Areas of Merger Due Diligence

Conducting M&A due diligence is a rigorous process that demands a substantial investment of time, money, and effort. To optimise these resources, prospective buyers can consider the following queries:

-

- “Does the target company align with our M&A objectives?”

- “Is the target company a worthy subject for merger due diligence?”

- “Which areas of the target company should be examined in order to mitigate acquisition risk?”

- “Do we have sufficient time, feasible plans, and competent personnel to investigate all critical areas of the target company?”

- “Are we able to access essential documents and key personnel of the target company?”

When conducting merger due diligence, it is important to determine which areas of a company require investigation. The areas to investigate may vary depending on the case and the industry involved.

Each industry has a different risk.

For example, in the pharmaceutical industry, it would be more essential to investigate research & development, intellectual property rights, and human resources allocated to research and development. Meanwhile, for the recycling industry, you may focus on the company’s technology, efficiency, and compliance with environmental regulations. Additionally, the stage of a company’s growth may also influence the areas that require investigation. For early-stage companies, it may be critical to assess their products’ marketability and their key personnel’s capabilities. For declining companies, evaluating their probability of recovery, cash flow, and debt payment estimation would be essential.

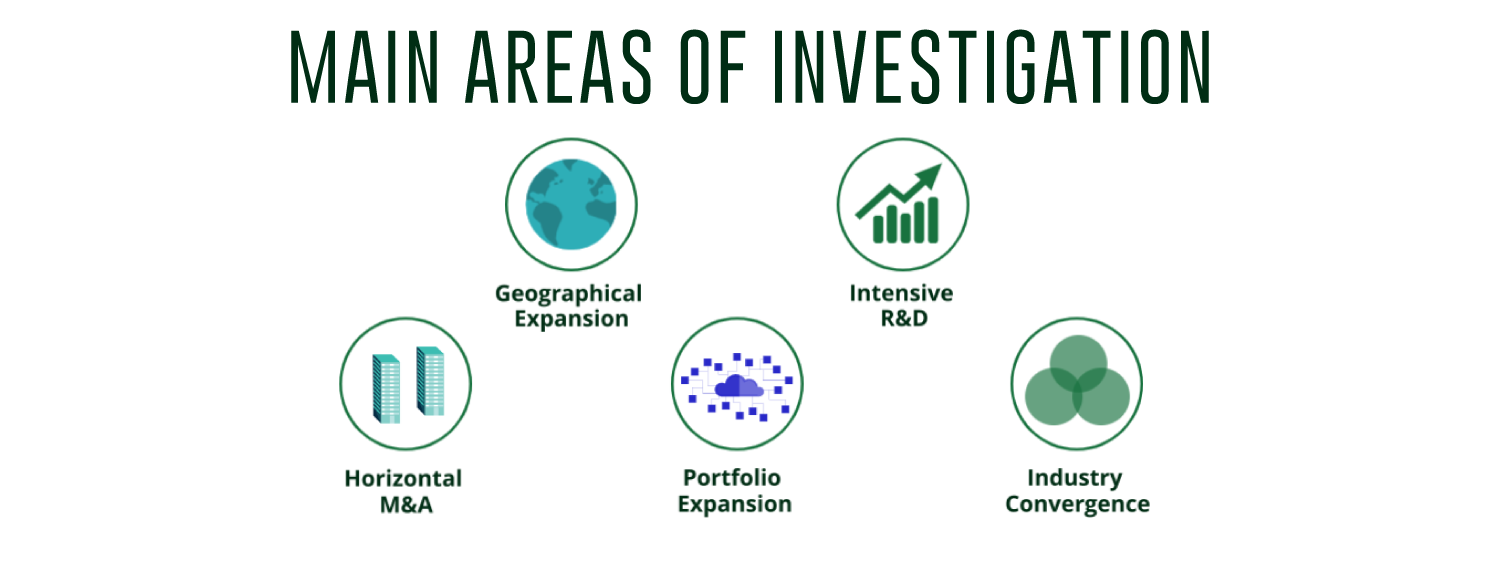

Main Areas Subject to Merger Due Diligence

The scope of an M&A investigation varies depending on its intended purpose. Let’s take a look at the main areas subject to merger due diligence according to the M&A strategy.

- Horizontal M&A

A company seeks to increase market share by acquiring a competitor in the same industry. Therefore, it is essential to investigate the resulting market share after acquisition and cost reduction due to economies of scale. A particular survey on the human resources of the target company would become critical.

- Geographical expansion

This involves acquiring a foreign company to develop overseas markets. In cross-border M and A, conducting thorough research on the foreign market is crucial, including consumer preferences and government regulations. Additionally, it is important to analyse the operational and commercial aspects of the company as well as its strengths compared to competitors in the market.

- Product/Business Portfolio Expansion

It is to absorb the target’s business to improve sales revenue. So, the buyer should comprehensively analyse the target company’s products and potential synergies with the buyer’s existing products. They should also establish a systematic integration plan for the target’s operations and human resources.

- Research and Development

That is for gaining already completed R&D and raising its business through the buyer’s internal infrastructure to advance into a new market. Therefore, the buyer should carefully investigate the target company’s technology, R&D and intellectual property rights. They must also identify key personnel and implement an effective retention strategy.

- Industry Convergence

Which involves acquiring a company that has entered a new emerging market. This M&A requires extensive commercial and technical research of the target company. The buyer should also build up an excellent strategy to retain essential personnel.

Determining the Level of Merger Due Diligence

The extent of merger due diligence required can vary depending on the nature of the merger or acquisition. Typically, the degree of due diligence increases with the size or complexity of the transaction, as well as the regulatory requirements involved. Additionally, the level of M&A due diligence may be influenced by the industry sector or the financial stability of the target company.

In general, firms with significant technological components or weakened financial positions may warrant a more extensive level of merger due diligence. Meanwhile, if the target company is on public auction or highly sought after, conducting a thorough merger due diligence process may not be feasible, despite its necessity. This is because competitors may submit their offers while you’re still conducting the investigation. There also tend to be stringent deadlines to work towards. In such cases, it is essential to develop a comprehensive checklist and prioritise the items to investigate in order of importance. This approach enables you to perform the most critical due diligence first quickly. It is crucial to note that any issues identified during merger due diligence should be explicitly stated in the final investment agreement to ensure that both parties can address them.

Areas of Merger Due Diligence – Disney’s Preparation for Marvel Investigation

Let’s examine the key areas of merger due diligence that are critical in the context of Disney‘s acquisition of Marvel. The primary goal of Disney’s acquisition of Marvel was to integrate the Marvel characters into its portfolio, focusing on strengthening the adult male fanbase. Consequently, we’d realise which areas of Marvel Disney should have done more merger due diligence in. Disney would have needed to comprehensively assess Marvel’s operational, legal, and financial aspects.

Regarding operations, Disney should fully understand Marvel‘s characters, particularly their fan base, development process, and new characters in development. It also entails analysing the popularity rankings and profiles of each character. The legal part is crucial, particularly for Marvel, which possesses numerous intangible assets. Disney must conduct a detailed analysis of Marvel‘s intellectual property rights and monitor ongoing or upcoming related lawsuits. Financial due diligence is critical in all M&A. Disney needs to examine the revenue generated by each Marvel character in every area, as well as their profitability trends.

Interviewing key personnel in the target company is also essential to acquisition due diligence, as it can provide insights that cannot be obtained solely by examining documents. When conducting M&A due diligence on Marvel, Disney could pose several questions to the executives in each division to gain a more in-depth understanding of Marvel‘s characters. Disney could ask the operation team the following questions for a more in-depth analysis of Marvel‘s characters:

- Why Marvel‘s popular characters have achieved such significant success?

- How much is each character expected to generate cash flow?

- Why have certain characters failed if any, and what caused the losses?

Disney should also meet with the legal team and ask the following questions:

- Is Marvel currently involved in a legal dispute? If so, what is it?

- Have there been IP infringement claims against Marvel?

Additionally, to prevent the loss of key personnel, Disney could ask the HR team about the following:

- Marvel‘s unique corporate culture.

- Whether there are individuals opposed to Disney’s acquisition of Marvel.

- Which external parties or companies are critical to Marvel’s operations?

Sources and Further Reading

If you have found the information insightful, head over to the M&A Institute, log in and start our online courses now. Or go to our Youtube Channel for further watching! For further reading check out:

- Disney to acquire Marvel in $4 billion deal | Reuters

- Marvel: How Good A Deal For Disney? (forbes.com)

If you can, here is Essentials of Merger Due Diligence by Peter Howson. Read up on the basics and enjoy!