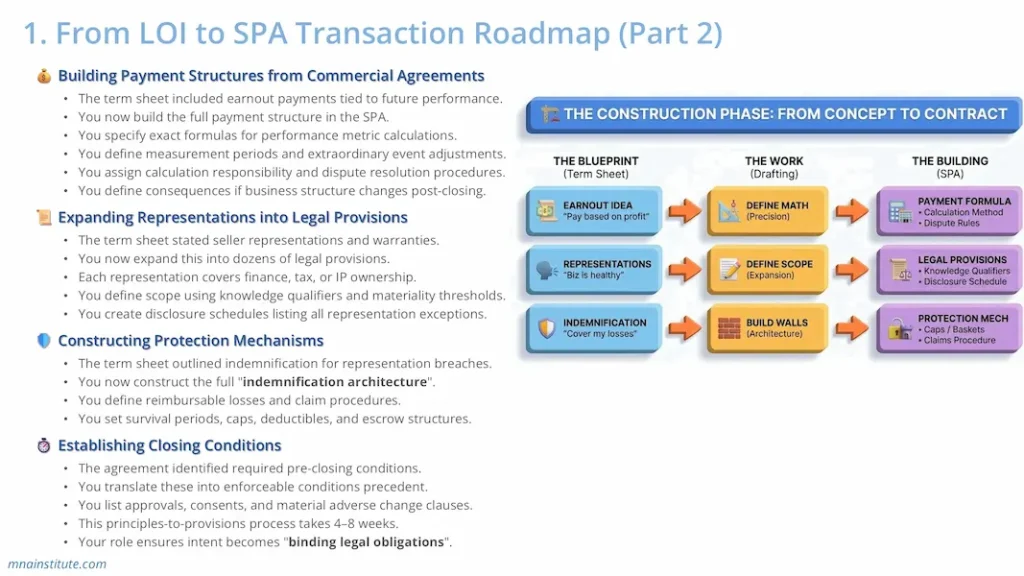

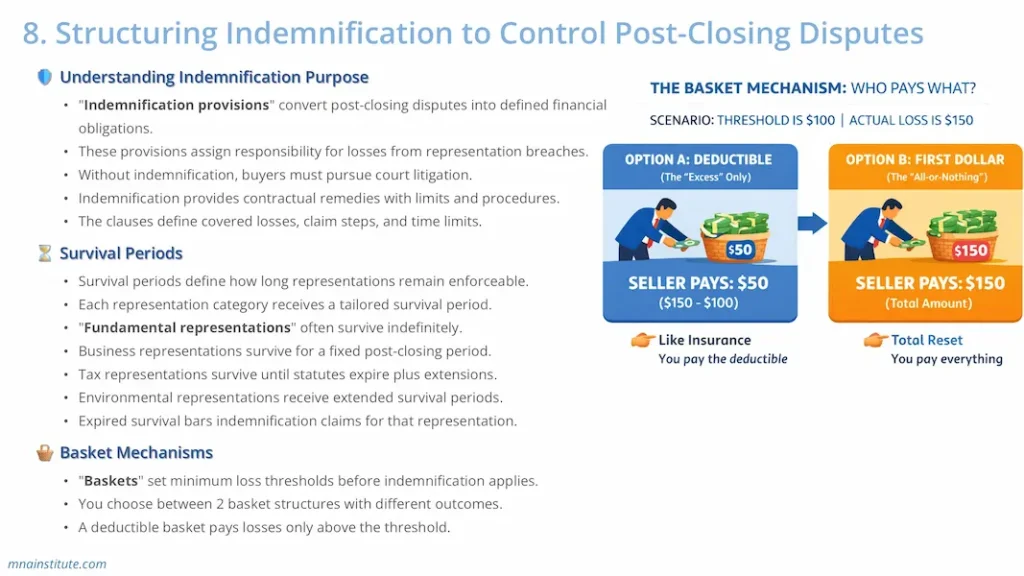

Course Structure & Learning Flow

Practical Training Built for Real SPA Drafting and Execution

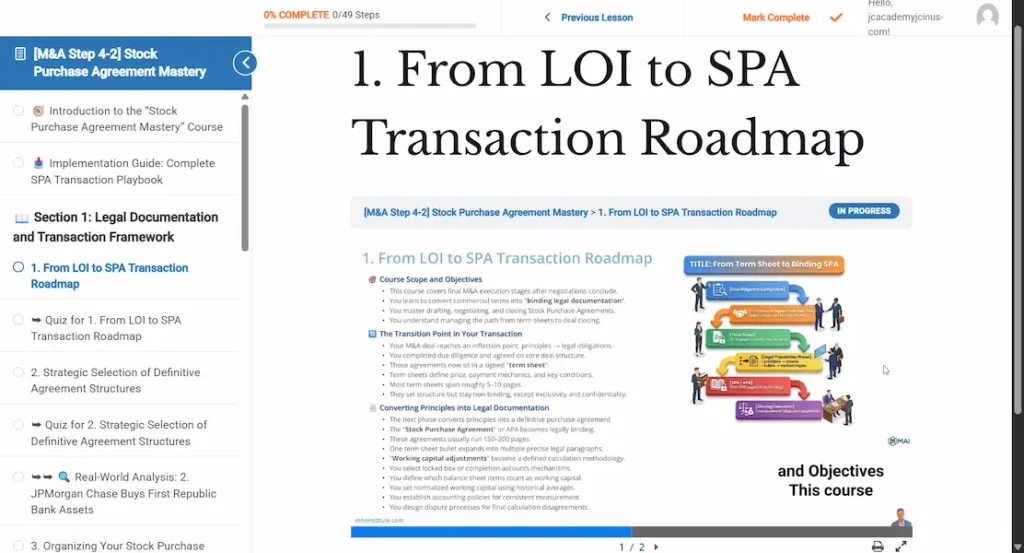

The M&A Institute Learning Interface

Learning Complex M&A Made Effortless

Our learning UI/UX is engineered to transform complex technical data into intuitive strategic judgment.

- Scientifically Designed Three-Layer Interface

Every lesson follows a three-layer learning structure designed to help learners understand complex concepts quickly and intuitively.# Left Panel: Structured Written Content

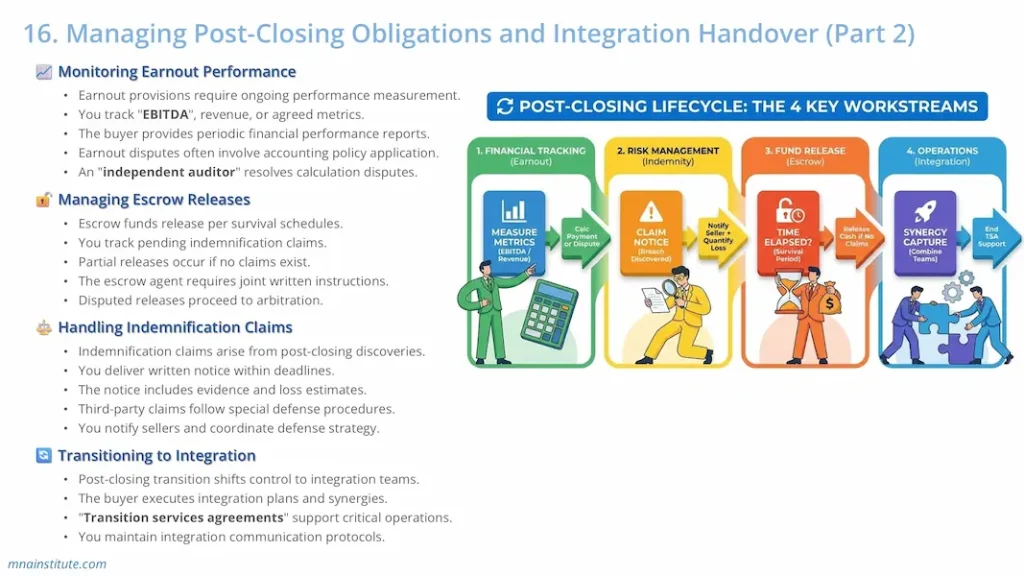

Carefully edited bullet points guide you through each concept with clarity. Even reading the text alone ensures full comprehension. As the audio plays, your eyes naturally follow along, reinforcing understanding through synchronized reading and listening.# Right Panel: Visual Infographics

Colorful diagrams translate abstract ideas into concrete visuals. This graphic reinforcement transforms difficult concepts into intuitive, friendly frameworks you can grasp instantly, turning complexity into clarity.# Bottom: Audio Narration with Real-Time Subtitles

Live subtitles appear word-by-word as you listen. Adjust playback speed (0.5x to 2x) to match your learning pace. Fullscreen mode available for immersive focus. - Practical Application Quizzes

What you learn in the lesson becomes yours through targeted quizzes. Each question is designed with real-world scenarios, testing not just knowledge, but your ability to apply these concepts in actual deal situations. You'll discover exactly how to use what you've learned in practice. - Real-World Case Studies

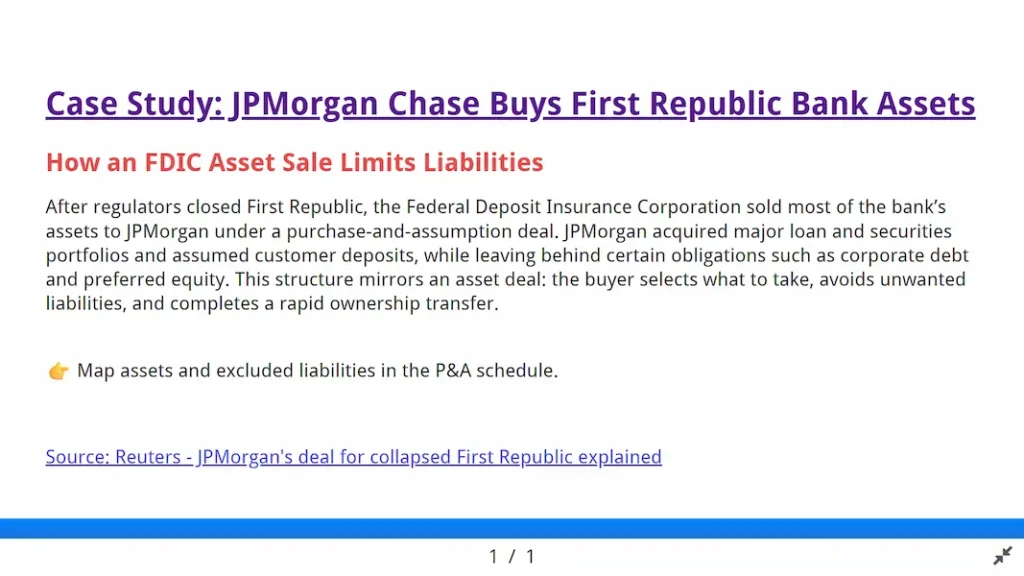

See theory meet reality. Explore how major deals, from household-name acquisitions to landmark transactions, actually implemented these exact concepts. Learn from what worked, what failed, and why, bridging the gap between classroom and boardroom.

The result? You don't just understand M&A. You master it, step by step, with confidence.

Visual Examples of Our Learning Tools

Sample Internal View of This Course

Course Content

Your Course Deliverables

Four Professional Stock Purchase Agreements Templates

What You'll Build

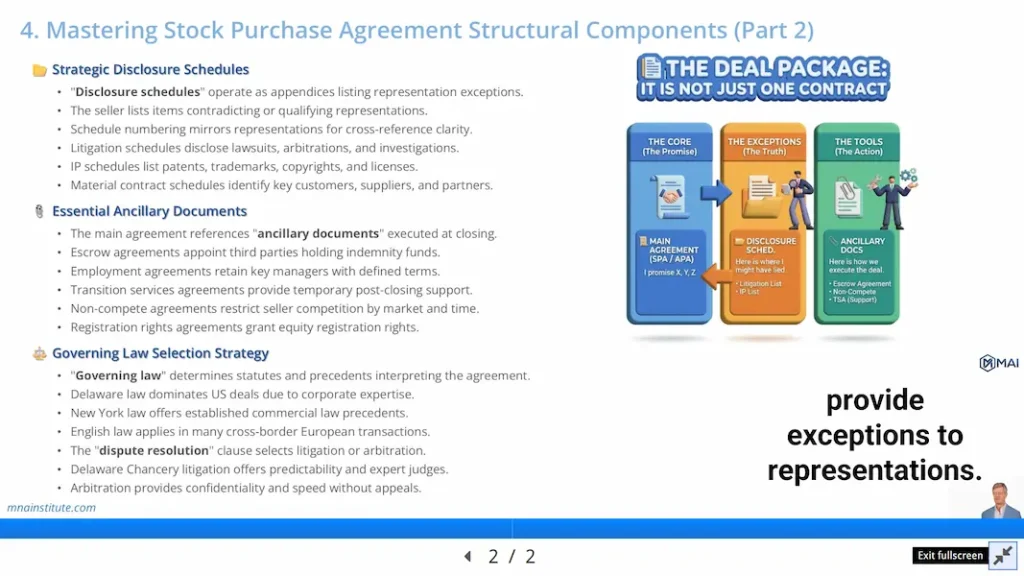

- SPA Clauses & Annotated Risk Mastery

- A complete Stock Purchase Agreements architecture with embedded commentary explaining risk allocation.

- Includes standard language for price, adjustments, covenants, indemnities, and termination.

- Highlights where leverage exists in every clause, helping you draft provisions that survive redlines.

- Signing-to-Closing Control Workbook

- An Excel-based control tower to track every redline, disclosure schedule, and condition precedent.

- Maps every m&a agreement clause to commercial objectives and fallback positions.

- Closing Checklist: A rigorous monitor for critical path items like regulatory approvals and funds flow calculations.

- SPA Negotiation Tactics & Closing Mastery

- A scenario-driven manual translating common negotiation conflicts into repeatable decision frameworks.

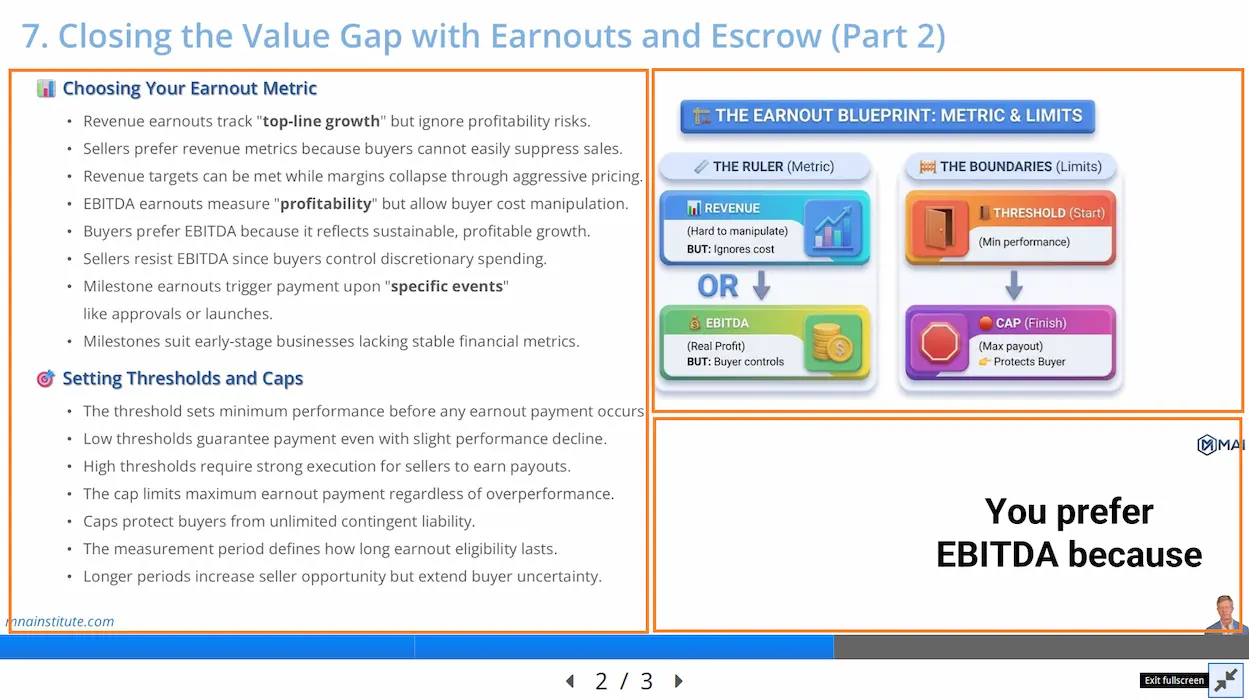

- Covers valuation gaps, earnout structure disputes, and indemnity basket negotiations.

- Teaches how to package economics and legal language to close issues without re-trading.

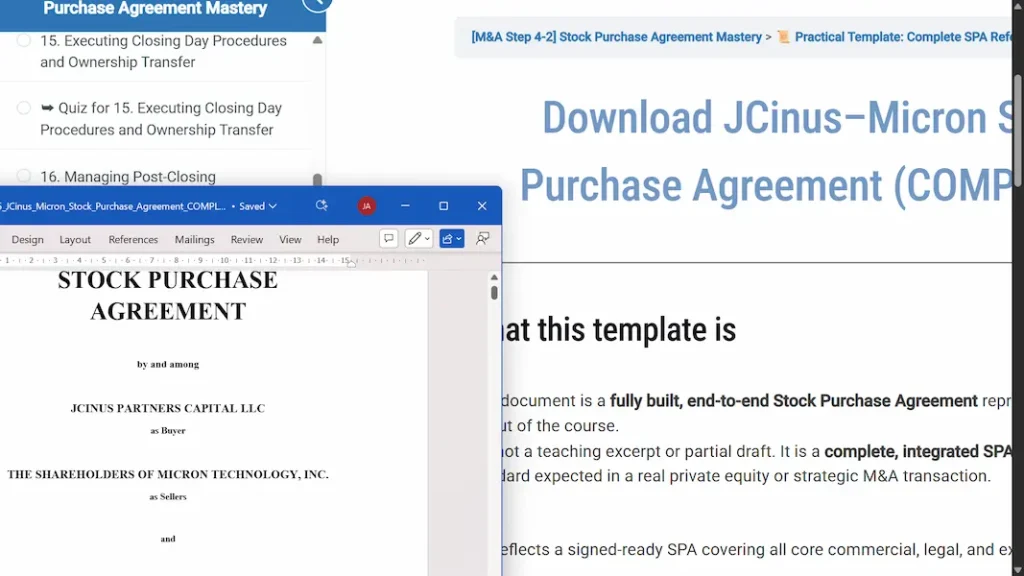

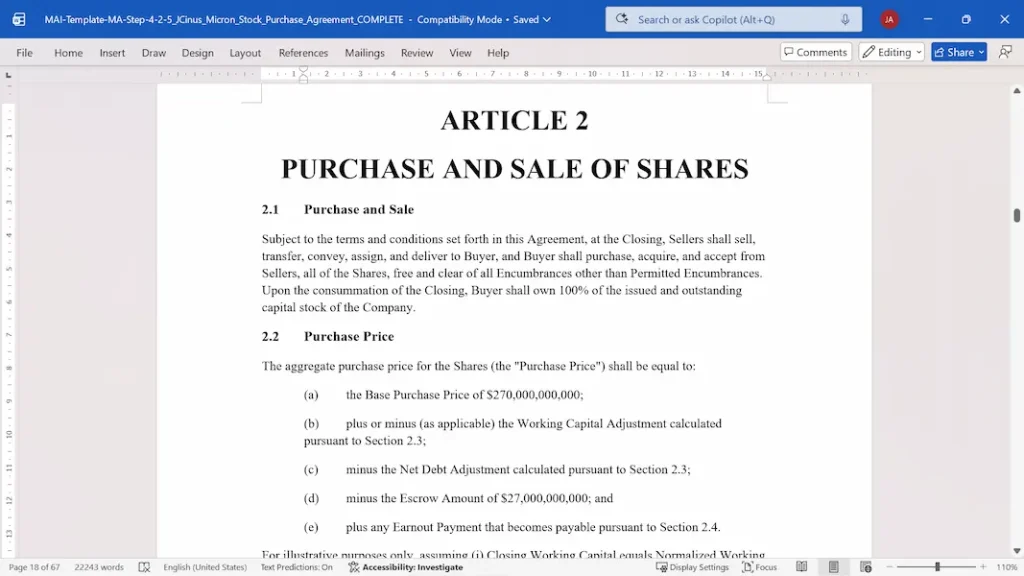

- Complete SPA Reference (PE-Micron)

- A fully built, signed-ready Stock Purchase Agreements document representing the final output of the course.

- Shows how pricing, reps, covenants, and indemnities converge into one enforceable contract.

- Represents the destination point of all drafting work, answering "What does a finished deal look like?"

You will master the exact Stock Purchase Agreements architecture that translates commercial intent into enforceable mechanics, controls risk across signing, closing, and post-closing, and produces documents that survive real redlines without leakage or ambiguity.

AI-Powered SPA Drafting Practice

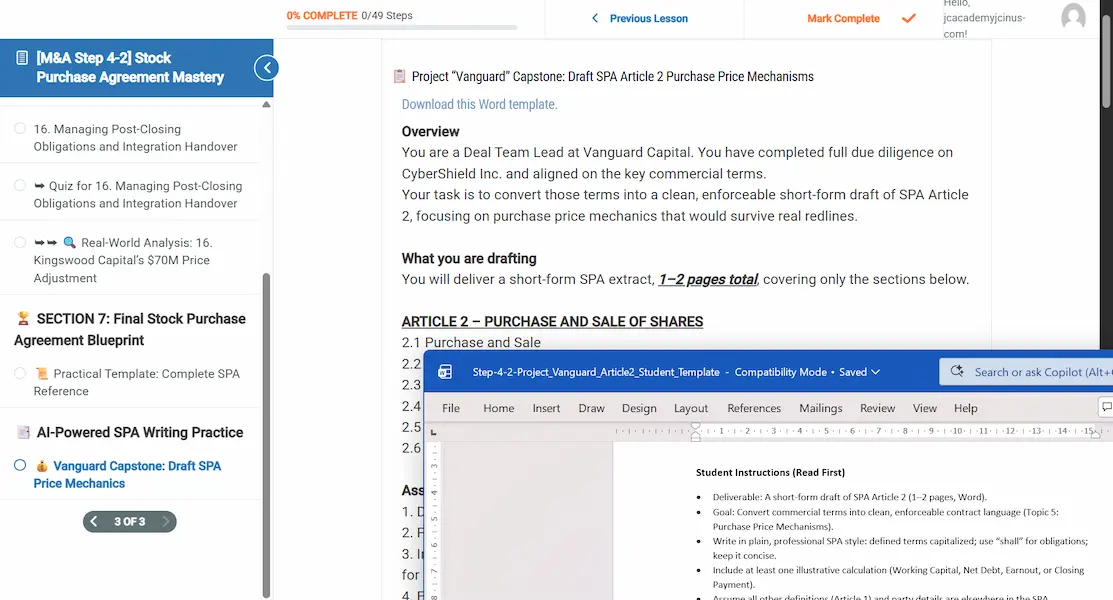

Project Vanguard: Draft SPA Article 2 Price Mechanics

This is an AI-assisted legal drafting module. You will write real SPA language and receive structured AI evaluation of your mechanical clarity, drafting precision, and execution enforceability.

You will act as Deal Team Lead at Vanguard Capital, having completed full due diligence on CyberShield Inc. and aligned on commercial terms.

Your task is to draft a short-form Article 2 of the Stock Purchase Agreements covering the full purchase price architecture.

You must produce a 1–2 page SPA extract applying every purchase price mechanics framework from the course:

- Structuring completion accounts workflow with Closing Statement, review period, dispute notice, and Independent Accountant process

- Drafting working capital purchase price adjustment with a $45M peg, dollar-for-dollar mechanics, and an illustrative calculation

- Writing net debt adjustment with a precise formula, defined categories, and an illustrative calculation

- Building earnout structure covering a 3-year cumulative EBITDA payout schedule from $120M to $150M with a linear formula and Buyer good-faith covenant

- Designing escrow mechanics for $50M held 24 months with a pending claims hold-back concept

- Drafting the closing payment equation integrating all adjustments into one executable closing day calculation

Submit your Article 2 draft and receive instant AI feedback

on whether your mechanics can be executed with minimal ambiguity.

What You Will Gain from This Course

Draft and execute Stock Purchase Agreements

with the clause frameworks, templates, and judgment used in real transactions.