Course Structure & Learning Flow

A Practical Learning Built for Real Decision-Making

The M&A Institute Learning Interface

Learning Complex M&A Made Effortless

Our learning UI/UX is engineered to transform complex technical data into intuitive strategic judgment.

- Scientifically Designed Three-Layer Interface

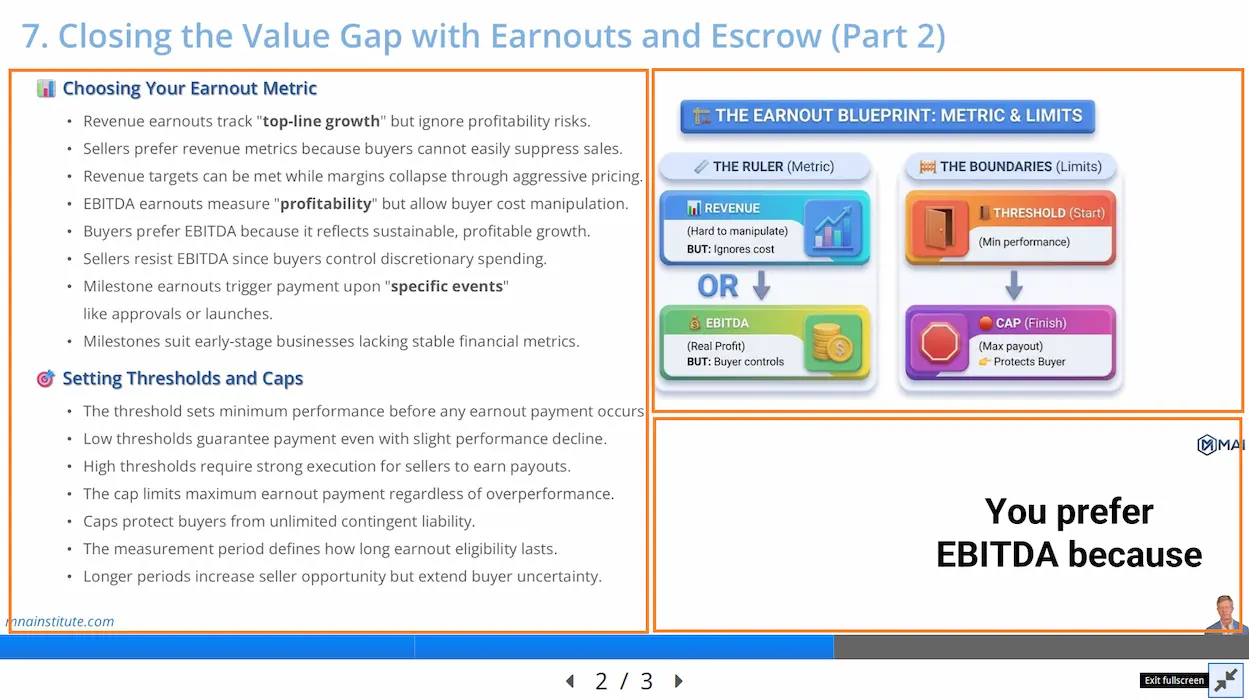

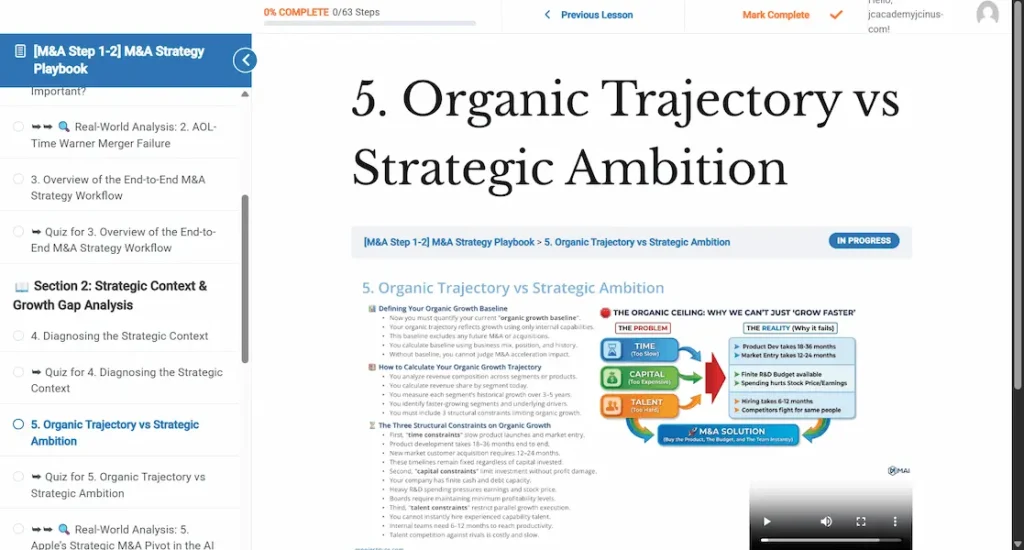

Every lesson follows a three-layer learning structure designed to help learners understand complex concepts quickly and intuitively.# Left Panel: Structured Written Content

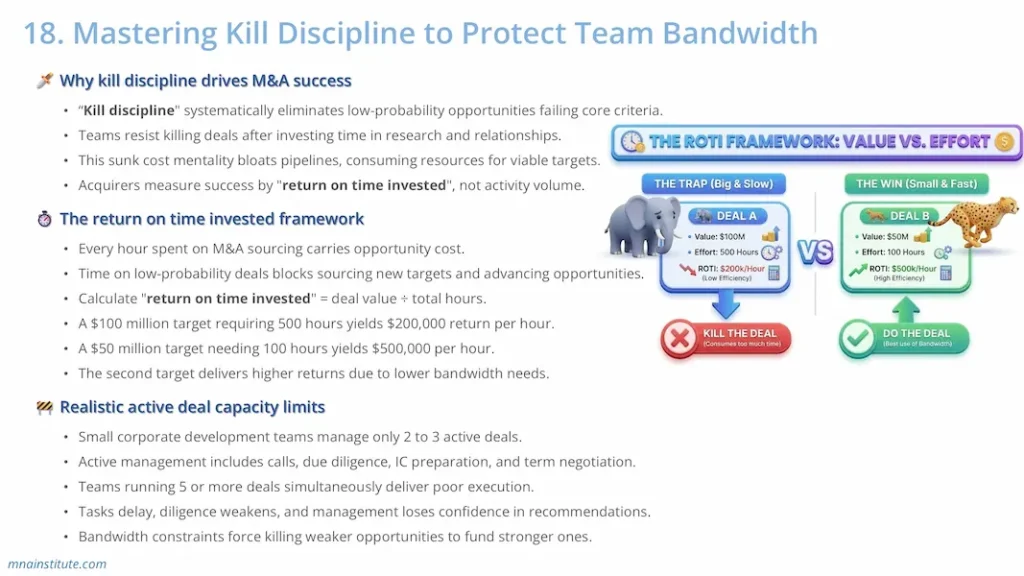

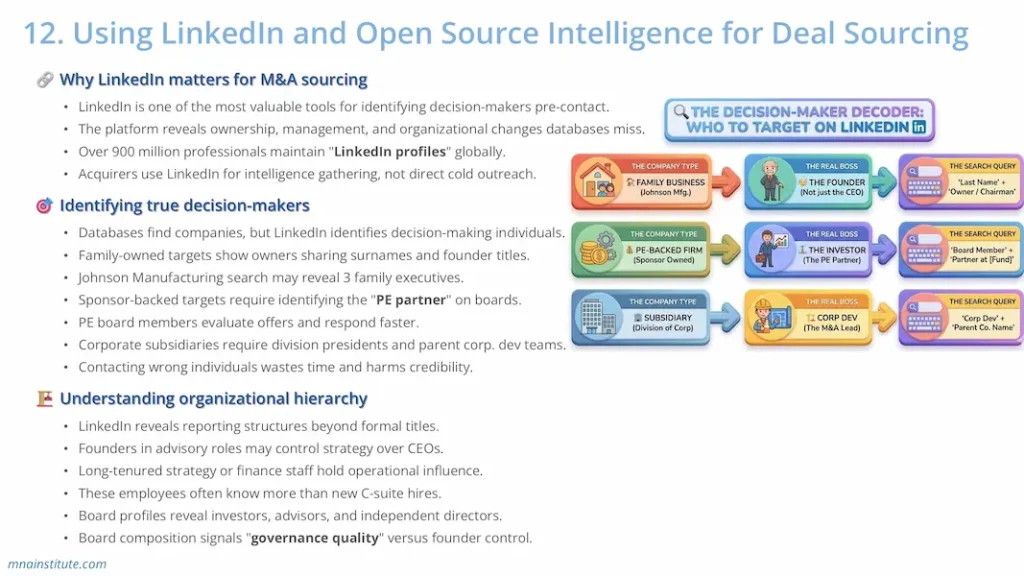

Carefully edited bullet points guide you through each concept with clarity. Even reading the text alone ensures full comprehension. As the audio plays, your eyes naturally follow along, reinforcing understanding through synchronized reading and listening.# Right Panel: Visual Infographics

Colorful diagrams translate abstract ideas into concrete visuals. This graphic reinforcement transforms difficult concepts into intuitive, friendly frameworks you can grasp instantly, turning complexity into clarity.# Bottom: Audio Narration with Real-Time Subtitles

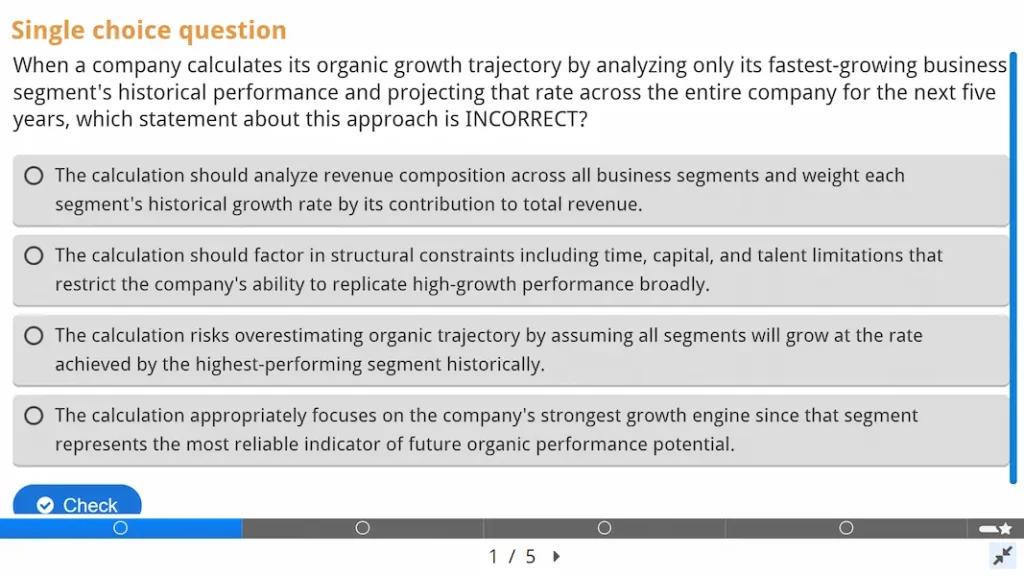

Live subtitles appear word-by-word as you listen. Adjust playback speed (0.5x to 2x) to match your learning pace. Fullscreen mode available for immersive focus. - Practical Application Quizzes

What you learn in the lesson becomes yours through targeted quizzes. Each question is designed with real-world scenarios, testing not just knowledge, but your ability to apply these concepts in actual deal situations. You'll discover exactly how to use what you've learned in practice. - Real-World Case Studies

See theory meet reality. Explore how major deals, from household-name acquisitions to landmark transactions, actually implemented these exact concepts. Learn from what worked, what failed, and why, bridging the gap between classroom and boardroom.

The result? You don't just understand M&A. You master it, step by step, with confidence.

Visual Examples of Our Learning Tools

Sample Internal View of This Course

Course Content

Your Course Deliverables

Board-Ready M&A Strategy Template

Upon completing this course, you'll create a professional merger and acquisition strategies document that investment committees actually use.

What You'll Build:

- Strategic Context Analysis

- Growth gap quantification across revenue, EBITDA, and free cash flow

- Organic trajectory modeling with structural constraint identification

- Strategic ambition validation using board-approved growth targets

- Investment Theme Framework

- 2–3 capability-led themes with clear strategic rationale

- Deal archetype selection aligned to competitive positioning

- Synergy blueprint and integration stance for each theme

- Target Screening Criteria

- Financial guardrails: profitability thresholds, scale requirements, unit economics

- Strategic fit scorecard: product, technology, geographic, regulatory alignment

- Exclusion criteria preventing deal-driven opportunism

- Execution Roadmap

-

- Governance architecture with decision rights and stage gates

- 30-60-90 day sourcing plan converting strategy into action

- Deal funnel management process from theme to target outreach

Real Deliverables, Not Theory

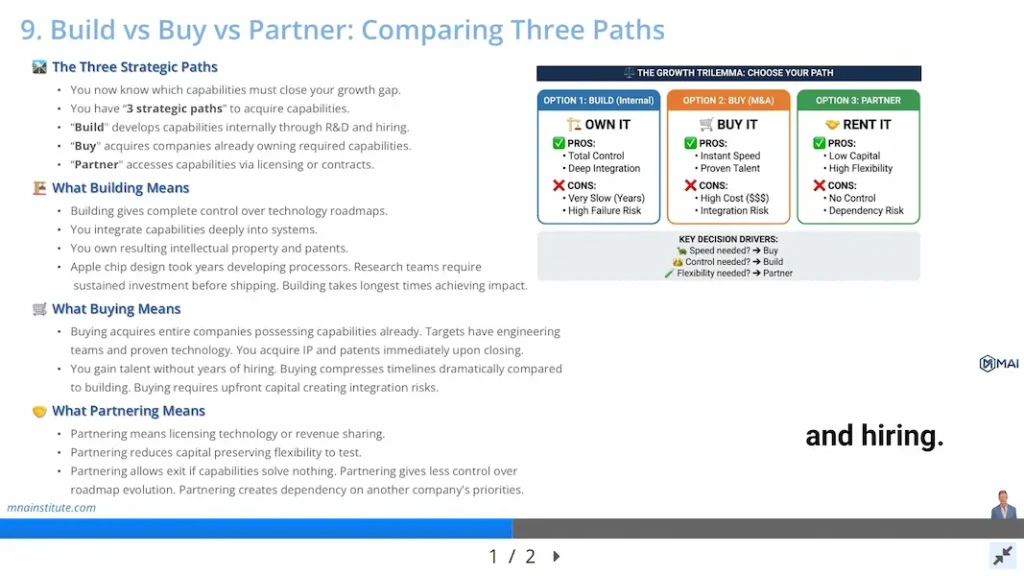

You'll master the exact M&A strategy structure that prevents "deal heat" from overriding strategic logic, protects capital allocation discipline, and forces rigorous build vs. buy justification at every decision gate.

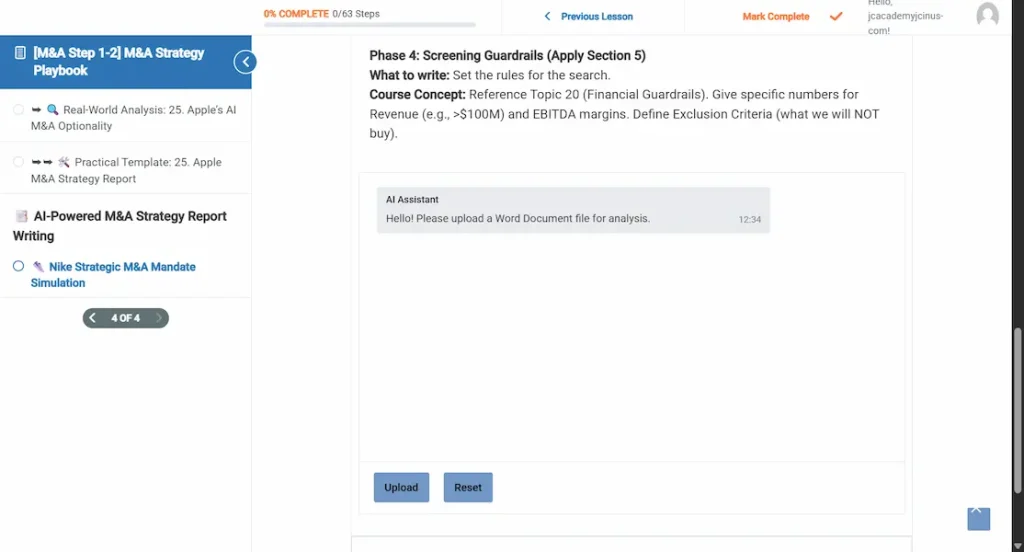

AI-Powered Report Writing

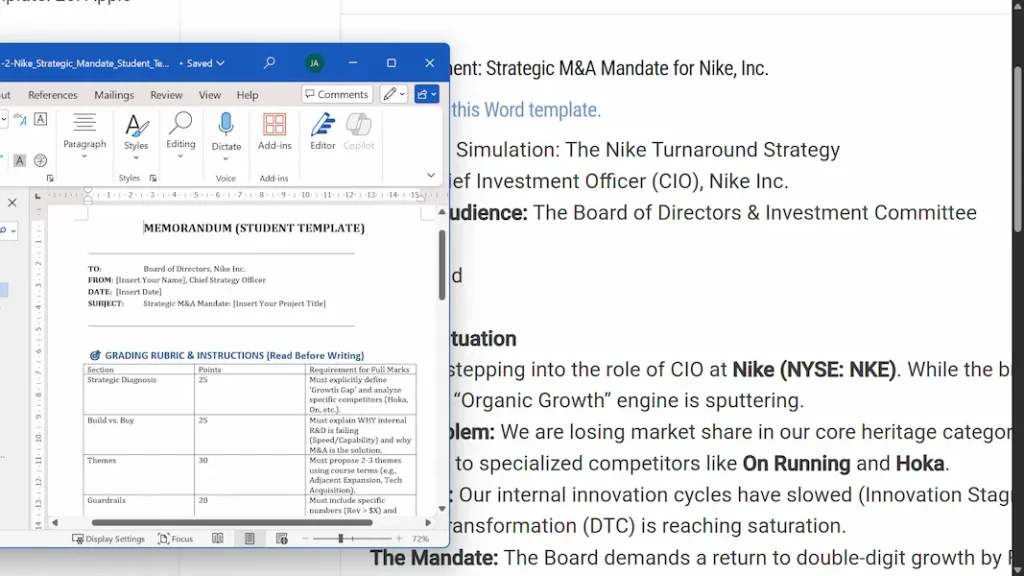

Assignment: Nike Strategic M&A Mandate

In this capstone assignment, you will act as Chief Investment Officer at Nike, Inc., designing an merger strategy to regain market share lost to specialized competitors like On Running and Hoka.

You must navigate the complete strategy development process by:

- Quantifying the growth gap between board targets and organic trajectory

- Justifying build vs. buy logic despite Nike's massive R&D capabilities

- Designing 2 investment themes using adjacent expansion or vertical integration frameworks

- Setting financial guardrails for revenue scale, profitability thresholds, and exclusion criteria

Submit your strategy memo and receive instant AI feedback on growth gap quantification, theme rigor, and guardrail specificity!

What You Will Gain from This Course

Move beyond theory and execute Merger and Acquisition Strategies

using real decision frameworks, documents, and judgment applied in live transactions.