Introduction to Financial Due Diligence

Financial due diligence is one of the most important aspects of M&A DD. It is more than just investigating financial records. It also involves examining the underlying profit, what contributes to it and how the target company’s future looks. The M&A FDD team will spend much time assessing the target company. Hence, their knowledge could also be utilised to gain an in-depth understanding of the overall commercial aspects of the target, not just their financials. The main objectives of M&A Financial Due Diligence are the following.

- Precise examination of the assets and liabilities of the target company, which will later be used in the upcoming negotiation stages. It may lower the purchase price depending on the due diligence result.

- Items related to the income statement. If the due diligence team identifies factors that may adversely affect the target company’s future performance, that will also affect the purchase price adjustment.

- Quantify the synergies they could create after acquiring the target company. For this, they should find out how well the target company fits into their acquisition strategy and where they could save on costs together. In that process, they may unearth any potential dealbreakers.

The reason for close scrutiny of assets, liabilities and future performance is that the seller controls all information about their company until the offer has been made. Most of the information they present will paint the target company in the best light to discourage buyers from dropping the deal. Therefore, potential buyers must find out if everything the seller presents is true. If they are far from the facts, stopping the deal is much wiser.

Dropping a Deal during Financial Due Diligence

The following things require you to drop the deal or affect the final contract or valuation:

- Deal Breaker – a significant risk factor that requires you to drop the deal.

That can be divided into financial and non-financial factors. The former are mainly undisclosed debts, understated assets, and black holes requiring continuous capital consumption. The latter are usually legal or regulatory compliance risks, intellectual property issues, or unsolved environmental concerns.

- Ammunition – information that can be used to gain leverage in your negotiation or help you make an informed decision about whether or not to proceed with the deal.

Ammunition includes the target company’s liabilities, operations, customers, suppliers, employees, intellectual property, or legal issues.

- Normalised Profit – a target company’s maintainable profit. This is the underlying profit that the target company can earn continuously in the future.

To estimate it, you should fully understand the target’s business and identify the profit it earns from its core business. Then, you should remove one-time gains or expenses such as asset sales, restructuring costs, insurance claims, or even accounting gains and losses.

Financial Due Diligence Process

The Financial DD process can be divided into four steps.

-

- Assemble a team of experts responsible for conducting the investigation. This team should consist of professionals with external and internal expertise, such as accountants and financial professionals who understand the acquirer’s M&A strategy and objectives well.

- The team should define the scope of the financial due diligence process. This includes identifying the key focus areas, such as certain tangible or intangible assets, maintainable profit, tax compliance, contracts, or regulatory compliance. During this process, the team could draft a ‘Terms of Reference’ – a document that outlines the scope and objectives of the due diligence process. Defining the roles and responsibilities of the due diligence team and setting out the framework for the review process.

Terms of Reference

-

-

- Overview: It begins with an overview of the Financial DD process and the purpose of the engagement.

- Scope: It outlines the scope of the due diligence process, including the areas of focus and specific objectives to be achieved.

- Timeline: It includes the expected timeline for completing the due diligence process, including key milestones and deadlines.

- Roles and Responsibilities: It defines each team member’s roles and responsibilities, including the client’s team and third-party advisors.

- Data Room Access: The document should specify the procedures for gaining access to the data room, including any security or confidentiality requirements.

- Deliverables: It lists the expected deliverables, including the due diligence report and any other supporting documents.

- Assumptions and Limitations: The document outlines any assumptions made during the due diligence process and any limitations that may impact the findings or conclusions.

-

-

- Ask the target company to prepare the data list. The data should include all relevant financial documents, such as audited financial statements, tax returns, and contracts. Also, the team should arrange interviews with the target’s key employees, as interviews are critical in due diligence. They would need to sign a ‘Harmless Letter’.

Harmless Letter

-

Conduct an onsite investigation to review data and interview key personnel. And they should compile their findings into a comprehensive due diligence report. This report should include a summary of the team’s findings, any identified financial risks, and recommendations for mitigating those risks. The report will be shared with key stakeholders, including management and potential investors, to inform decision-making.

The Financial Due Diligence Team

A financial due diligence team typically comprises a group of accountants, financial analysts, and sometimes lawyers. Of course, the team’s size and composition may vary depending on the target company’s size and business.

- The buyer’s team should include internal auditors or financial experts.

They should already know the buyer’s FDD strategy, goal, and internal finances well. In addition, they could lead and supervise external experts during the financial due diligence, providing greater comfort to the board of directors. And they would utilise their experience and know-how when conducting another M&A next time.

- The buyer should hire external advisors such as accountants and lawyers.

The buyer can only handle financial due diligence with an internal workforce. Advisory services are expensive, so the buyer should make a wise decision comparing employment and efficiency. For that, the internal team should determine what roles and responsibilities to assign to each member based on their skills and expertise.

- An internal team is recommended to be the due diligence leader, but if they have little experience, they should entrust an external team.

The internal leader should communicate with the whole team regularly to ensure that due diligence is proceeding in an orderly manner. They should also monitor the overall flow and external teams and make necessary adjustments.

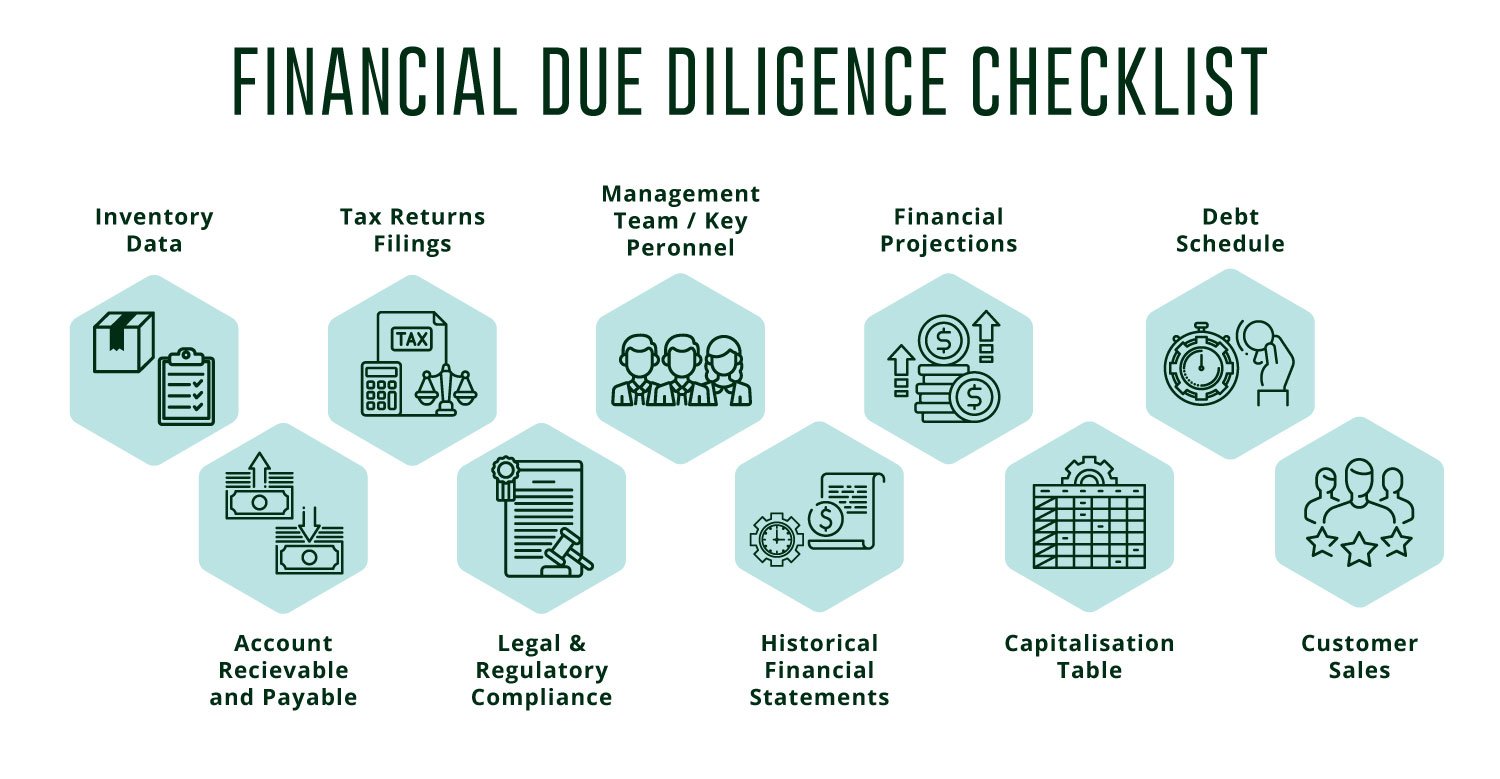

A Financial Due Diligence Checklist

Let’s look at some common data that should be checked in financial due diligence.

- Historical financial statements: Reviewing the target company’s historical financial statements is basic and crucial for assessing the company’s financial performance, profitability, and cash flow. You should identify revenue, expenses, and profitability trends over time.

- Financial projections: Evaluating the target’s financial projections is essential for assessing the company’s potential for future growth and profitability. These projections are typically prepared by the target company’s management team and are based on assumptions about future market conditions and company performance.

- Capitalisation table: A capitalisation table shows the target’s ownership structure, including the number and type of shares outstanding, the percentage of ownership held by each shareholder, and the share price. This data helps identify potential conflicts of interest or issues related to ownership structure.

- Debt schedule: The debt schedule shows the target company’s outstanding debt obligations, including the principal amount, interest rate, maturity date, and any covenants or restrictions associated with the debt. You need to evaluate the target company’s ability to service its debt and assess the risk associated with it.

- Customer and sales data: Reviewing the target company’s customer and sales data is important for understanding the company’s revenue streams and customer base. With them, you could identify any revenue concentration among a small number of customers and any trends or changes in customer behaviour.

- Inventory data: Reviewing the inventory data is important for evaluating the company’s supply chain management practices and identifying any potential inventory obsolescence or write-downs.

- Accounts receivable and payable: You should assess the target’s cash flow and liquidity by reviewing the accounts receivable and payable. They help identify any potential issues with late payments or collections and any potential liabilities associated with outstanding payables.

- Tax returns and filings: Reviewing the target company’s tax returns and filings is important for evaluating the company’s compliance with tax laws and regulations. The team must identify any potential tax liabilities or issues related to tax compliance.

- Legal and regulatory compliance: Reviewing legal and regulatory compliance is important for evaluating any potential legal or regulatory risks associated with the company’s operations. This data helps identify potential liabilities related to litigation, regulatory fines, or penalties.

- Management team and key personnel: Evaluating the target company’s management team and key personnel helps you assess the target’s ability to execute its business strategy and manage risks. Then, you would consider any potential talent gaps or concerns related to the target’s leadership team.

Preparation for Cross-Border FDD

When you conduct cross-border M&A, financial due diligence becomes even more prominent. Here are some key areas:

- Financial reporting standards can vary between countries.

This makes it difficult to compare financial information across borders. So, evaluating the target’s financial reporting standards is critical, and you should ensure that the financial information provided is comparable and accurate.

- Tax laws and regulations can also vary significantly between countries.

Evaluating the potential tax implications of the transaction is important. This includes assessing the tax status of the target company and any potential tax liabilities associated with the deal.

- Legal and Regulatory Requirements – You should ensure that the target company complies.

It will be connected to any potential liabilities or legal disputes the target company may face.

- Political and Economic stability – do not overlook this. It can significantly impact the target’s financial performance and valuation.

That’s why you need to assess the political and economic climate in the target country and evaluate any potential risks or uncertainties.

- Currency risk can significantly impact the target’s financial performance and valuation.

If you target the company in one of the emerging countries, you need to carefully evaluate the target company’s exposure to currency risk and assess the potential impact on the financial projections.

For a cross-border deal, seeking advice from a local advisor to prepare is recommended. That will help you understand the differences between countries. If you deal with a global company running operations in several countries, due diligence should be even more extensive. In such cases, hiring a large advisory firm capable of conducting due diligence on global companies may be necessary.

Sources and Further Reading

If you have found the information insightful, head over to the M&A Institute, log in and start our online courses now. Or go to our Youtube Channel for further watching!