Navigating HR and Cultural Integration in Cross-Border M&A

Today on the MAI blog, we delve into the complexities of HR and cultural integration in cross-border M&A. It covers vital topics such as the nuances of HR practices in an international context, the pivotal role of culture and communication, effective strategies for cultural integration during post-merger phases, and the critical importance of thorough due diligence. This post aims to provide a comprehensive understanding of these key aspects and their impact on the success of cross-border M&A transactions.

HR Intergration in Cross-Border M&A

Cultural integration in M&A is a decisive factor in the harmonisation of different corporate cultures and legal frameworks.

Adapting HR Strategies for Diverse Cultures

Cultural integration in M&A necessitates a revaluation of HR strategies:

- Balancing Diverse Appraisal Methods: For example, merging a U.S. company’s individual performance focus with a Japanese partner’s group harmony approach requires a thoughtful blend of both cultural values.

- Local Labour Law Compliance: Understanding labour laws in the target company’s country is vital for ensuring that HR policies are legally compliant and culturally appropriate.

Restructuring with Sensitivity

Restructuring in the context of cultural integration involves:

- Analysing Organisational Structures: Identifying redundancies and deciding on the optimal structure while considering cultural integration.

- Ethical Restructuring Practices: Implementing changes such as layoffs must be done ethically, ensuring compliance with local laws and maintaining cultural sensitivity.

Organisational Structuring

Integration plays an important role in aligning the organisational structures of merging entities:

- Reviewing and Integrating Organisational Charts: Decisions on senior management retention and departmental integration should consider both strategic objectives and cultural nuances.

- Phased Departmental Integration: A gradual approach to merging departments like R&D or sales can minimise disruption and foster cultural integration.

Culture and Communication in Cross-Border M&A

In the complex terrain of cross-border M&A, managing cultural integration and communication is a crucial aspect that often determines the success of the merger or acquisition.

Understanding the Role of Corporate Culture

Corporate culture, a shared set of beliefs and practices, plays a significant role in how employees interact and make decisions. In cross-border M&A, aligning different corporate cultures can be challenging due to varied business ethics, workplace norms, and communication styles.

Cultural and Communication Disparities

- Communication Styles: For instance, the direct style of American companies may contrast with the nuanced approach in many Asian cultures, leading to potential misunderstandings.

- Language and Ethical Considerations: Effective communication in cross-border M&A transcends language translation, extending to understanding business contexts and cultural nuances. Employing bilingual experts can facilitate better understanding and alignment.

Addressing Practical Challenges

- Diverse Communication Styles: The indirect communication in high-context cultures like Japan versus the direct style in low-context cultures such as the US can create misunderstandings.

- Decision-Making Processes: Variations in decision-making, from democratic to hierarchical, affect strategy formulation and execution, which can cause friction in joint operations.

Solutions for Effective Integration

Several measures can enhance cultural integration in cross-border M&A:

- Cultural Training and Awareness: Programs educating employees about each other’s norms and practices foster mutual understanding.

- Cross-Cultural Teams: These teams can bridge cultural divides, harmonising different working styles.

- Communication Strategies: Clear protocols and tools are necessary to overcome language barriers and prevent misunderstandings.

Case Study: Renault-Nissan Alliance

The successful Renault-Nissan alliance showcases effective cultural integration. Despite initial differences between Renault’s centralised approach and Nissan’s traditional Japanese methods, the formation of cross-cultural teams and a bi-cultural leadership style under Carlos Ghosn facilitated a seamless integration. Extensive training and workshops merged French and Japanese business practices, exemplifying successful cultural integration in cross-border M&A.

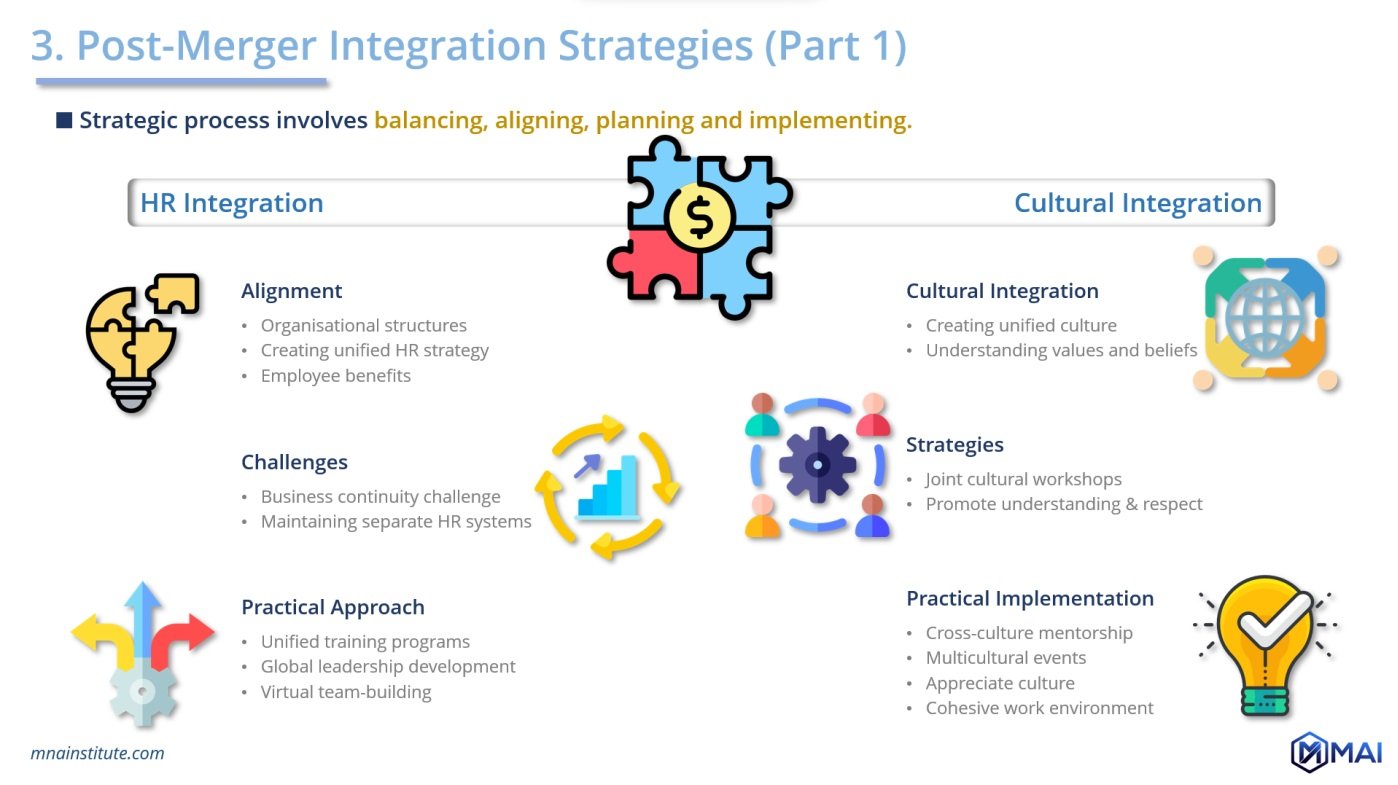

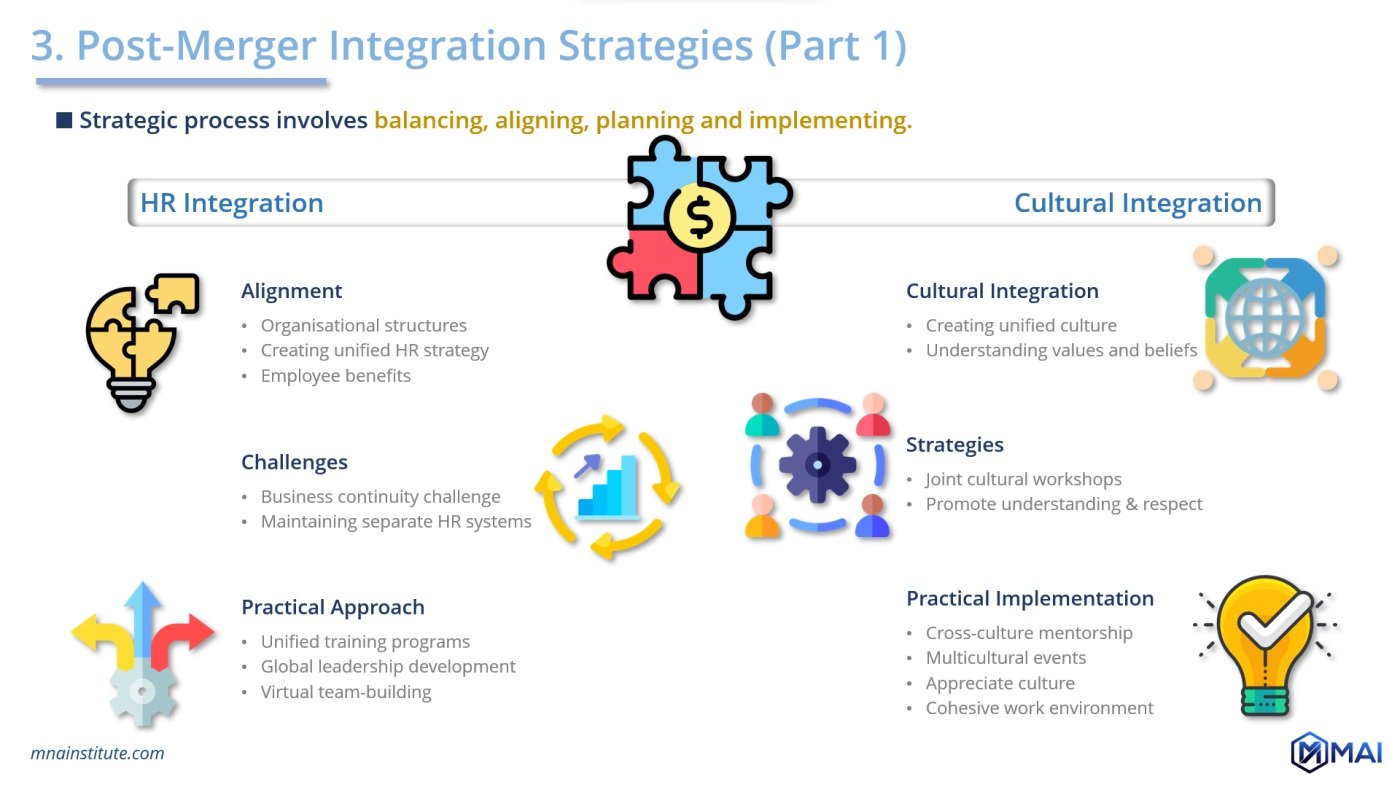

Strategies for Cultural Integration in Post-Merger Cross-Border M&A

Post-merger integration in cross-border M&A demands a balanced approach that melds both human and operational elements to create a cohesive new entity.

HR Integration in Cross-Border M&A

A key component of HR integration in cross-border M&A is aligning organisational structures and employee practices:

- Creating a Unified HR Strategy: This includes aligning employee benefits and compensation structures across multinational teams.

- Overcoming Geographic Limitations: In situations where physical integration isn’t feasible, companies can standardise core HR policies while maintaining separate systems in each country.

- Virtual Integration Initiatives: Online training programs and global leadership initiatives help develop a shared organisational culture, crucial for cultural integration.

Example: Implementing Unified Online Training

In cases where teams are geographically dispersed, online training and virtual team-building activities can facilitate a unified cultural ethos.

Creating a Unified Culture

Cultural integration in cross-border M&A transactions transcends mere merging of existing cultures; it involves cultivating a new, shared culture:

- Deep Understanding of Values and Practices: Hosting joint cultural workshops and encouraging regular interactions can promote mutual understanding and respect.

- Cross-Cultural Initiatives: Initiatives like mentorship programs and multicultural events help employees appreciate each other’s cultural nuances.

Planning for Integration During Due Diligence

A crucial step in cultural integration is the detailed analysis of HR structures and cultural norms:

- Examining HR Policies and Cultural Norms: This includes comparing leave entitlements, reward systems, and assessing compatibility.

- Conducting Cultural Audits: Understanding workplace ethos and communication styles is vital for seamless integration.

Implementing HR Integration Frameworks

Specificity is crucial when developing integration frameworks:

- Aligning Leadership and Communication: Joint training sessions and the adoption of common communication platforms are essential.

- Harmonising Employee Engagement Practices: Creating a unified approach to feedback and performance appraisals facilitates integration.

Case Study: Daimler-Chrysler

The Daimler-Chrysler merger underscores the depth of cultural integration challenges. Despite initial efforts like joint training programs and cross-cultural teams, the integration highlighted the need for more nuanced strategies.

Due Diligence in Cross-Border M&A: A Practical Approach

Cross-border M&A presents a unique set of challenges in due diligence, requiring an alignment of diverse legal, financial, and operational aspects from different countries. Understanding these challenges and adopting a practical methodology is key to successful culture intergration in cross-border M&A.

Challenges in Cross-Border Due Diligence

Effective due diligence in cross-border M&A involves navigating various complexities:

- Diverse Legal Frameworks: Adapting to different legal and regulatory environments is crucial.

- Financial Assessments: Variations in accounting and tax systems impact asset and liability evaluations.

- Operational Understanding: Gaining insight into the target’s supply chain, local market conditions, and labour practices is essential.

- Market Dynamics and Compliance: Understanding local consumer behaviour, competition, and compliance with international laws like GDPR or FCPA is imperative.

Methodology for Effective Due Diligence

To address these challenges, a balanced approach is necessary:

- Engaging Local Experts: Local advisors provide crucial insights into the market and cultural nuances.

- Balancing Perspectives: Combining local expertise with advisors from the buyer’s country or independent third parties ensures a comprehensive and unbiased due diligence process.

Case Study: British Petroleum’s Acquisition of Rosneft

BP’s acquisition of a stake in Rosneft highlights the importance of a balanced due diligence approach. Engaging local experts for an in-depth analysis of the Russian market, while also incorporating broader perspectives from BP’s internal team or independent experts, ensured a thorough and culturally sensitive due diligence process.

Conclusion

In cross-border M&A, effective due diligence is critical for ensuring cultural integration and transaction success. A practical approach, combining local insights with global perspectives, allows companies to navigate the complexities of cross-border transactions effectively, laying the groundwork for a successful merger or acquisition that respects and integrates diverse cultures and practices.