What are Joint Ventures?

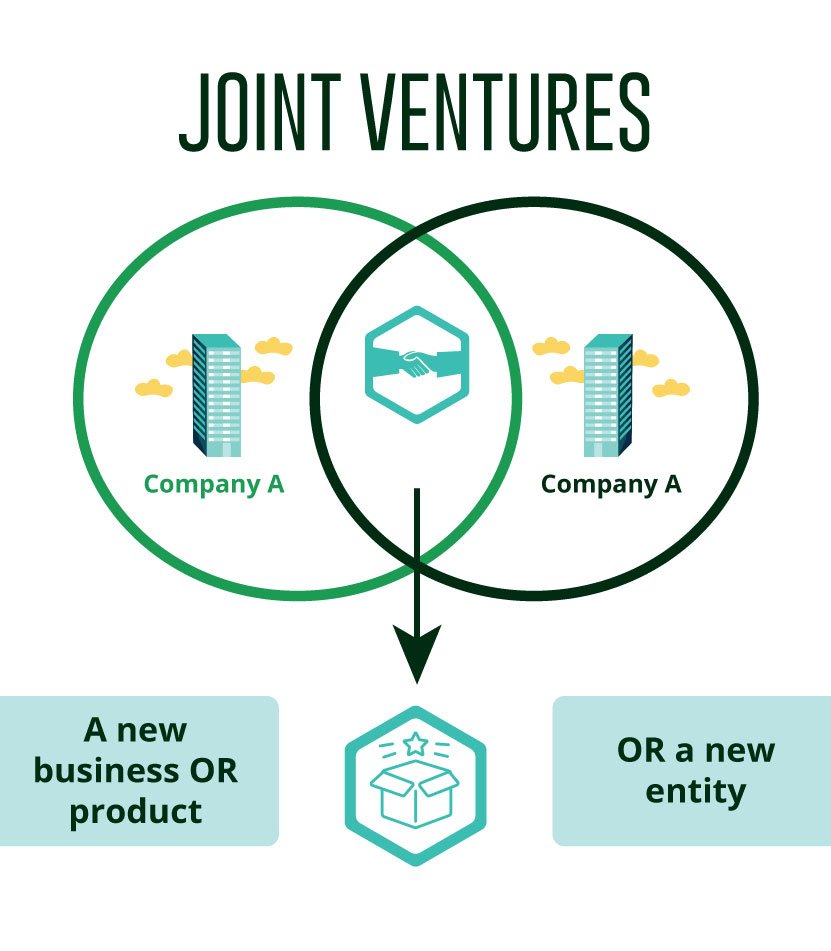

Joint Ventures are when a venture company structure is established by two or more companies to achieve a common goal. Here, the common goal is the overlapped part between companies in their business strategies, even if their business might differ. Ultimately, all participants should be able to create cash flow from the venture in the short or long term. If companies can achieve what each other wants by working together, a joint venture will be worth building. In this sense, a joint venture can be an alternative to M&A because companies could expand their existing business or advance into a new business in a less timely and more cost-effective manner.

Companies may have shared goals for joint ventures in areas such as:

- Joint purchase of raw materials to produce final products

- Selling more of their existing products

- Resource exploration in a new field

- Infrastructure development

- Production work in a new area

- Collaborative research and development of a project

- Or engineering and construction of a large-scale real estate project

Why do companies form Joint Ventures?

Joint Ventures can be great alternatives to M&A because companies could strengthen their existing businesses or enter a new market. Above all, the most significant advantage of joint ventures would be that companies would not have to pay an excessive premium for acquisition. In addition, after acquiring another company, the buyer must integrate the target company through post-merger integration. In the process, it may encounter various unexpected risks due to cultural differences.

However, in Joint Ventures, the companies that become shareholders can retain their own culture and identity. There are many reasons for establishing Joint Ventures, but here let’s look at just four representative ones:

- First, a company may establish Joint Ventures to enter a new sector or industry.

In this case, the businesses of the participants in Joint Ventures may be different. Thus, companies might leverage each other’s various resources. For example, a car manufacturer and a software company can establish joint ventures to develop self-driving cars. Through joint research, they might enter a new future market.

- The second is building Joint Ventures to expand an existing business in another country.

Starting a business in a foreign country can be risky due to different cultures, consumer preferences, and behaviours. Therefore, finding a partner that is very familiar with that local area and setting up Joint Ventures is a very efficient way.

- Thirdly, companies can form a joint venture to strengthen existing businesses further.

In this case, all the participants may have the same or similar businesses. Nevertheless, if they could win-win through collaboration, the Joint Venture is worth it. That is especially true in areas that require significant R&D. Many technology companies, such as software, semiconductor, and game companies, often create new product portfolios while reducing costs through joint ventures.

- Finally, companies get what they want by combining each other’s expertise.

Let’s see that through an example.

Suppose a venture company has invented a new energy tank containing a large amount of LNG in a small capacity using compression technology. But this company is too small to have sufficient facilities for massive production. Meanwhile, let’s say one large shipping company has only fossil fuel vessels. But, the company must only use LNG or renewable energy from fossil fuels for the vessels shortly due to the ESG problem. In this case, the two companies could form Joint Ventures. And then, the venture company could apply its technology and generate cash flow, while the shipping company could operate its existing business in line with ESG regulations.

However, there are also downsides to forming joint ventures:

- It might take a long to reach the goal via a joint venture because it could require work from scratch.

- Another is that disputes may arise between participants because there are more than two participants in one company.

The Structure of Joint Ventures

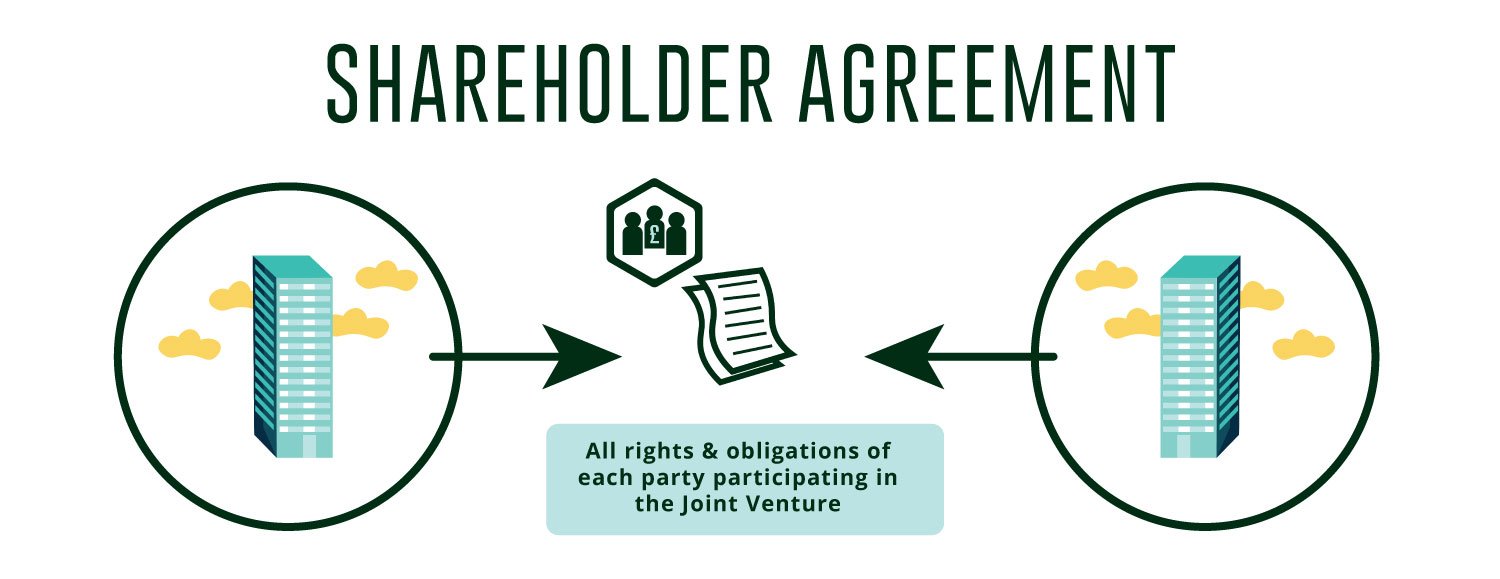

Companies can choose a type when establishing a Joint Venture. Depending on their circumstances and business objectives, legal structures might be corporations, partnerships, limited liability companies, and other business entities. Whatever the structure’s type is, companies participating in the JV will ultimately enter a shareholder agreement. This will include all rights and obligations of each party participating in the JV. Most importantly, the agreement must be concretely specific and straightforward regarding their gains and losses. This is because if the JV business goes well, a dispute may arise between them over profit sharing, and if the JV business does not go well, over liability for losses.

Let’s learn its structure through the following examples.

Case Study of a Joint Venture between Microsoft and General Electric

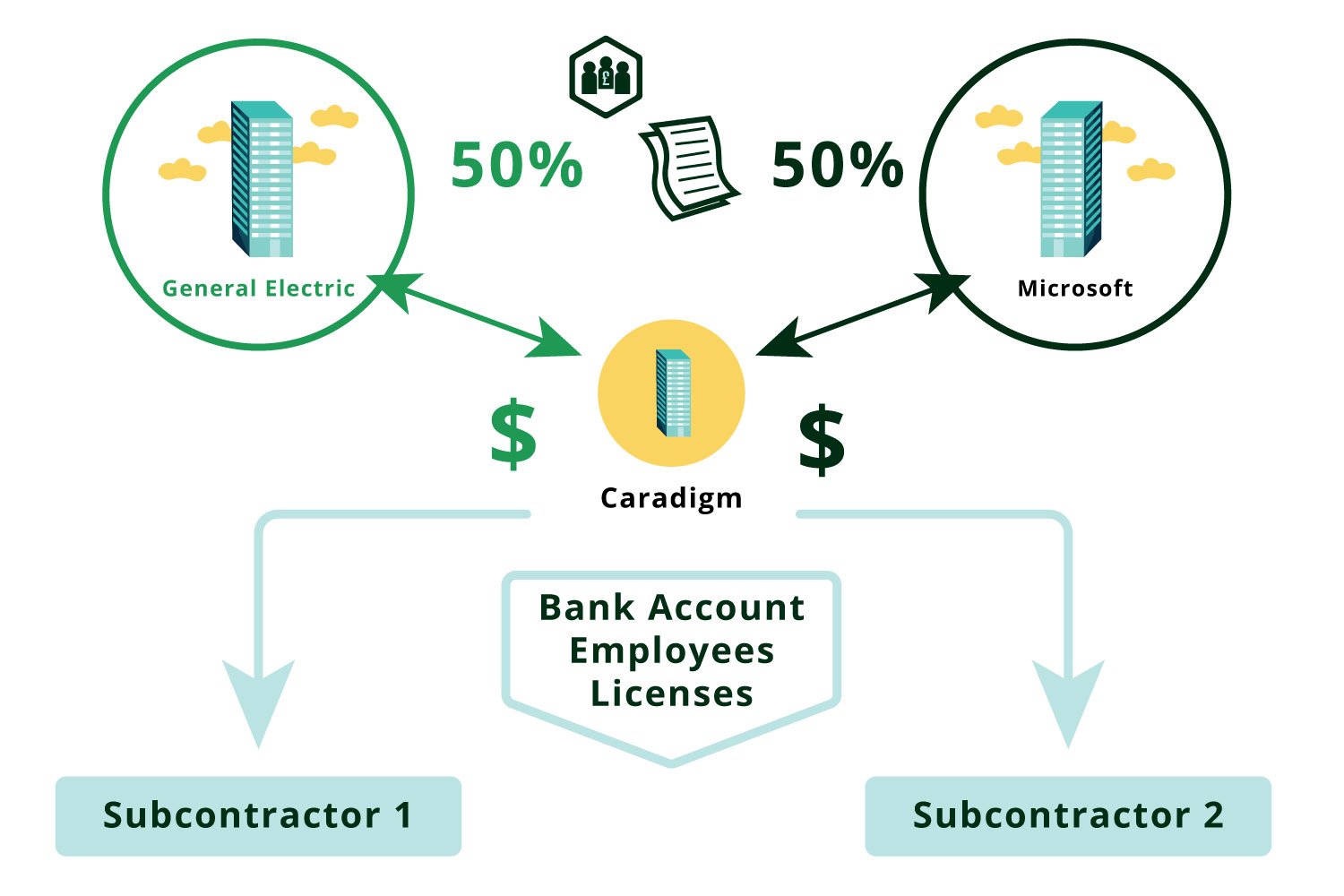

In June 2012, General Electric and Microsoft announced establishing a 50-50 joint venture, Caradigm. Caradigm was a venture company dedicated to developing and selling open health intelligence platforms and collaborative clinical applications. After founding Caradigm, the two companies sent their own people to the new venture. The procedure and structure for establishing a joint venture between GE and MS are as follows.

- First, GE planned to collaborate with Microsoft for more in-depth business advancement in the healthcare IT field.

- Secondly, after the two companies met and shared their vision, GE and Microsoft formed Caradigm, a 50-50 joint venture.

- Thirdly, they completed a shareholder agreement on June 1, 2012.

- Fourthly, GE placed their people and healthcare know-how, and Microsoft contributed their IT technology to the venture to create innovative healthcare solutions.

- Finally, they based Caradigm in Washington as a standalone entity.

Therefore, the new venture would have its own executives, employees, intangible assets and financial statements.

If you have found the information insightful, head over to the M&A Institute, log in and start our online courses now. Or go to our Youtube Channel for further watching! For further studying, check out these articles and case study websites:

- Newsroom | GE Healthcare

- A guide to joint ventures and joint venture structures (burges-salmon.com)

- Joint Venture (JV): What Is It and Why Do Companies Form One? (investopedia.com)

- Microsoft and GE Healthcare Complete Joint Venture Agreement – Stories

- Inspirata Acquires Health Analytics Company Caradigm – Inspirata