Original price was: $249.8.$99.5Current price is: $99.5.

-

D

-

H

-

M

-

S

Category: M&A Transaction and PMI Planning

Our 3-Stage Path to LBO Mastery

Transform financial theory into practical, deal-ready expertise

through our structured, application-driven methodology.

Example of the AI-driven Interactive Deal Simulation

Course Content

📖 I. Acquisition Financing

1. Introduction to Acquisition Financing

You don't currently have access to this content

2. Strategic Acquisition Financing

You don't currently have access to this content

4. Advanced Debt Financing

You don't currently have access to this content

5. Mezzanine Financing – Loan Part

You don't currently have access to this content

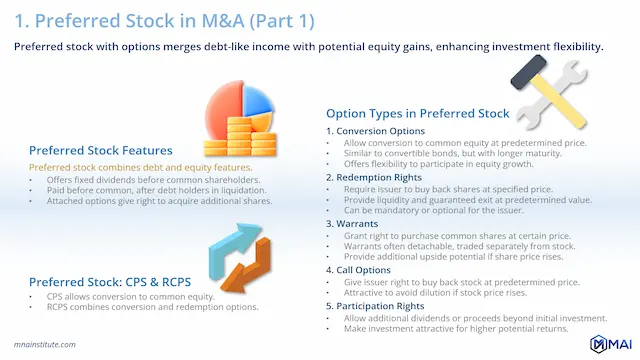

6. Mezzanine Financing – Equity Part

You don't currently have access to this content

7. Equity Financing

You don't currently have access to this content

8. Exit Strategies for M&A Financing

You don't currently have access to this content

9. Strategic Financing Vehicles

You don't currently have access to this content

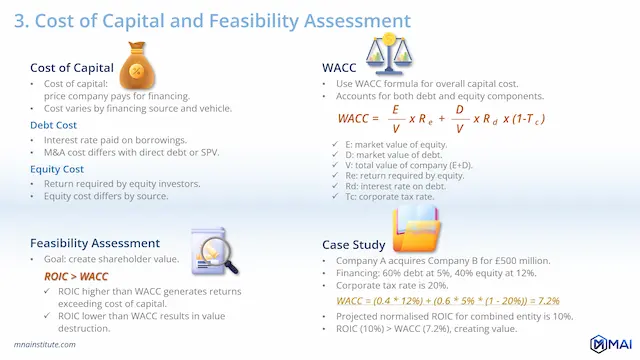

10. Capital Structure Optimisation

You don't currently have access to this content

11. Case Study Report – Elon Musk’s Acquisition of Twitter –

You don't currently have access to this content

💡🤖 AI Simulation Exercise

🤝 Acquisition Finance

You don't currently have access to this content

📖 II. Leveraged Buyouts

1. Introduction to LBOs and Key Features

You don't currently have access to this content

3. LBO Lifecycle and Reverse Merger Process

You don't currently have access to this content

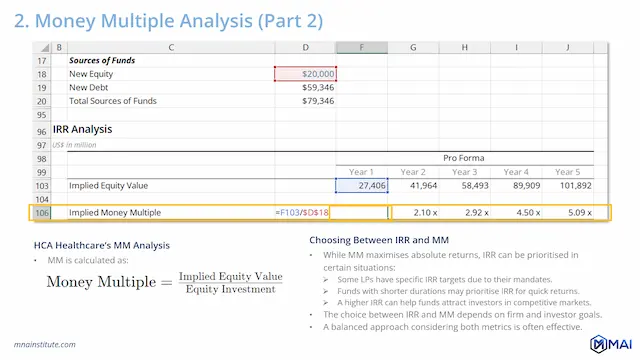

4. Ideal LBO Targets with Case Study – HCA Healthcare

You don't currently have access to this content

5. LBO Analysis 1 – Acquisition to Pro Forma Income Statement

You don't currently have access to this content

6. LBO Analysis 2 – Income Statement, Interest, and EBITDA Forecast

You don't currently have access to this content

7. LBO Analysis 3 – Cash Flow Statement Forecast

You don't currently have access to this content

8. LBO Analysis 4 – IRR and Sensitivity Analysis

You don't currently have access to this content

What You Will Gain from This Module

By completing this LBO modelling course, you will achieve: