Course Structure & Learning Flow

A Scientifically Designed M&A Learning System You Can Apply Immediately

The M&A Institute Learning Interface

Learning Complex M&A Made Effortless

Our learning UI/UX is engineered to transform complex technical data into intuitive strategic judgment.

- Scientifically Designed Three-Layer Interface

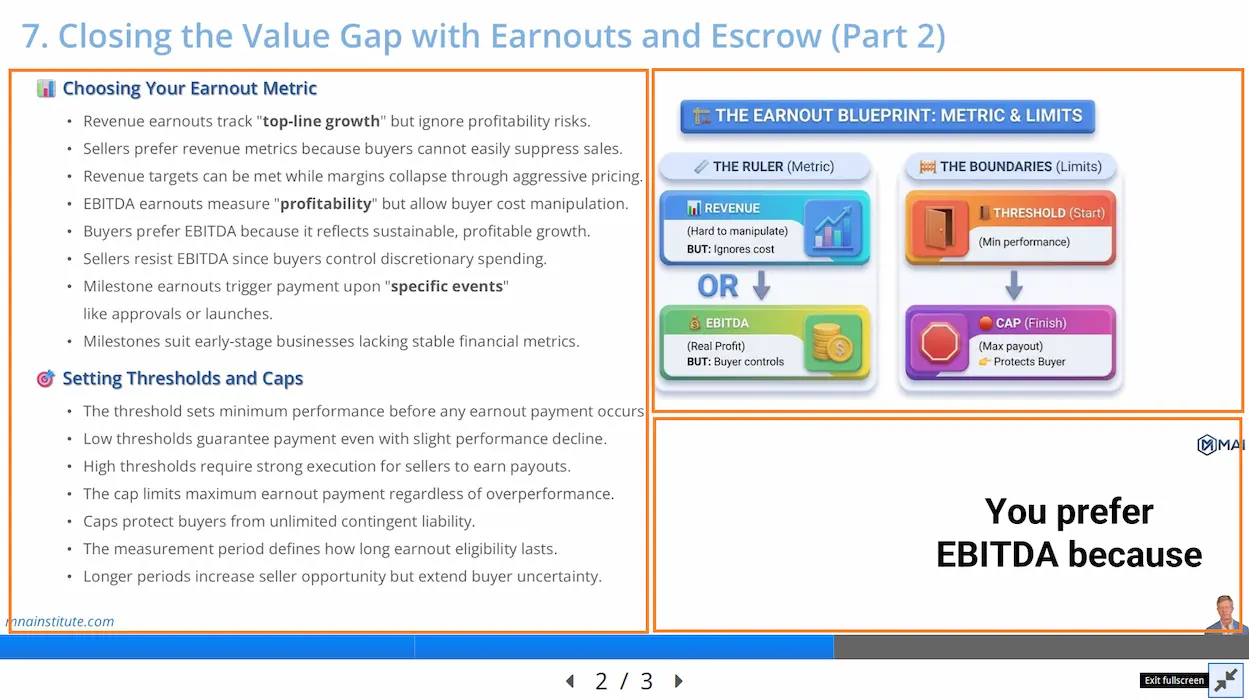

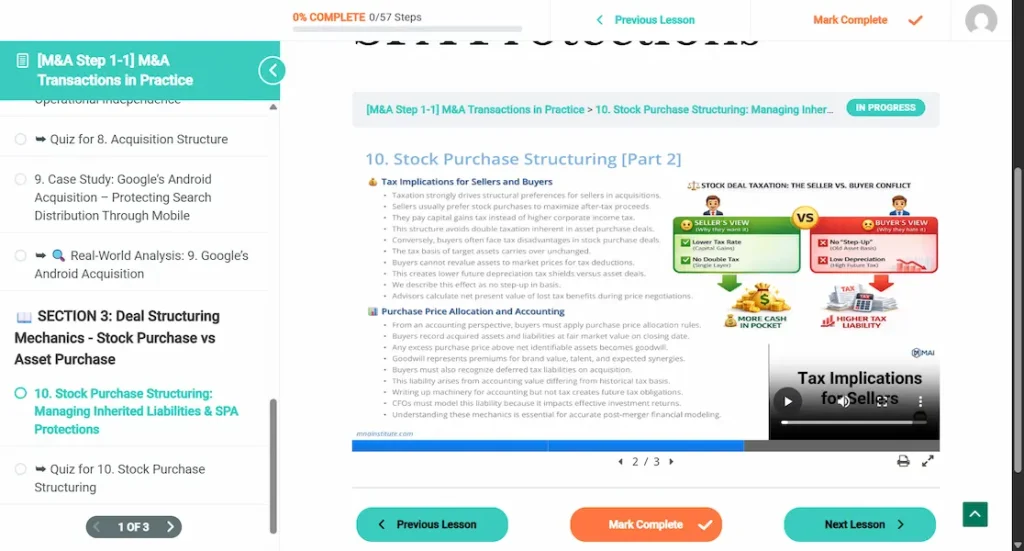

Every lesson follows a three-layer learning structure designed to help learners understand complex concepts quickly and intuitively.# Left Panel: Structured Written Content

Carefully edited bullet points guide you through each concept with clarity. Even reading the text alone ensures full comprehension. As the audio plays, your eyes naturally follow along, reinforcing understanding through synchronized reading and listening.# Right Panel: Visual Infographics

Colorful diagrams translate abstract ideas into concrete visuals. This graphic reinforcement transforms difficult concepts into intuitive, friendly frameworks you can grasp instantly, turning complexity into clarity.# Bottom: Audio Narration with Real-Time Subtitles

Live subtitles appear word-by-word as you listen. Adjust playback speed (0.5x to 2x) to match your learning pace. Fullscreen mode available for immersive focus. - Practical Application Quizzes

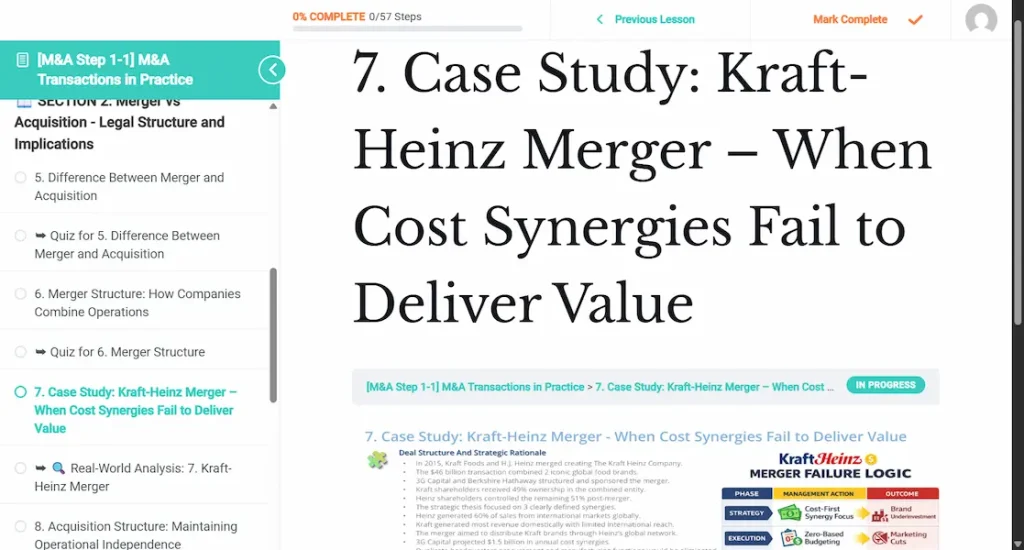

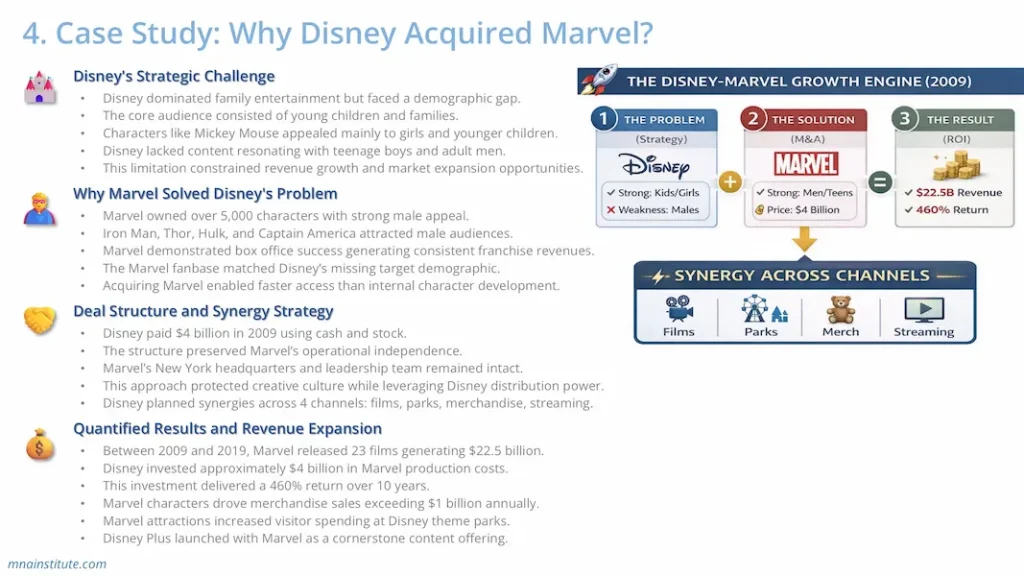

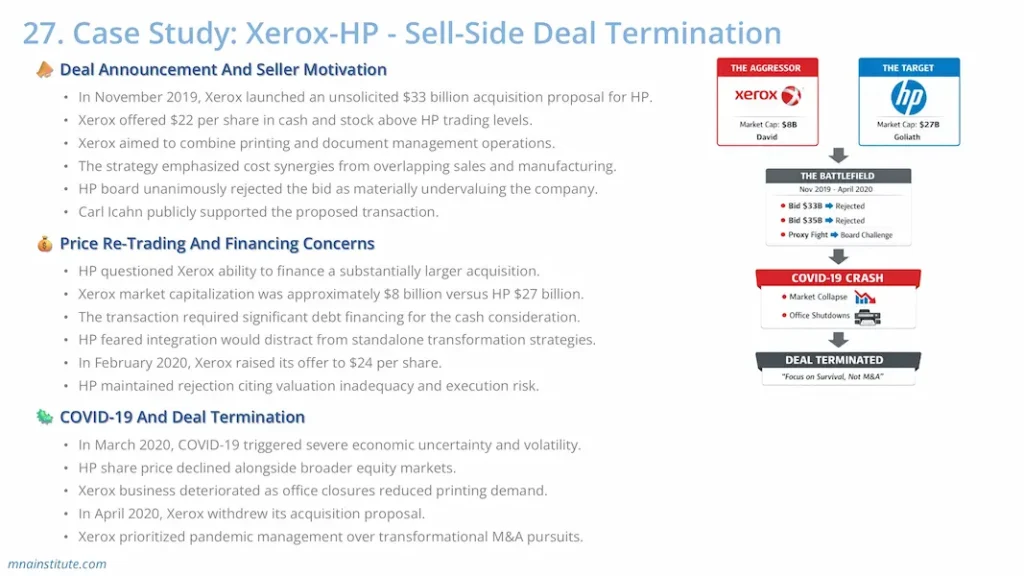

What you learn in the lesson becomes yours through targeted quizzes. Each question is designed with real-world scenarios, testing not just knowledge, but your ability to apply these concepts in actual deal situations. You'll discover exactly how to use what you've learned in practice. - Real-World Case Studies

See theory meet reality. Explore how major deals, from household-name acquisitions to landmark transactions, actually implemented these exact concepts. Learn from what worked, what failed, and why, bridging the gap between classroom and boardroom.

The result? You don't just understand M&A. You master it, step by step, with confidence.

Visual Examples of Our Learning Tools

Sample Internal View of This Course

Course Content

Your Course Deliverables

Board-Ready Decision Frameworks

What You'll Build

- Buy-Side Decision Framework

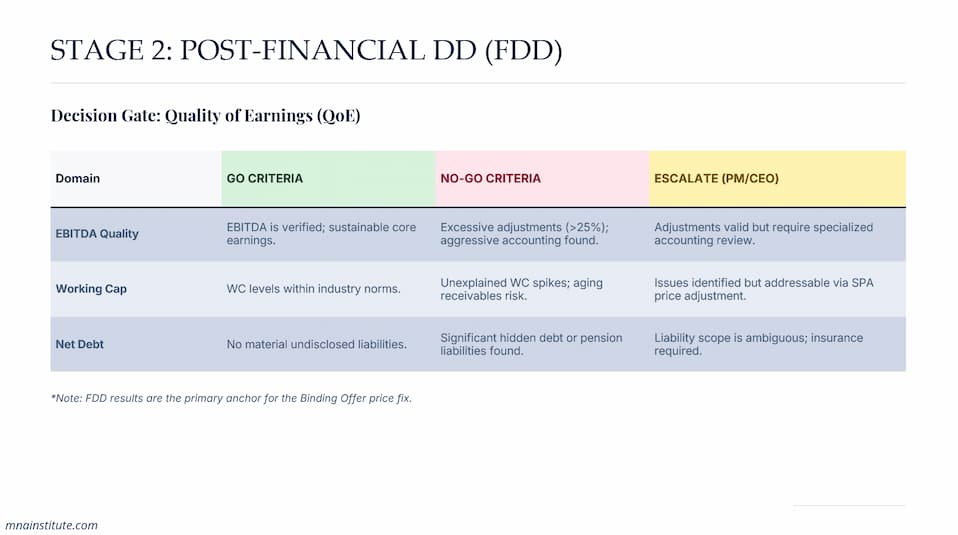

- Strategic screening gates with clear go/no-go criteria

- Quality of Earnings checkpoints preventing value destruction

- Risk mitigation triggers across the full deal lifecycle

- Sell-Side Decision Framework

- Pre-marketing readiness assessment preventing premature launches

- Buyer qualification gates protecting against intel-hunters

- Exclusivity control mechanisms maximizing competitive tension

Real-World Deliverables

- You'll master the exact governance structure that prevents "deal heat" from overriding logic, protects enterprise value, and forces disciplined capital allocation at every decision gate.

AI Interactive Simulation to Improve Your Practice

Scenario: Acquiring AI Tech for a Legacy Manufacturer

In this interactive simulation, you will act as the Corporate Development Lead for a traditional manufacturing firm looking to acquire an agile AI venture company. You must navigate the M&A transaction process by:

- Assessing the strategic fit and "build vs. buy" logic

- Selecting the appropriate deal structure to retain key talent (Acqui-hire considerations)

- Negotiating the Letter of Intent LOI terms

- Managing due diligence risks and making the final Go/No-Go decision

What You Will Gain from This Course

Move Beyond Theory: Run the M&A transaction process

with the structure, documents, and judgment used in real deals.