Introduction to Due Diligence Risks

Preparing for due diligence can often be hard to break down and navigate. Within M&A, we must understand the due diligence risks and the key provisions of confidentiality agreements. We need to develop Due Diligence risks by looking at what the Heads of Terms are and what are their main elements.

How to prepare is key to reinforcing insufficient due diligence risks. We will learn the key points to check in cross-border M&A Due Diligence. To start your studying, take a look first at Due Diligence and Preparing for Due Diligence.

Confidentiality Agreements for M&A Due Diligence Risks

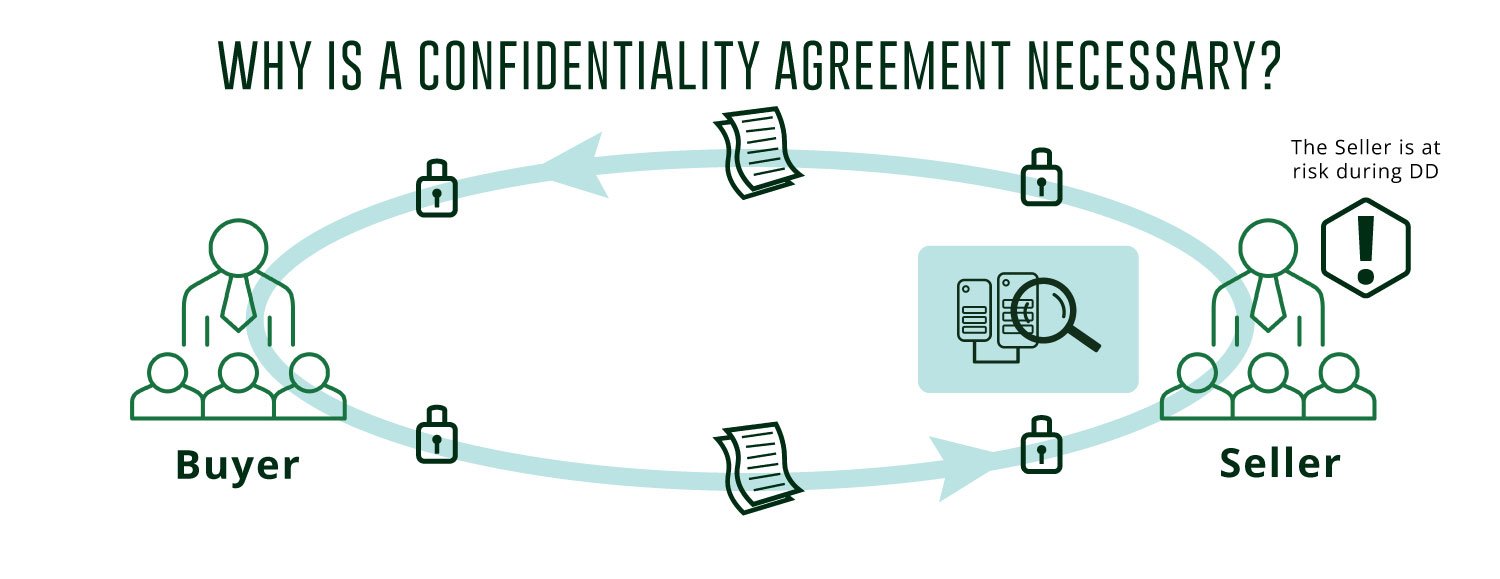

A seller is exposed during a buyer’s due diligence risks. The due diligence process involves the buyer thoroughly reviewing the seller’s financial, legal, and operational information to evaluate the potential M&A due diligence risks and benefits of acquiring the company. This process often requires the seller disclosing sensitive information about their business, such as trade secrets, know-how, financial statements, customer lists, and employee information. To ensure this information remains confidential and refrains from becoming due diligence risks, it is not shared with third parties, the seller may require the buyer to sign a confidentiality agreement before beginning the due diligence process. The agreement outlines the terms and conditions under which the seller can share confidential information with the buyer and specifies the consequences of any breach of the agreement. By signing a confidentiality agreement, the buyer agrees to keep the information shared during due diligence confidential and not to disclose it to anyone else without the seller’s permission. This helps to protect the seller from potential harm or due diligence risks, such as a competitor gaining access to sensitive information that could be used against them.

What is a Confidentiality Agreement?

A M&A confidentiality agreement, also known as a Non Disclosure Agreement (NDA), is a legal contract between the buyer and seller in a merger and acquisition deal that sets out the terms and conditions under which confidential information can be shared only between the parties. The purpose of an M&A confidentiality agreement is to protect the confidential information of the parties involved in the transaction. This could include sensitive financial data, customer lists, trade secrets, and other proprietary information that could be used by competitors or cause harm to the company if it were to be disclosed.

A confidentiality agreement is an essential document in any M&A transaction, as it helps to protect the parties’ confidential information and prevent it from falling into the wrong hands.

Provisions involved in Confidentiality Agreements

A confidentiality agreement typically includes the following provisions:

- Definition of confidential information: The agreement defines what constitutes confidential information and may consist of exclusions for publicly available information or independently developed by the receiving party.

- Obligations of the receiving party: The receiving party, usually buyers, agrees to keep the confidential information secret and not to use it for any purpose other than evaluating the proposed transaction.

- Exceptions to confidentiality: The agreement may include exceptions to the confidentiality obligation, such as disclosures required by law, court order, or disclosures made to professional advisors.

- Duration of confidentiality: The agreement specifies the duration of the confidentiality obligation, which can vary depending on the information being shared.

- Consequences of breach: The agreement outlines the consequences of violating the confidentiality obligation, including injunctive relief, monetary damages, and attorneys’ fees.

- Governing law: The agreement specifies the law that will govern the interpretation and enforcement of the agreement.

Types of M&A Confidentiality Agreements

There are two main types of M&A confidentiality agreements:

- Unilateral confidentiality agreement: A unilateral confidentiality agreement is used when only one party, usually sellers, will disclose confidential information to the other party. This type of agreement is typically used when the seller discloses confidential information to a potential buyer.

- Mutual confidentiality agreement: A mutual confidentiality agreement, also known as a bilateral confidentiality agreement, is used when both parties disclose confidential information. This type of agreement is typically used when both parties consider a potential transaction and must exchange confidential information to evaluate the deal.

Both types of agreements generally contain similar provisions, such as the definition of confidential information, the obligations of the receiving party, the exceptions to confidentiality, the duration of privacy, and the consequences of a breach. However, the terms of each agreement will be tailored to the specific needs of the parties involved in the transaction. It is essential to carefully consider the scope and terms of the agreement to protect both parties’ confidential information during the M&A process.

What is a Head of Terms?

A Head of Terms, also known as a Letter Of Intent (LOI) or Memorandum Of Understanding (MOU), is a document, usually non-binding, that outlines the key terms and conditions of a proposed M&A deal. It serves as a preliminary agreement between the buyer and seller, setting out the framework for the transaction and outlining the key points that need to be negotiated in the final agreement. The Head of Terms is typically created after initial discussions between the buyer and seller before the formal due diligence process begins. It helps to establish a shared understanding of the deal and provides a basis for further negotiations.

A Head of Terms is a helpful tool in M&A deals for several reasons.

- First, A Head of Terms establishes the basic framework for the transaction, setting out the key terms and conditions of the deal. This helps ensure that both the buyer and seller clearly understand the deal and can move forward with negotiations more efficiently and organisationally.

- Secondly, by outlining the key terms of the deal, a Head of Terms can help to identify any potential issues or areas of concern that may need to be addressed during the negotiation process. This can help avoid surprises and ensure the parties negotiate in good faith.

- Thirdly, a Head of Terms can help to manage the expectations of both the buyer and seller by clearly outlining the scope of the transaction and the key terms that have been agreed upon. This can help to avoid misunderstandings and ensure that both parties are on the same page throughout the negotiation process.

- Finally, a Head of Terms can help to facilitate the due diligence process by providing a clear framework for the buyer to assess the seller’s business. This can help to ensure that the buyer has access to all the information they need to make an informed decision about the transaction.

Overall, a Head of Terms can help streamline the negotiation process in an M&A deal and ensure that both parties clearly understand the deal and the key terms that need to be negotiated. Head of Terms helps to eliminate Due Diligence Risks. While it is generally non-binding and does not create a legally binding obligation to complete the transaction, it serves as an important roadmap for the negotiation process and helps to establish a shared understanding of the deal.

Elements to a Head of Terms

Some of the critical elements that may be included in a Head of Terms for an M&A deal are:

- Purchase price: The agreed-upon price the buyer would pay to acquire the seller’s business.

- Payment terms: The method and timing of payment for the transaction, such as a lump sum or instalment payment.

- Conditions precedent: Any conditions that must be met before the transaction can be completed, such as regulatory approvals or financing requirements.

- Deal structure: The proposed structure of the transaction, such as assets purchase or shares purchase.

- Confidentiality: The parties’ agreement to maintain the confidentiality of the negotiations and not to disclose any information about the deal to third parties.

- Exclusivity: The seller’s agreement to negotiate exclusively with the buyer for a specified time period, usually until the final agreement is signed.

- Governance: The proposed governance structure of the company after the transaction is completed, such as the composition of the board of directors.

Warranties and Indemnities

A buyer cannot discover all fatal defects during the due diligence risks period. After the deal is closed, in cases where the buyer finds due diligence risks that were not discovered during the due diligence, due diligence itself could not be used as a tool of legal protection. Therefore, buyers must add legal protections as a second line of defence. In M&A agreements, warranties and indemnities are used as defensive provisions that aim to protect the parties involved in the transaction. Warranties refer to the representations made by the seller to the buyer regarding the target company’s financial performance, assets, liabilities, legal compliance, and other pertinent factors. These representations assure the buyer that the statements made by the seller are truthful and accurate during the transaction. Should any representations be found false or inaccurate, the buyer has the right to seek compensation or terminate the agreement.

Meanwhile, indemnities are clauses that assign risks between the buyer and the seller for specific types of losses or liabilities that may arise after the transaction’s completion. These may include legal claims, environmental liabilities, taxes, or warranty breaches. An indemnity is a pledge made by one party to compensate the other for losses or damages arising from particular events or circumstances. Overall, warranties and indemnities function in tandem to provide both parties with protection. The warranties guarantee that the target company is in good condition, giving the buyer peace of mind in their purchase. At the same time, the indemnities offer the seller security against certain post-transaction liabilities. Transaction insurance can be expensive, but it can also safeguard the buyer from any risks or liabilities related to the transaction and offer compensation for any losses incurred.

Due Diligence Risks in Cross-Boarder M&A

Cross-border M&A transactions involve purchasing or consolidating companies from different countries, which can pose various unique challenges and special issues. Some of the significant considerations in cross-border M&A transactions are:

- Cultural and language differences: Cultural and language differences can create communication barriers, misunderstandings, and conflicts that hinder the transaction’s success. It is essential to deeply understand the culture, language, and business practices of the target company’s country to overcome these barriers.

- Regulatory and legal differences: Cross-border M&A transactions often require the acquirer to comply with different regulatory frameworks and legal systems, which can be complex and time-consuming. Companies must understand the legal and regulatory requirements of the target company’s country to avoid any compliance issues and liabilities.

- Political and economic risks: Buyers are subject to various political and economic risks, including changes in foreign investment laws, currency fluctuations, and geopolitical instability. Companies must conduct a thorough risk assessment and have contingency plans to mitigate these risks.

- Integration challenges: Integrating companies from different countries and cultures are challenging, particularly with differences in management styles, business practices, and communication methods. Buyers must establish a comprehensive integration plan to overcome these challenges and ensure a successful merger.

- Intellectual property issues: Cross-border M&A transactions involve complex intellectual property issues, including differences in patent and trademark laws, licensing agreements, and technology transfer restrictions. It is crucial to conduct thorough due diligence to identify and address any potential intellectual property issues.

Buyers must conduct thorough due diligence, understand the legal and regulatory requirements of the target country, and have a comprehensive integration plan to ensure a successful transaction.

Sources and Further Reading

If you have found the information insightful, head over to the M&A Institute, log in and start our online courses now. Or go to our Youtube Channel for further watching!

To check out more on Due Diligence Risks, you can take a look at some of the websites we used to gain our understanding and research: