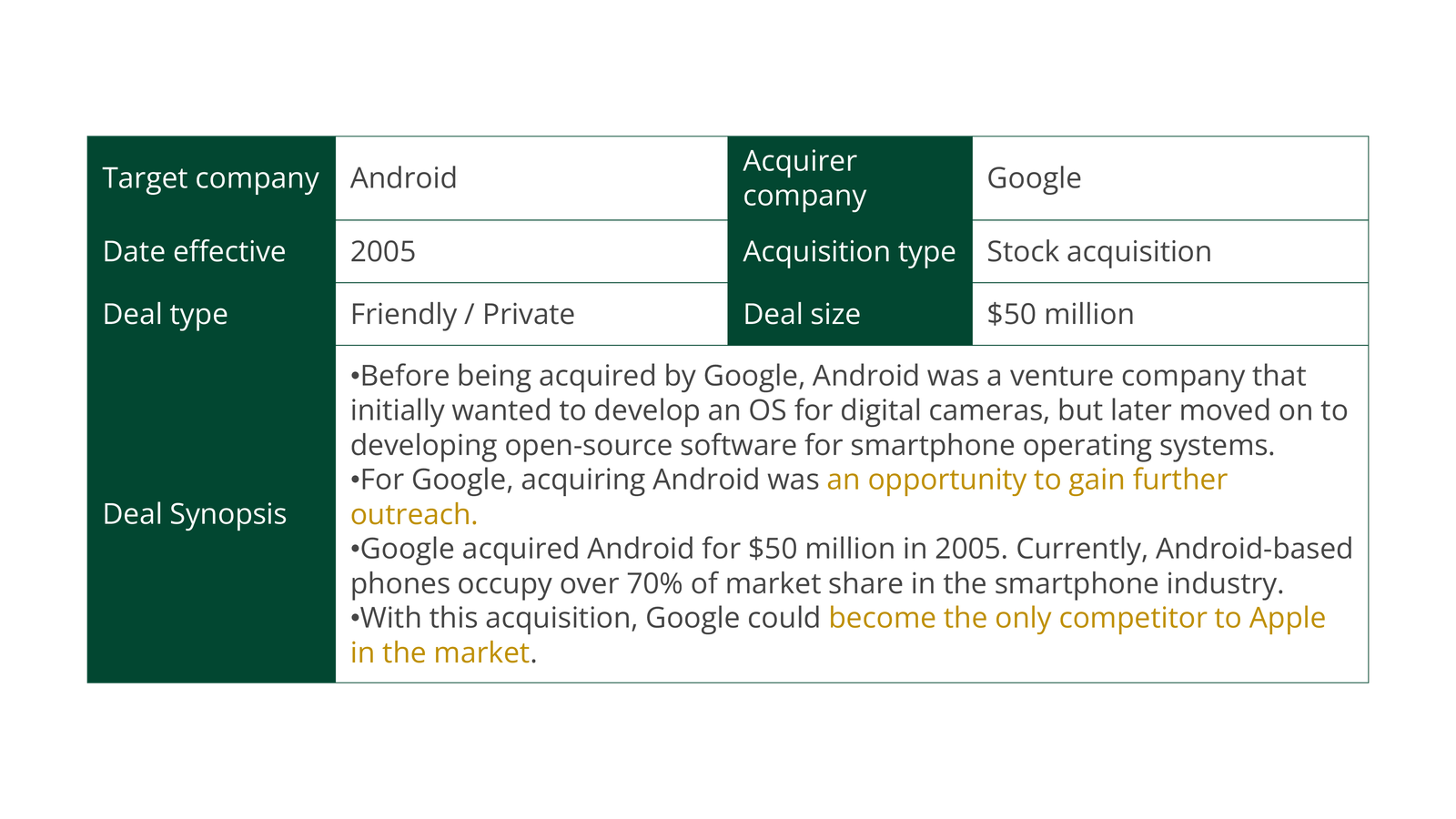

We will now look at a real-world example of an acquisition. This table shows the case of Google’s full acquisition of Android, a deal worth 50 million dollars.

The venture company of 8 employees started in 2003, firstly designing an operating system for digital cameras. The following year, they changed their plans and began developing open-source smartphone operating systems.

It may be surprising that Google spent so much money on a company that gives out free software. However, it was a wise decision.

Google generates revenues primarily from advertisements and data tracking. Upon obtaining the rights to Android, Google was then allowed to put all their applications onto the operating system, make themselves the default search browser, and create even more revenue through the Google Play Store.

Android’s market share is currently over an astounding 70%, meaning 70% of smartphone users generate revenue for Google. As of 2016, it was reported that the Android operating system had created 31 billion dollars of revenue for Google, 22 billion of that being net profit.

Want to delve deeper into your understanding of Acquisitions? Check out Disney’s Acquisition of Marvel.

Here is a list of links we have used for this post to expand our knowledge and practise:

- Android | The platform pushing what’s possible

- Android Help (google.com)

- Google Acquisition History: What Are the Biggest Companies Google Owns? (forex.com)

If you want to learn more, take our online course by logging into the M&A Institute today and find out more.