Course Structure & Learning Flow

Practical Training Built for Desktop Due Diligence

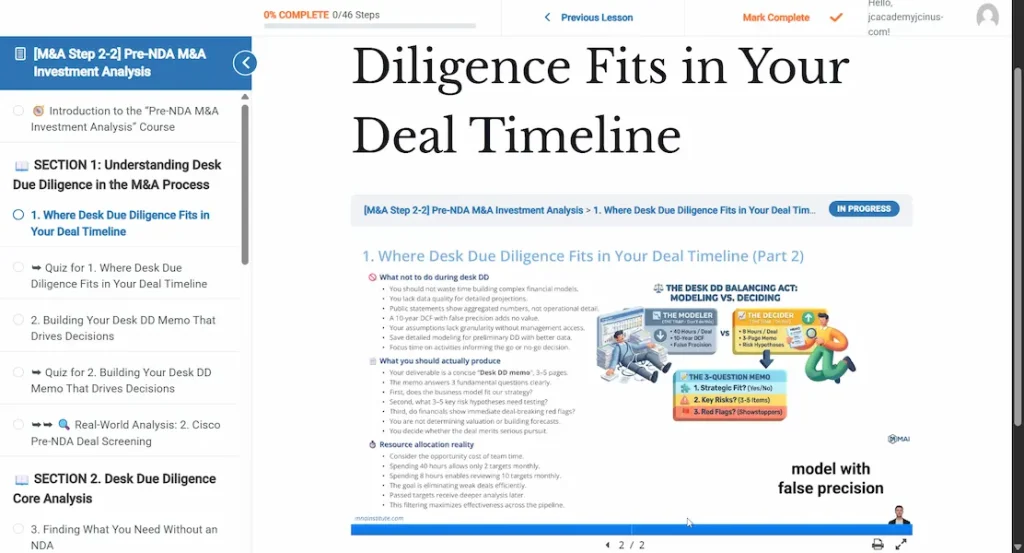

The M&A Institute Learning Interface

Learning Complex M&A Made Effortless

Our learning UI/UX is engineered to transform complex technical data into intuitive strategic judgment.

- Scientifically Designed Three-Layer Interface

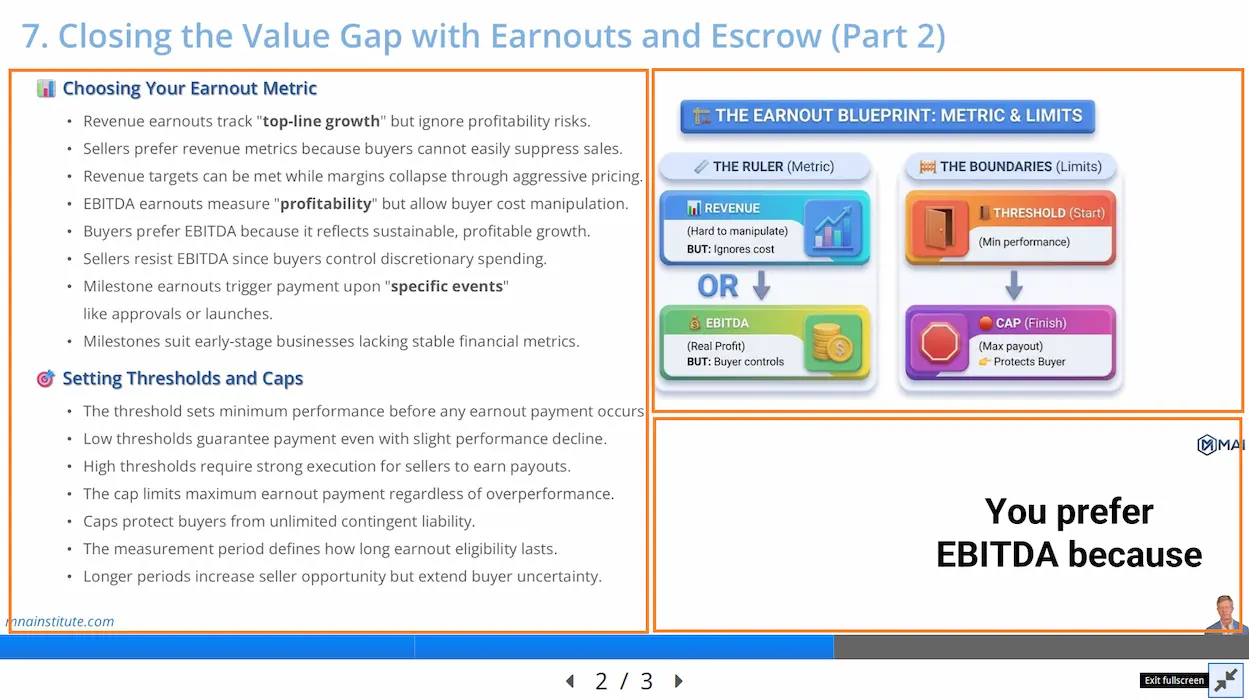

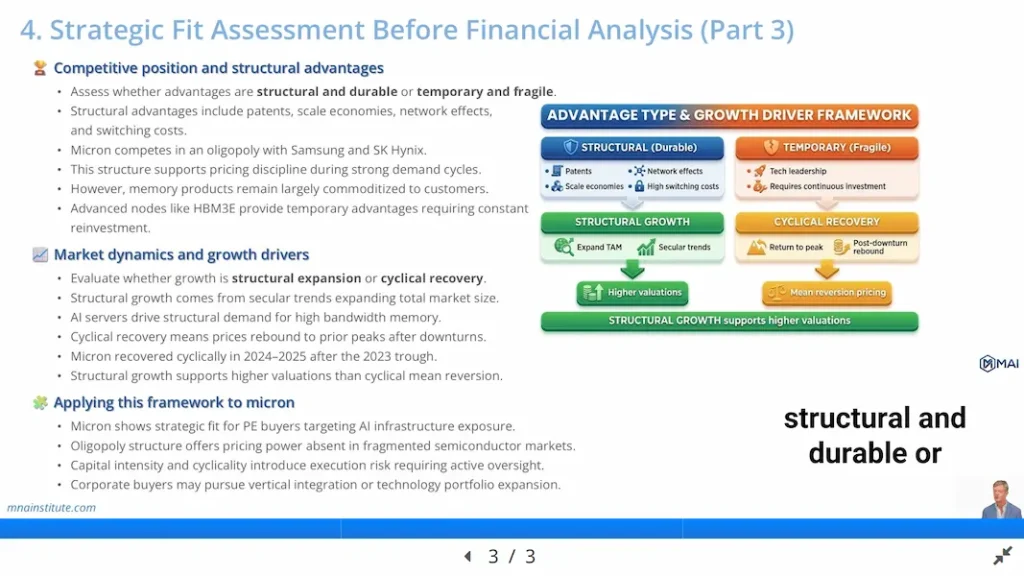

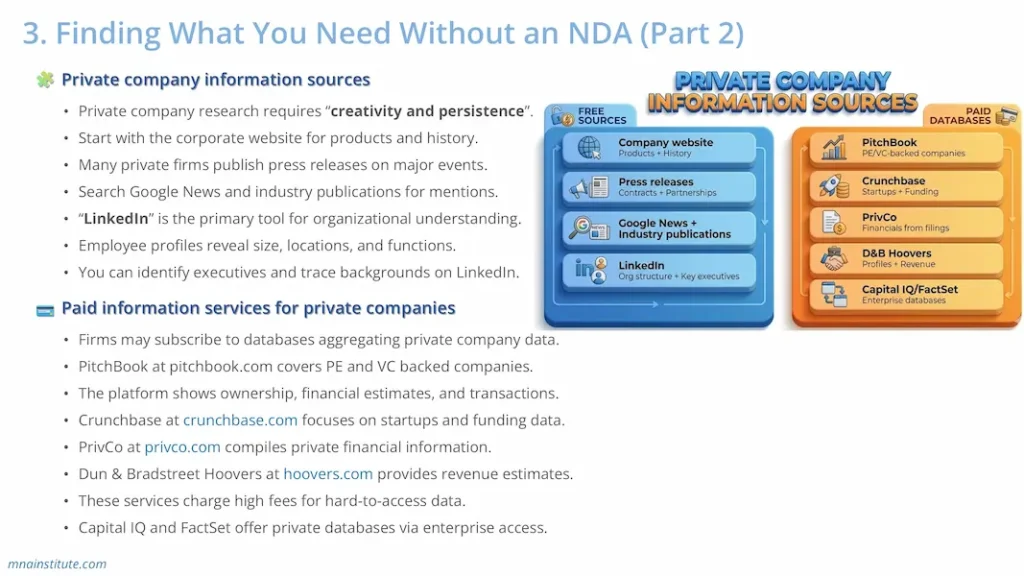

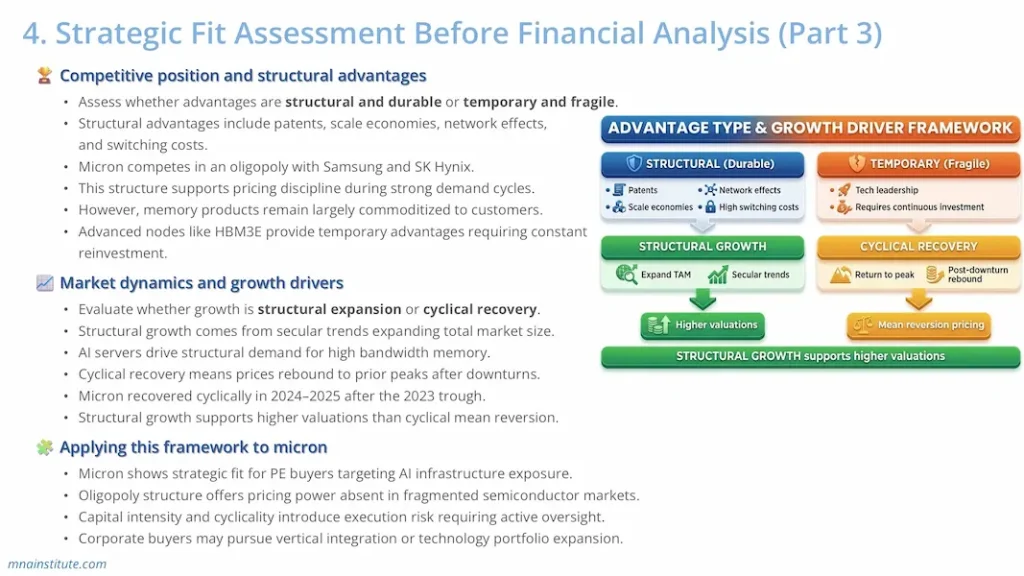

Every lesson follows a three-layer learning structure designed to help learners understand complex concepts quickly and intuitively.# Left Panel: Structured Written Content

Carefully edited bullet points guide you through each concept with clarity. Even reading the text alone ensures full comprehension. As the audio plays, your eyes naturally follow along, reinforcing understanding through synchronized reading and listening.# Right Panel: Visual Infographics

Colorful diagrams translate abstract ideas into concrete visuals. This graphic reinforcement transforms difficult concepts into intuitive, friendly frameworks you can grasp instantly, turning complexity into clarity.# Bottom: Audio Narration with Real-Time Subtitles

Live subtitles appear word-by-word as you listen. Adjust playback speed (0.5x to 2x) to match your learning pace. Fullscreen mode available for immersive focus. - Practical Application Quizzes

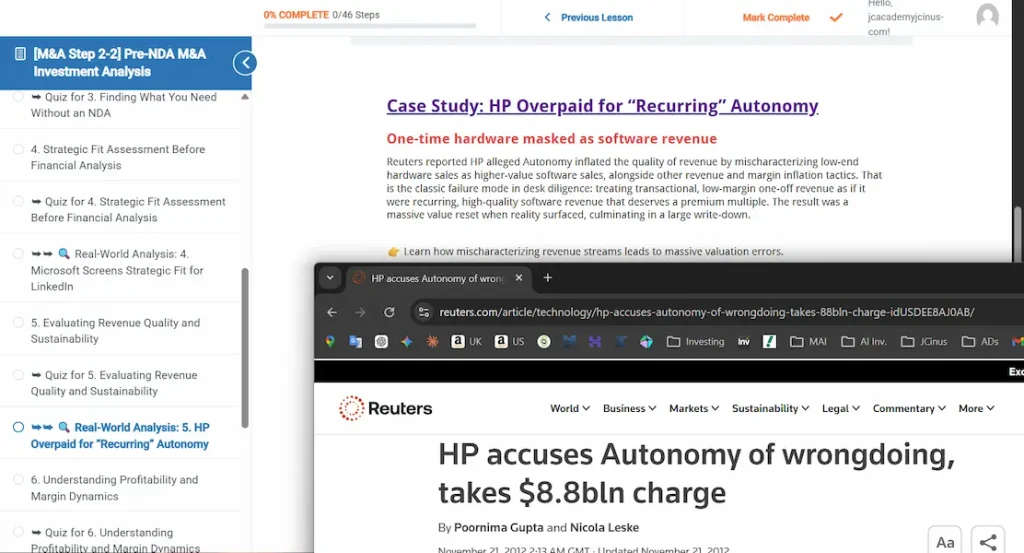

What you learn in the lesson becomes yours through targeted quizzes. Each question is designed with real-world scenarios, testing not just knowledge, but your ability to apply these concepts in actual deal situations. You'll discover exactly how to use what you've learned in practice. - Real-World Case Studies

See theory meet reality. Explore how major deals, from household-name acquisitions to landmark transactions, actually implemented these exact concepts. Learn from what worked, what failed, and why, bridging the gap between classroom and boardroom.

The result? You don't just understand M&A. You master it, step by step, with confidence.

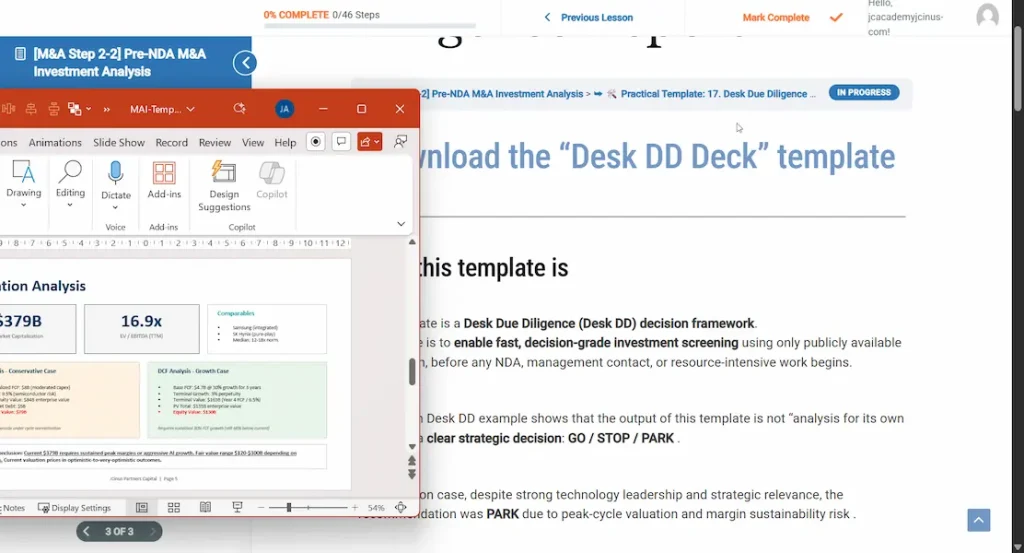

Visual Examples of Our Learning Tools

Sample Internal View of This Course

Course Content

Your Course Deliverables

Two Professional Templates: Desk DD Memo + Mutual NDA

What You'll Build

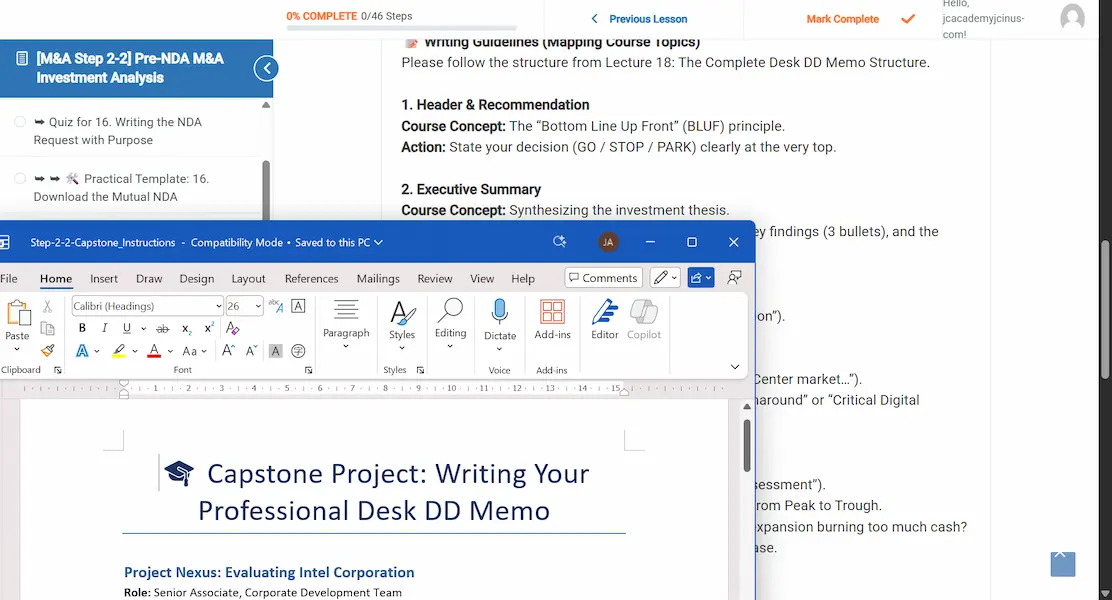

- Desk Due Diligence Report

Decision-grade memo structure covering business introduction, strategic fit, financials, quick valuation, red flags, and go/stop/park recommendation Eight-component framework that forces bottom-line-up-front clarity before any confidential data is requested Capital allocation filter that stops weak deals at desk level and protects IC bandwidth and senior team time - Mutual NDA Template

Governance-grade NDA framework designed specifically for the transition from desktop due diligence to active preliminary diligence Defined confidentiality scope covering financial, strategic, technical, and ownership data with three-year survival and perpetual trade secret protection Process gate mechanics connecting desk DD go decision to clean-team access, data room entry, and management presentations

You will master the exact pre-NDA deal analysis architecture that prevents premature resource commitment, forces disciplined go/stop decisions at every stage gate, and protects negotiation leverage through structured information access.

Advanced AI-Powered Desk DD Report Writing

Intel Desk DD Capstone Project

This is an AI-assisted professional report writing module. You will draft a real investment memo and receive structured AI evaluation of your analytical quality, precision, and recommendation logic.

You will act as Senior Associate on the Corporate Development team at JCinus Partners, responding to an urgent MD request to evaluate Intel Corporation as a potential PIPE or buyout opportunity following its significant stock decline.

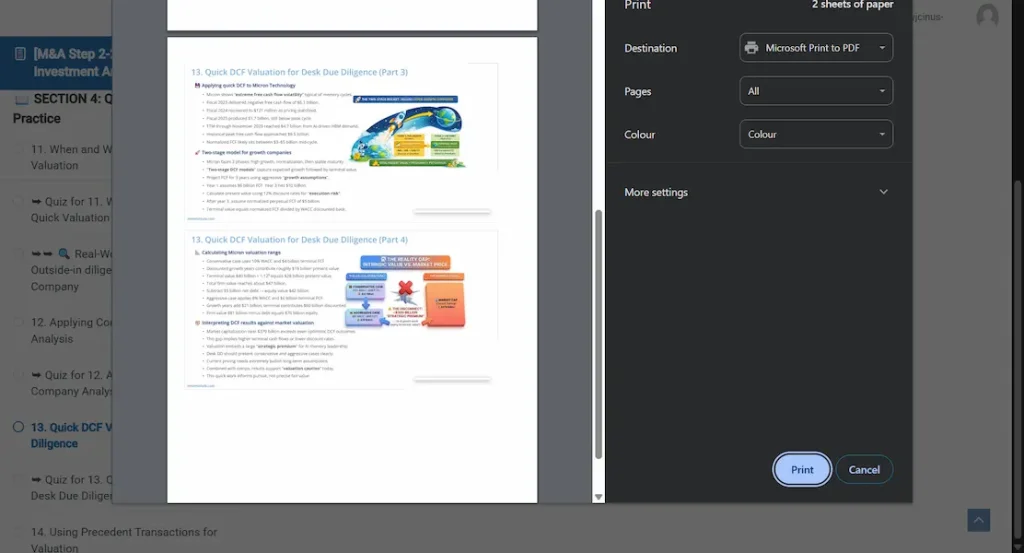

You must produce a 2~3 page professional Desk DD Memo by applying every desktop due diligence framework from the course:

- Assessing Intel's IDM 2.0 model, market share position, and strategic fit against JCinus investment themes

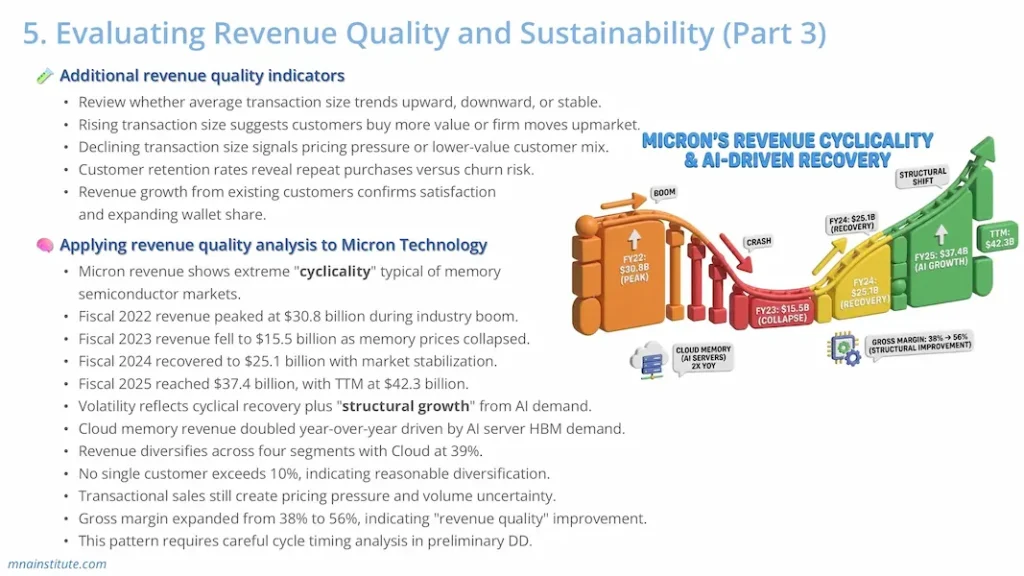

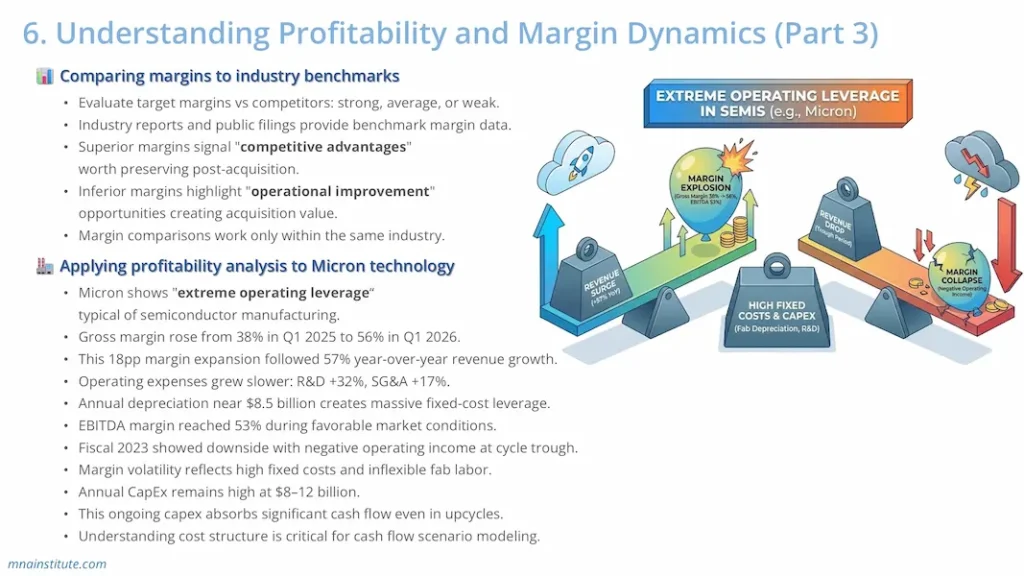

- Analyzing revenue trough-to-peak cyclicality, gross margin compression, and $20B annual capex sustainability

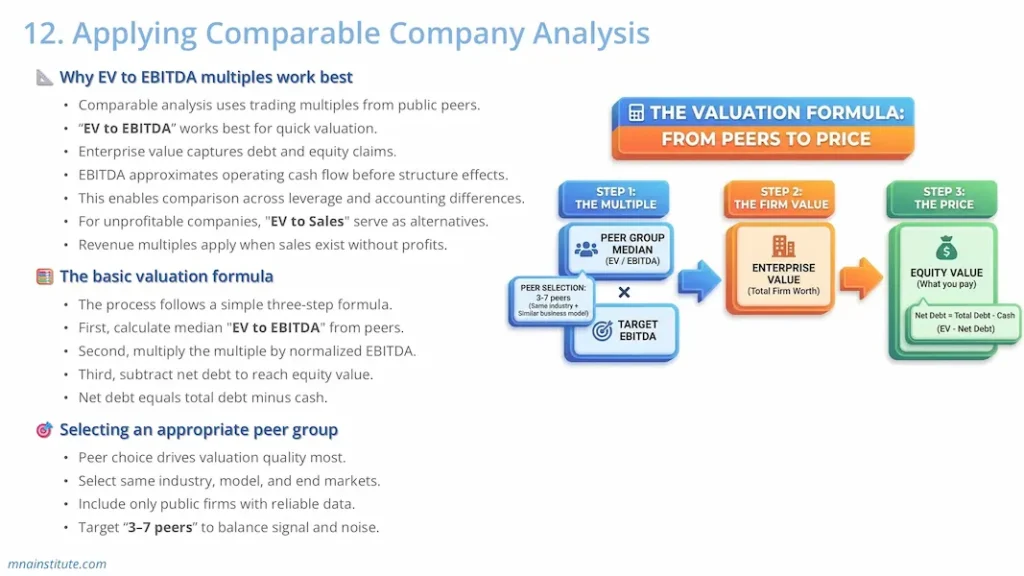

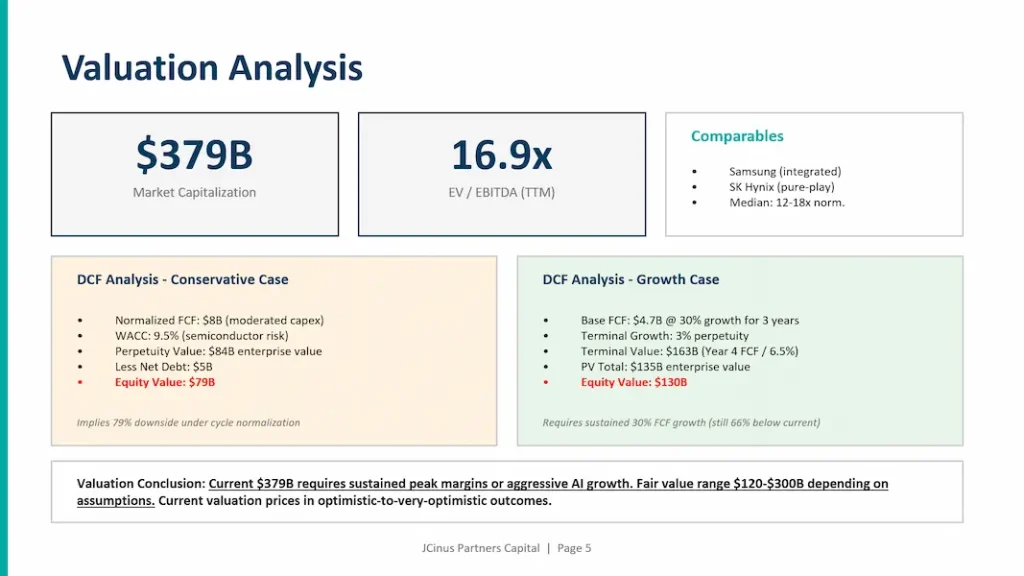

- Running quick valuation using EV/EBITDA peer comparisons against AMD, TSMC, and NVIDIA

- Identifying deal-breaker risks across foundry execution, AI competitiveness gap, and geopolitical exposure

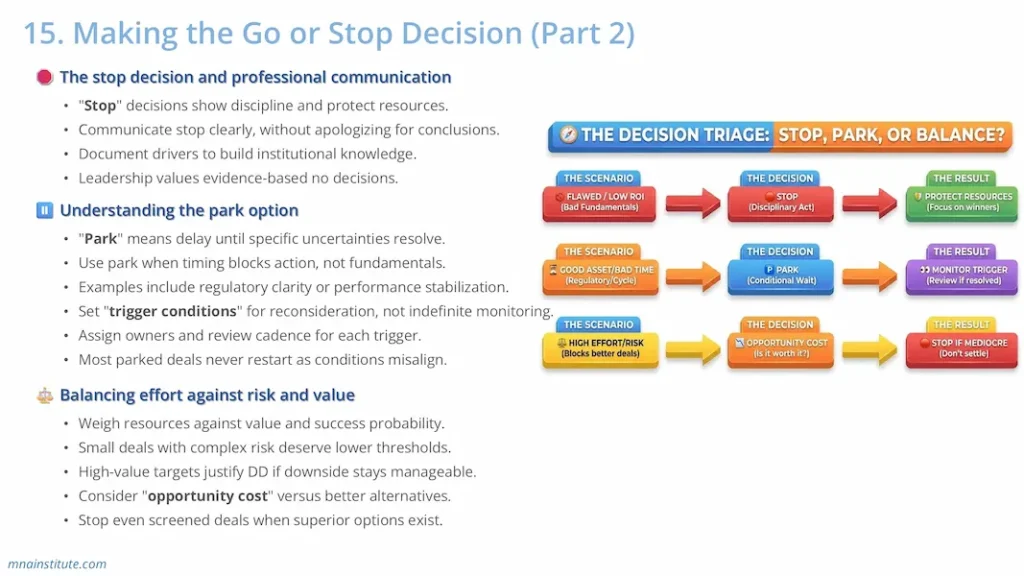

- Delivering a clear GO, STOP, or PARK recommendation with specific triggers and next steps

Submit your memo and receive instant AI feedback

on analytical rigor, valuation logic, red flag identification, and decision quality!

What You Will Gain from This Course

Run pre-NDA investment screening with the frameworks, templates,

and judgment used by real deal teams.