Unlocking Growth Through Deal Sourcing

Deal sourcing (or deal origination), a critical facet of successful Mergers and Acquisitions, is the art of discovering potential acquisition targets that resonate with a company’s strategic vision.

Here’s why it’s a game-changer:

1. Strategic Alignment

Aligning your acquisition targets with your M&A strategy is paramount. A robust deal sourcing mechanism ensures that the companies you pursue are not just random opportunities but strategic fits that can enhance your business’s overall value.

2. Competitive Edge

In a world where the demand for quality deals often surpasses supply, a unique deal sourcing strategy can be your competitive edge. While others comb through similar pipelines, a differentiated approach gives you the upper hand in discovering hidden gems.

3. Maximising Returns

The pursuit of outstanding investment opportunities, often referred to as ‘alpha,’ starts with effective deal sourcing. It can be the difference between achieving mediocre or exceptional investment returns.

4. Proactive Approach

Rather than passively waiting for opportunities to land on your doorstep, proactive deal sourcing allows you to take control of your M&A journey. This approach aligns better with your strategic objectives and timelines.

In essence, effective deal sourcing strategy is the compass that guides transformative acquisitions, unlocking growth potential and maximizing shareholder value.

Now, let’s delve into two deal sourcing approaches: in-house methodologies and the role of third-party advisors in M&A.

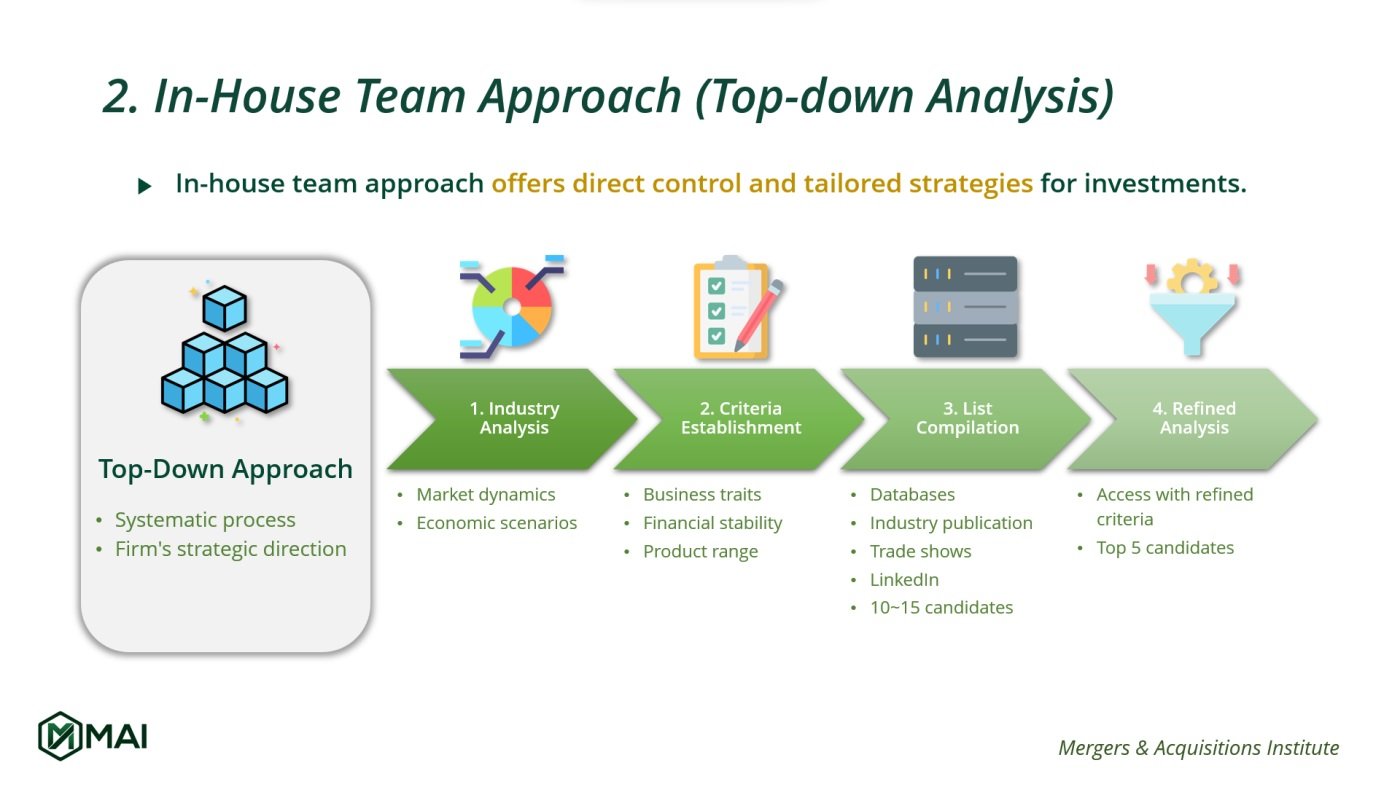

Mastering In-house Deal Sourcing

In-house M&A deal sourcing empowers companies to uncover investment opportunities using their internal resources and networks. While this approach demands time and effort, it offers direct control, deeper insights, and a customised strategy. Let’s explore the first of three key methodologies: the top-down approach.

The Top-Down Approach

This structured method ensures that potential acquisition candidates align with industry trends and your firm’s strategic direction. Here’s how it works:

1. Industry Analysis

Begin with a thorough examination of target industries, dissecting market dynamics and economic scenarios. This analysis provides the foundation for your selection criteria.

2. Criteria Establishment

Define your criteria for selecting target companies. Consider factors like business traits, location, financial stability, product range, and other pertinent features aligned with your firm’s strategy.

3. List Compilation

To compile a list of target companies, leverage databases like PitchBook, Capital IQ, and Mergermarket. Explore industry-specific publications, participate in trade events, and network on platforms like LinkedIn. Aim to pinpoint 10-15 standout candidates.

4. Refined Analysis

Dive deeper into the shortlisted companies, assessing them with more refined criteria. This scrutiny helps you refine your list to the top five ideal candidates.

5. Contacting Potential Acquisition Targets

Initiating contact during M&A deal origination is imperative. The approach varies based on whether it’s a minority investment or a full takeover. Here’s a practical guide:

Determine the Contact Person:

- For minority investments, connect with the CFO or IR representative.

- For full takeovers, approach the CEO, board members, or primary shareholders

Methods of Outreach:

- Utilise databases like PitchBook or Capital IQ for direct contact details.

- Leverage professional relationships, attend industry events, or join trade associations for introductions.

- Use LinkedIn for well-crafted messages or mutual connections for introductions.

- Employ advisory or consulting firms familiar with the industry for introductions.

- Consider cold calls or direct mail with a formal proposal.

- Utilise referrals from existing business partners or clients.

- Explore industry publications for directories with contact details of major players.

- Maintain utmost confidentiality during outreach due to the sensitive nature of acquisition discussions.

Advantages

- This approach provides a robust strategic framework that increases the likelihood of finding companies aligned with your desired sectors, scale, business models, and financial status.

- It serves as a reliable method to enhance in-house deal sourcing capabilities.

Disadvantages

- Challenges may arise in directly connecting with decision-makers.

- The process can be time-consuming and may overlook niche players.

- In-house deal sourcing, driven by the top-down approach, equips your company with the tools to strategically uncover investment opportunities.

Unlocking In-house Deal Sourcing Strategies

In-house deal sourcing offers a wealth of opportunities, and here, we delve into two distinct methods: targeting PE-backed companies and acquisition via auctions.

Targeting PE-Backed Companies

Investing in companies previously backed by private equities, known as secondary transactions, is a strategic approach. These companies have already undergone rigorous PE due diligence, indicating robust viability and growth potential. Here’s the methodology:

Define Objective and Scope

- For minority stakes, target PE funds like venture or growth capital.

- For full acquisitions, consider buyout funds nearing the end of their lifecycle.

- Align your investment size with the PE funds’ capacity. For sector-specific interests, approach corresponding PE funds.

Identify Suitable Private Equity Funds

- Utilise databases such as PitchBook or Capital IQ for fund information.

- Network at PE-specific events and webinars.

- Monitor industry publications for insights on active funds.

Engage with Stakeholders

- After listing potential PE funds, reach out using contact details from their websites or platforms like Capital IQ.

- LinkedIn often showcases essential roles within PE firms, such as Portfolio Managers.

Advantages

- Ready access to pre-existing PE data facilitates a faster assessment.

- The company has already undergone initial due diligence, indicating a degree of stability and potential.

- Companies previously backed by PE often have undergone operational enhancements, making them potentially more efficient and profitable.

Disadvantages

- The existing PE might inflate the company’s value to maximise their exit returns.

- Secondary transactions can be competitive, driving up prices, especially if the company has shown significant growth under PE guidance.

Acquisition via Auctions

Participating in auctions is a dynamic process where multiple prospective buyers bid for a target. It ensures that the seller garners the best possible offer based on market dynamics. Here’s the methodology:

Identification of Target

Start by understanding the business’s strategic fit, its financial health, and potential growth trajectory.

Engage with Stakeholders

Build relationships with intermediaries, bankers, and directly with target companies to gain insights and a competitive edge.

Due Diligence

Rigorously assess the target’s financials, operations, and potential synergies. This phase is crucial to determine the value proposition of the acquisition.

Submit the Bid

Post evaluations, prepare and submit the bid, ensuring it’s competitive yet within the set investment threshold.

Advantages

- Auctions provide readily available deals, significantly reducing the time spent on sourcing.

- All pertinent documents are well-organised, ensuring an efficient and systematic evaluation.

- When targeting the right business, auctions can pave the way for strategic growth and business expansion opportunities.

Disadvantages

- Competitive dynamics might drive the price beyond the actual value of the company.

- The process might expose sensitive information to multiple parties, including competitors.

- The predefined auction framework can lead to hasty due diligence, potentially overlooking critical details.

- These in-house deal sourcing strategies empower companies to navigate the complex landscape of potential investments effectively.

Unlocking Deal Sourcing Strategies with Consultancies

In the world of deal sourcing, the role of buy-side advisors is pivotal. When information isn’t readily obtained from the sell-side, acquirers can enlist the expertise of these professionals. These specialists act in the acquirer’s best interest, aiding in identifying suitable acquisition targets, assisting with accurate valuations, and steering negotiations. However, engaging buy-side advisors isn’t without cost. Here’s what you need to know:

Advantages

- Industry Expertise Saves Time and Effort:

- Buy-side advisors bring profound industry expertise to the table, ensuring no details are overlooked.

- Specialised Focus on M&A:

- Unlike in-house teams that often juggle varied roles, these advisors concentrate solely on the M&A process.

- Neutral Stance Strengthens Negotiation:

- Their neutral stance in the proceedings often endows them with a stronger negotiation position.

Disadvantages

- Costly Retainer and Success Fees:

- The retainer and success fees can weigh heavily on the buyer’s budget.

- Need for Buyer Involvement:

- Even with their knowledge, the buying company should always stay involved and stay updated.

Incorporating buy-side advisors into the deal sourcing process can be a strategic move for acquirers, particularly when navigating complex transactions or industries. While the cost should be considered, the expertise and specialised focus these advisors bring to the table can significantly enhance the chances of successful deal sourcing and negotiations.