Understanding Commercial Due Diligence

Commercial Due Diligence (CDD) is an extensive, structured analysis carried out on a prospective acquisition to evaluate its commercial potential and viability. At its core, commercial due diligence provides an in-depth understanding of the target company’s position in the market, its competitive strengths and weaknesses, customer sentiment, and its potential for future growth.

The process endeavours to identify commercial opportunities and risks that could impact the strategic and financial objectives of buyers’ M&A transactions. Ultimately, it offers them a commercial lens to assess the transaction’s viability. To conduct it, commercial due diligence involves a comprehensive analysis of market dynamics, customer base, product portfolio, sales and marketing strategy, and much more.

Commercial Due Diligence in the M&A Process

In the M&A process, commercial due diligence typically begins after:

- The signing of a Non-Disclosure Agreement (NDA)

- and The Expression of interest (EOI),

It also happens prior to:

- The negotiation of the Letter of Intent (LOI)

- or The Memorandum of Understanding (MOU).

The exact positioning can depend on the specific transaction’s dynamics and the buyer’s and seller’s preferences. Commercial due diligence is conducted during the due diligence phase and plays a key role in shaping the terms of the final agreement. It provides a comprehensive view of the target’s commercial position, which, along with the findings from financial, legal and other due diligence types, forms the foundation for transaction valuation, negotiation, and structuring. As the deal progresses, the results of the commercial due diligence can be used to refine integration planning, identify synergies, and plan for the realisation of value post-acquisition. Post-deal, the commercial due diligence findings can continue to guide the strategic direction of the combined entity.

Comparing Various Due Diligence types with CDD

CDD complements and intersects with other due diligence types, such as financial and legal, within the M&A process.

- Financial Due Diligence (FDD) primarily focuses on “verifying the target’s financial health by scrutinising its financial statements.“

- Commercial Due Diligence (CDD) takes a broader view by “examining the company’s market standing, competitive landscape, and growth potential.“

- Similarly, Legal Due Diligence (LDD) “examines legal and regulatory compliance, contracts, and potential legal risks, which can provide useful insights.“

For example, a regulatory change that poses a legal risk might also impact the company’s competitive position or growth prospects. Moreover, the outcomes of the commercial due diligence can significantly influence the findings of FDD and LDD. For example, a robust market position or high growth potential discovered during CDD could result in a higher valuation during financial due diligence. Conversely, identified commercial risks could lead to lower valuation or adjustments in the deal structure. Ultimately, CDD, FDD, LDD can collectively:

- provide a holistic view of the target company

- enable the buyer to make an informed decision about the transaction

- brings a different perspective

- ensure a comprehensive understanding of the target company, covering all significant aspects that could impact the M&A deal’s success

The Roles of Commercial Due Diligence in Valuation and Deal Structuring

Commercial Due Diligence plays a critical role in shaping the contours of an M&A transaction, influencing everything from valuation to deal structuring:

- Impact on Purchase Price

- CDD findings directly impact the purchase price. For instance, if commercial due diligence uncovers potential growth drivers like a robust product pipeline, it may justify a higher valuation. On the other hand, if it reveals risks such as customer retention issues or an adverse regulatory environment, these could lead to a downward adjustment in the purchase price.

- Influence on Deal Terms and Conditions

- CDD findings also play a crucial role in shaping the deal terms and conditions. For example, if commercial due diligence identifies a major risk, it might lead to specific indemnities in the acquisition agreement, protecting the buyer from that particular risk. Additionally, earn-outs might be used if there is uncertainty about future performance, with part of the purchase price contingent on the target achieving certain milestones.

- Contribution to Post-Merger Integration Planning

- Commercial Due Diligence doesn’t just inform the negotiation phase; it also feeds into post-merger integration planning. Insights gleaned from commercial due diligence, such as the competitive landscape, customer relationships, and the target’s business model, can inform how the target should be integrated and which synergies can be achieved.

Conducting Due Diligence – Organising a TF Team

Organising an in-house CDD Task Force (TF) team is critical in M&A deals.

An efficiently managed and balanced team is instrumental in thoroughly examining the target company, assessing potential risks, and aiding informed decision-making. The composition of the CDD TF team includes:

- Project Lead

- Ideally, a senior executive who acts as the project lead should be at the heart of the team. This expert is responsible for setting the strategic direction, liaising with stakeholders, and ensuring that due diligence stays on track. Their role also involves ensuring harmony between the in-house team and external advisors.

- Industry Experts

- Individuals with extensive knowledge of the company’s industry are crucial. They can provide valuable insight into the target’s product or service lifecycle and unique selling propositions.

- Technical/Product Experts

- These experts play a critical role in the team as they understand the intricacies of the target company’s product or technology. They are entrusted with critically evaluating the product’s competitive advantage, its place in the product lifecycle, the technology’s scalability, and identifying potential areas for integration or development.

- Financial Analysts

- They are skilled individuals who are brought on board to assess the financial viability of the target. Their job is to scrutinise their financial records, evaluate their profitability, and understand their revenue models.

- Legal Advisors

- In-house legal advisors can anticipate potential legal and regulatory issues impacting the M&A process.

External Advisors

Where the in-house team might lack specific expertise or when an impartial perspective is desired, external advisors may be engaged. These may include:

- IB firms or Specialist Consulting Firms

- These can be engaged for their extensive industry insight, helping to evaluate the target company’s commercial viability. They could be firms from among the largest in the field or niche consultancy firms with a specific focus.

- External Legal Advisors

- Another Valuable Resource. They have the expertise to conduct thorough LDD, which can reveal any hidden risks and offer strategies to navigate them.

- Financial Advisors

- They provide an additional layer of scrutiny to the financial analysis, ensuring a comprehensive financial evaluation of the target company.

To maintain harmony between the in-house team and external advisors, the project lead should ensure clear communication, coordination, and respect for each party’s unique insights. Regular meetings and updates, alongside clearly defined roles and expectations, will help keep everyone aligned and working toward the shared goal of a successful M&A transaction.

How to Conduct Commercial Due Diligence

Carrying out a robust commercial due diligence involves a blend of structured methodologies and effective research techniques.

-

Defining the scope

This typically includes aspects like the target’s market position, competitive landscape, customer relationships, product or service portfolio, business model, and growth prospects. Having a clearly defined scope ensures that the commercial due diligence process is focused and comprehensive.

-

Conducting interviews

Stakeholder interviews are a vital component of commercial due diligence. Engaging with key individuals such as senior management, employees, customers, and suppliers can yield valuable insights. Interviews should be strategically planned to cover essential topics like the company’s strategy, product performance, customer satisfaction, and market trends. Remember, each stakeholder offers a unique perspective, so it’s crucial to approach these conversations with a tailored set of questions.

-

Collecting and analysing data

Collecting pertinent data from a wide range of sources, including financial records, market reports, customer data, and regulatory filings, is crucial. This data should be analysed meticulously to understand the company’s financial health, market positioning, operational efficiency, and potential risks. For instance, financial data can reveal profitability trends, while customer data can shed light on retention rates and satisfaction levels.

-

Synthesis and reporting

Once the data has been collected and analysed, the findings need to be synthesised into a coherent narrative. It’s important to draw out key insights, identify potential risks and opportunities, and assess the target’s commercial viability. These conclusions should be reported clearly and structured, facilitating informed decision-making for the M&A deal.

Commercial Due Diligence is not a tick-box exercise.

It requires rigorous investigation, critical analysis, and a clear understanding of the commercial context. It’s about making informed judgements that will shape the success of the M&A transaction.

Commercial Due Diligence is also not a one-size-fits-all process.

It can be flexible to adapt to the unique circumstances of each potential acquisition. It combines analytical skills, a systematic approach, and effective interpersonal communication. A well-conducted CDD offers a comprehensive understanding of a target’s potential, forming a crucial foundation for any M&A decision-making process.

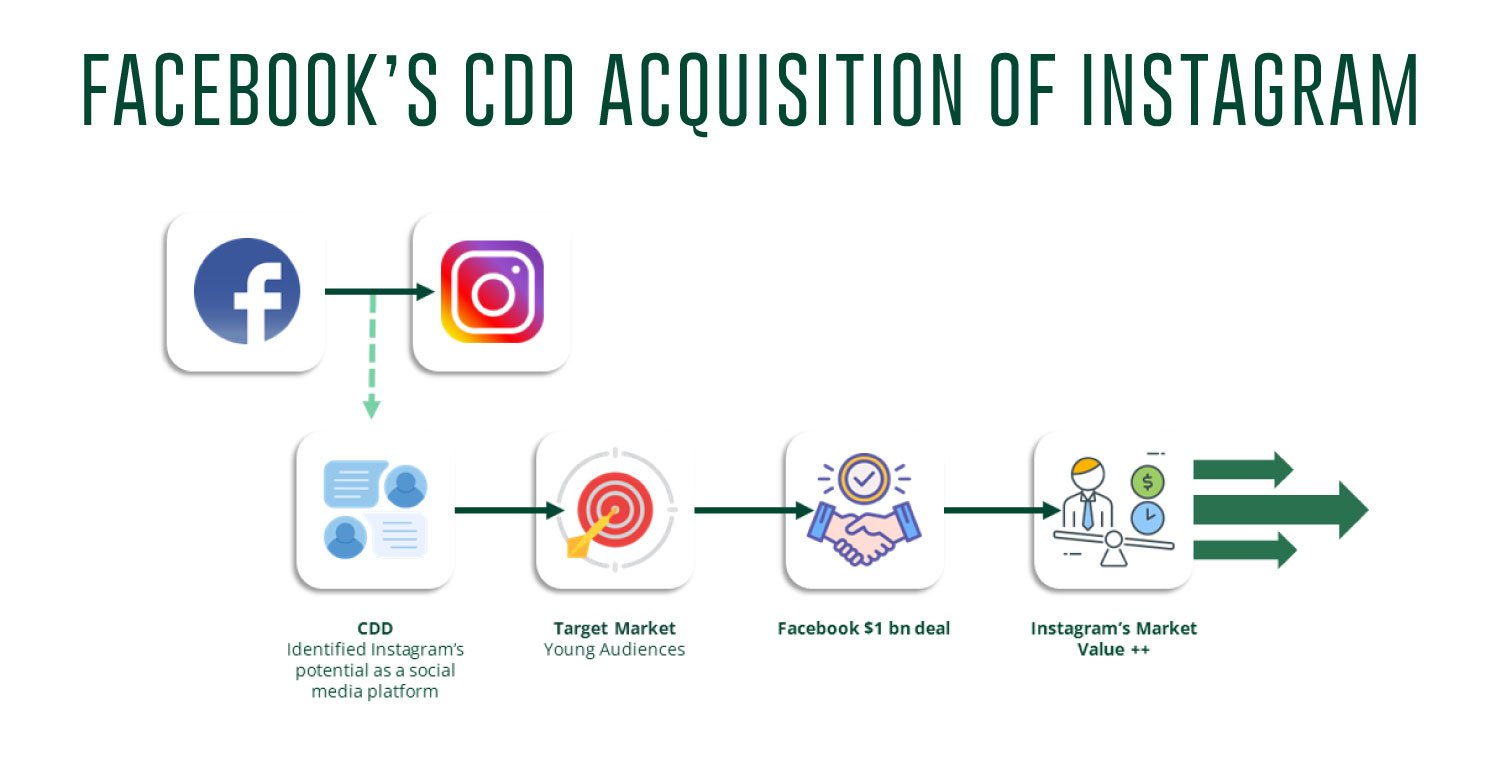

Case Study – Facebook’s CDD Acquisition of Instagram

Let’s look at a case study of Facebook’s CCD acquisition of Instagram in 2012. Through commercial due diligence:

- Facebook identified Instagram’s potential as a burgeoning social media platform despite its lack of a clear monetisation strategy.

- Instagram’s user base grew rapidly, and its unique photo-sharing functionality resonated with younger audiences, a segment where Facebook sought increased penetration.

- The commercial due diligence process validated the strategic rationale of the acquisition, and Facebook proceeded with the $1 billion deal.

- Today, Instagram is worth significantly more, showing how effective CDD can guide successful M&A decisions.

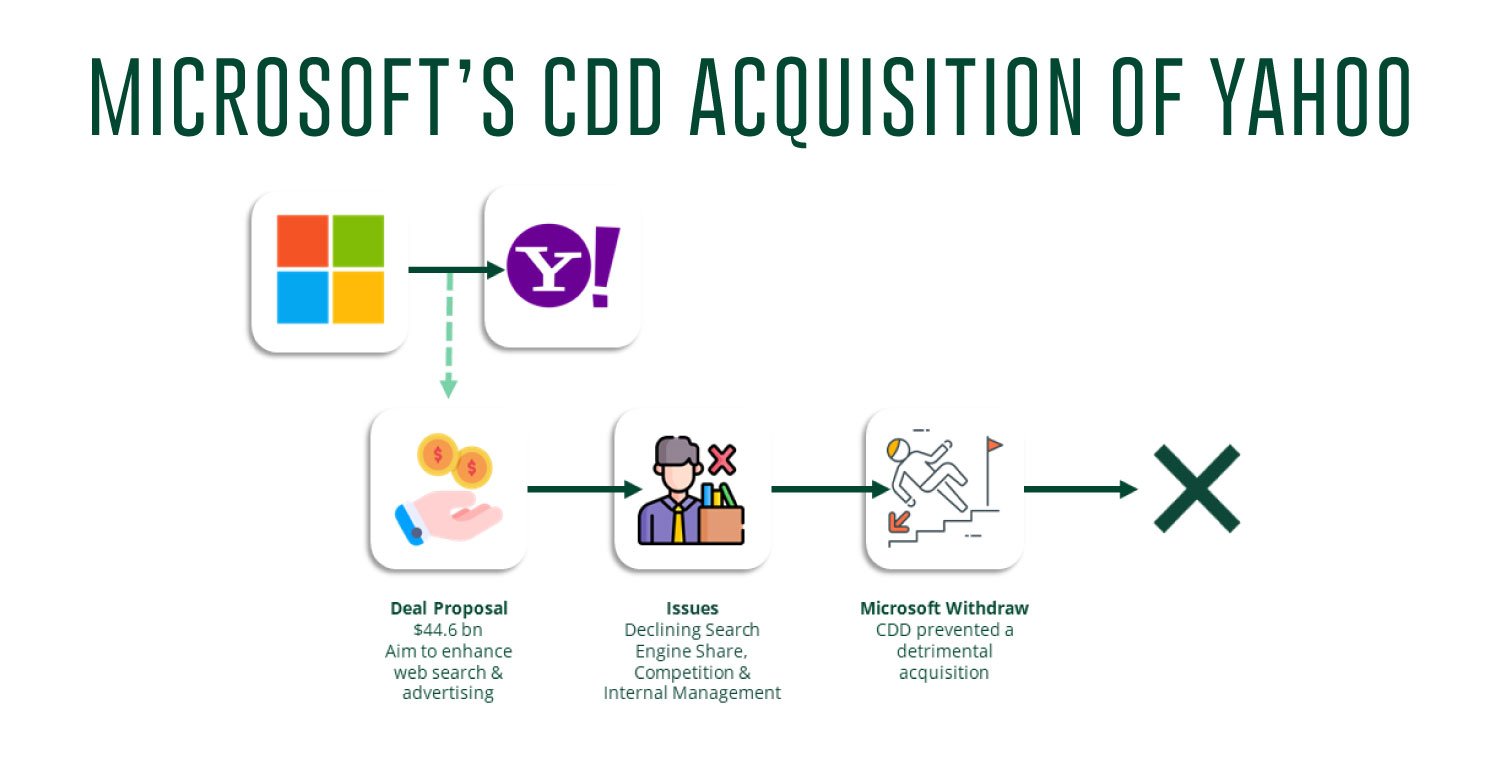

Case Study – Microsoft’s CDD Acquisition of Yahoo

Contrastingly, let’s examine Microsoft’s proposed acquisition of Yahoo in 2008.

- Microsoft initially offered $44.6 billion for Yahoo to enhance its web search and advertising capabilities.

- However, during CDD, Microsoft identified several concerns. These included Yahoo’s declining search engine market share, competition from Google, and internal management issues.

- As a result of the risks identified during CDD, Microsoft withdrew its offer, demonstrating that commercial due diligence can play a vital role in preventing potentially detrimental acquisitions.

CDD provided critical insights that influenced the decision-making process in both cases, underscoring its crucial role in M&A transactions.

Sources and Further Reading

If you have found this information on Commercial Due Diligence insightful, head over to the M&A Institute, log in and start our online courses now. Or go to our YouTube Channel for further watching!

Other M&A Transactions where the sell-side process can be found:

- Preparation for Due Diligence

- Intro to Due Diligence

- Due Diligence Risks

- Financial Due Diligence

Check out any further research from our case studies here:

- Zuckerberg Testimony: Facebook Instagram Deal to Quash Competitor – Bloomberg

- Facebook buys Instagram photo sharing network for $1bn – BBC News

- Facebook Instagram deal delay threat | Financial Times (ft.com)

- Microsoft and Yahoo seal deal | Financial Times

- BBC News – Microsoft-Yahoo search deal approved