M&A Negotiation Course Structure

Practical Training Built for Real M&A Negotiation

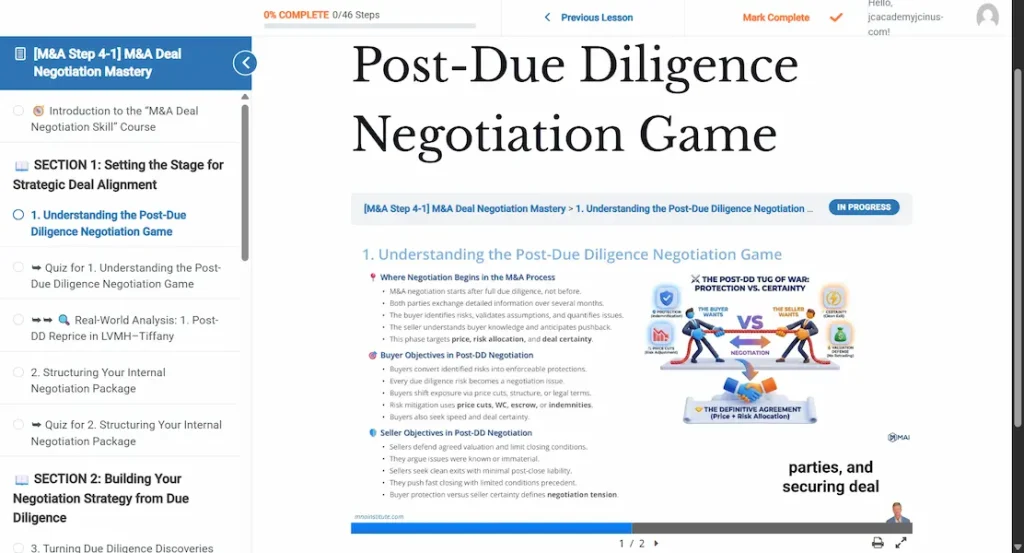

The M&A Institute Learning Interface

Learning Complex M&A Made Effortless

Our learning UI/UX is engineered to transform complex technical data into intuitive strategic judgment.

- Scientifically Designed Three-Layer Interface

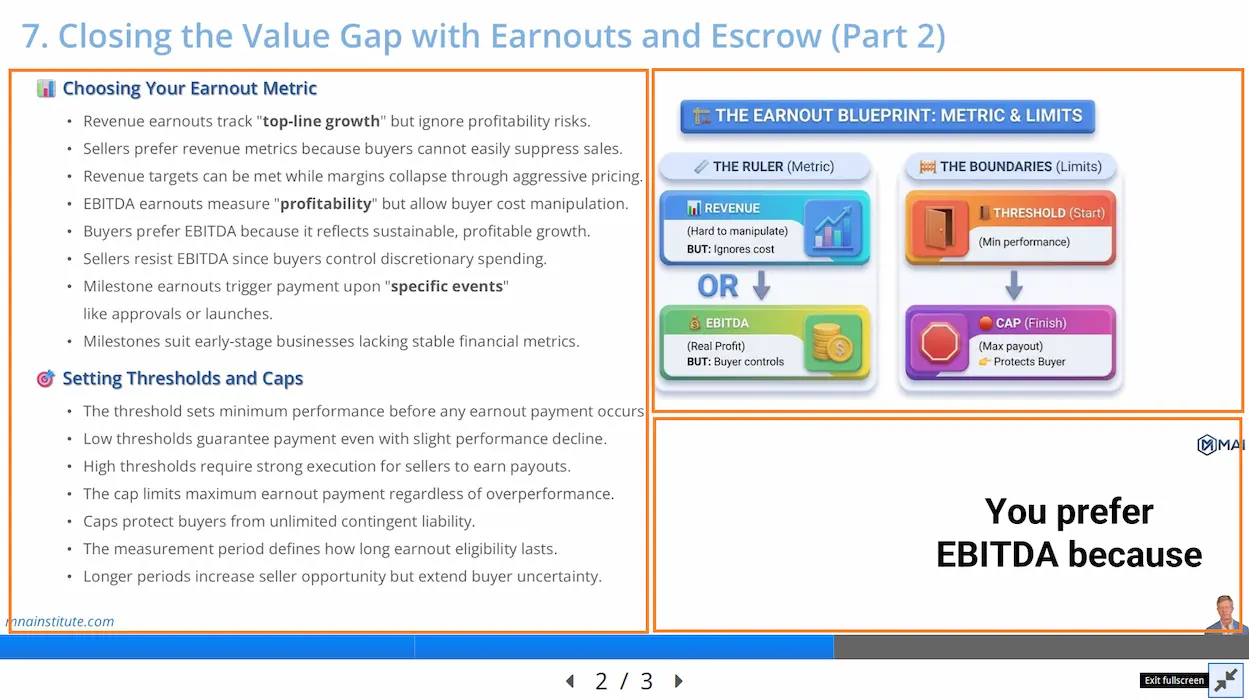

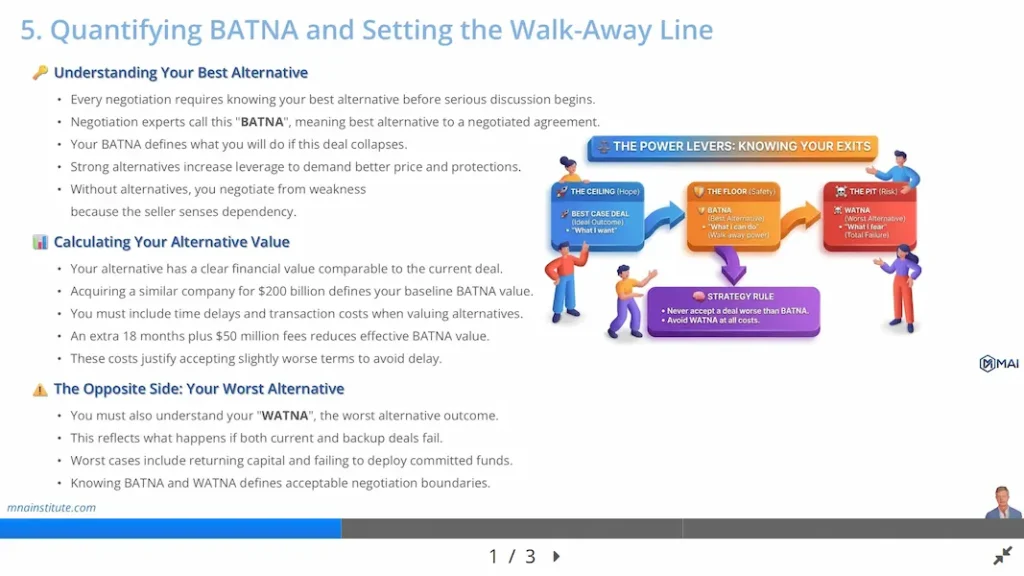

Every lesson follows a three-layer learning structure designed to help learners understand complex concepts quickly and intuitively.# Left Panel: Structured Written Content

Carefully edited bullet points guide you through each concept with clarity. Even reading the text alone ensures full comprehension. As the audio plays, your eyes naturally follow along, reinforcing understanding through synchronized reading and listening.# Right Panel: Visual Infographics

Colorful diagrams translate abstract ideas into concrete visuals. This graphic reinforcement transforms difficult concepts into intuitive, friendly frameworks you can grasp instantly, turning complexity into clarity.# Bottom: Audio Narration with Real-Time Subtitles

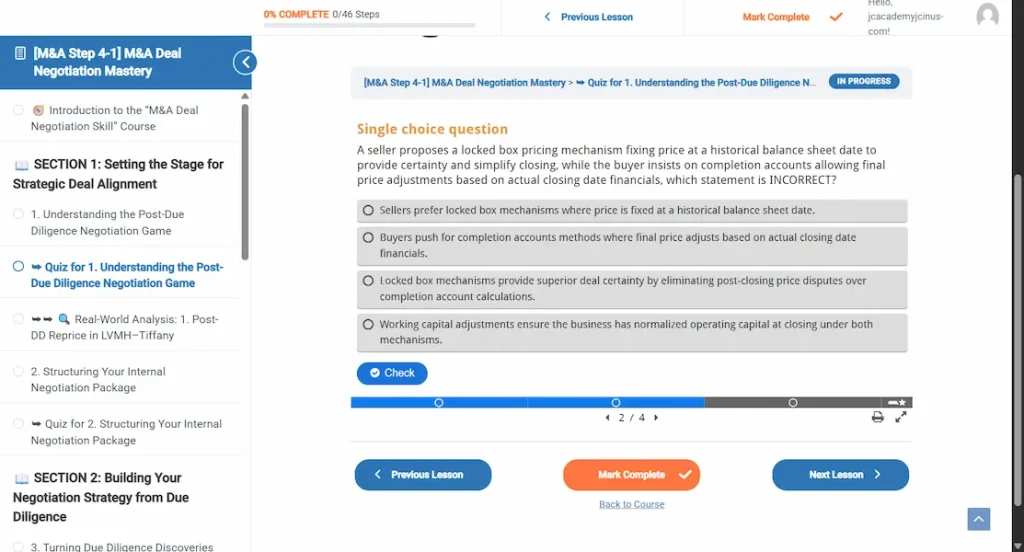

Live subtitles appear word-by-word as you listen. Adjust playback speed (0.5x to 2x) to match your learning pace. Fullscreen mode available for immersive focus. - Practical Application Quizzes

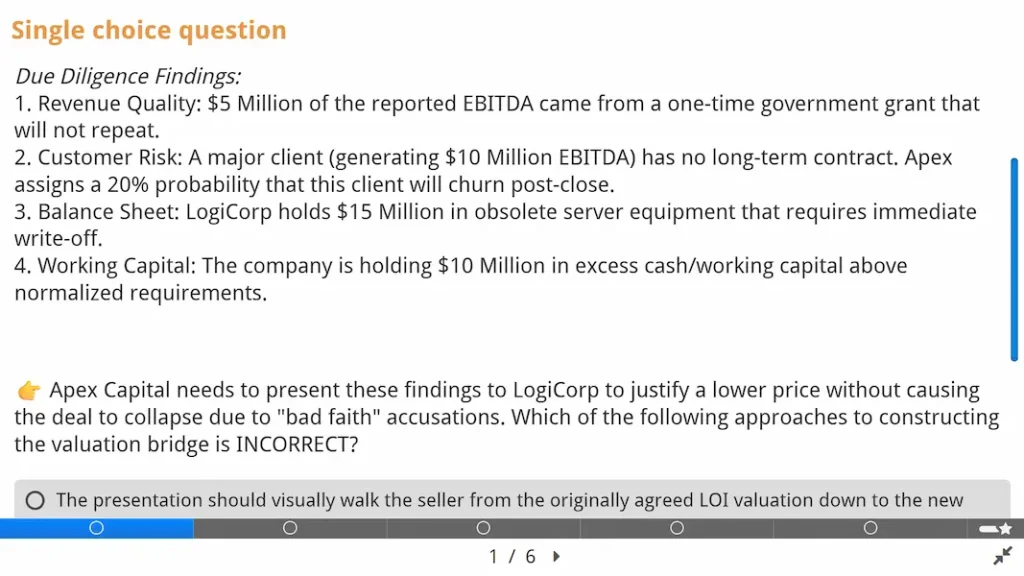

What you learn in the lesson becomes yours through targeted quizzes. Each question is designed with real-world scenarios, testing not just knowledge, but your ability to apply these concepts in actual deal situations. You'll discover exactly how to use what you've learned in practice. - Real-World Case Studies

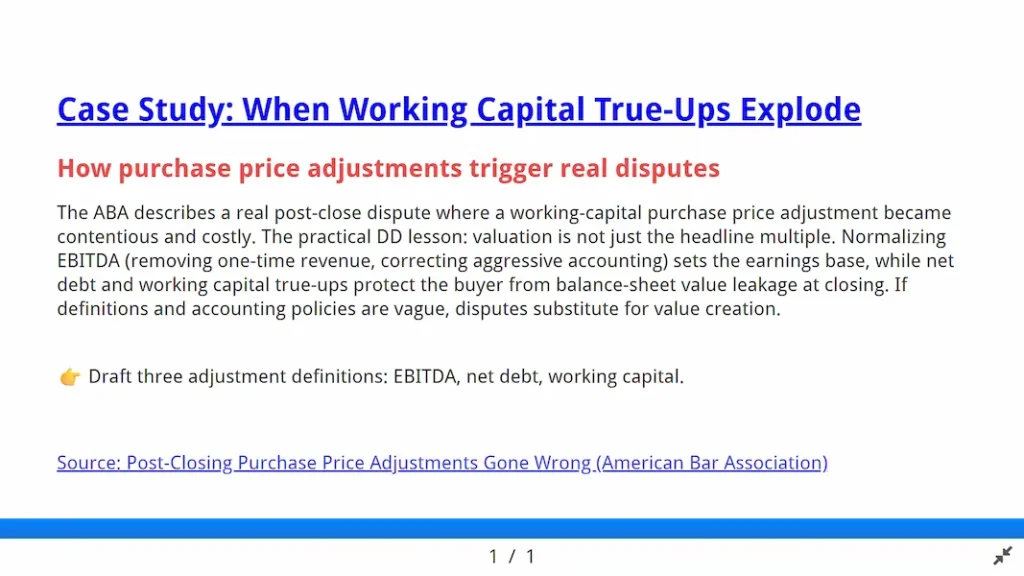

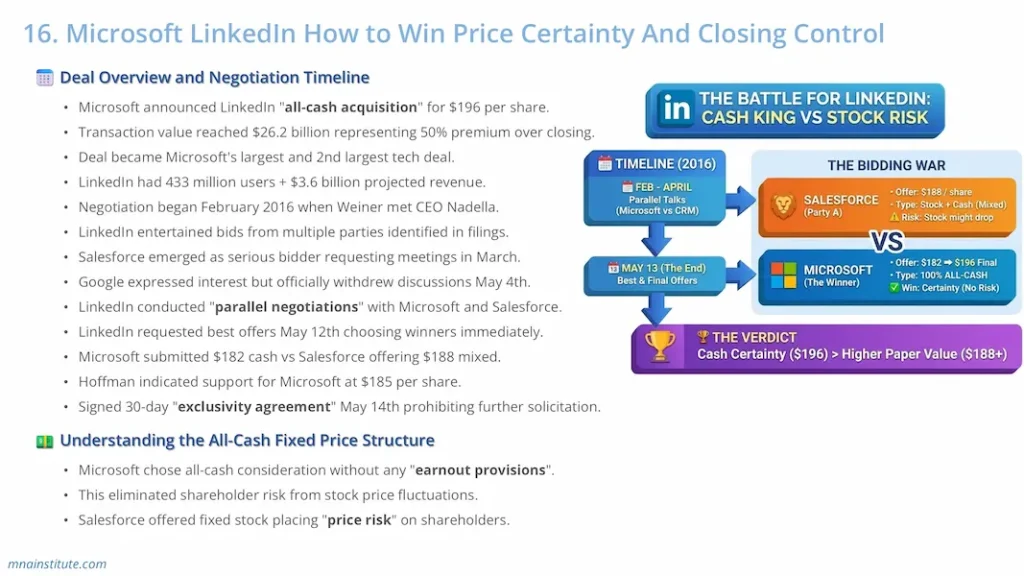

See theory meet reality. Explore how major deals, from household-name acquisitions to landmark transactions, actually implemented these exact concepts. Learn from what worked, what failed, and why, bridging the gap between classroom and boardroom.

The result? You don't just understand M&A. You master it, step by step, with confidence.

Visual Examples of Our Learning Tools

Sample Internal View of This Course

Course Content

Your Course Deliverables

Four Professional M&A Negotiation Templates

What You'll Build

- Negotiation Issue Map

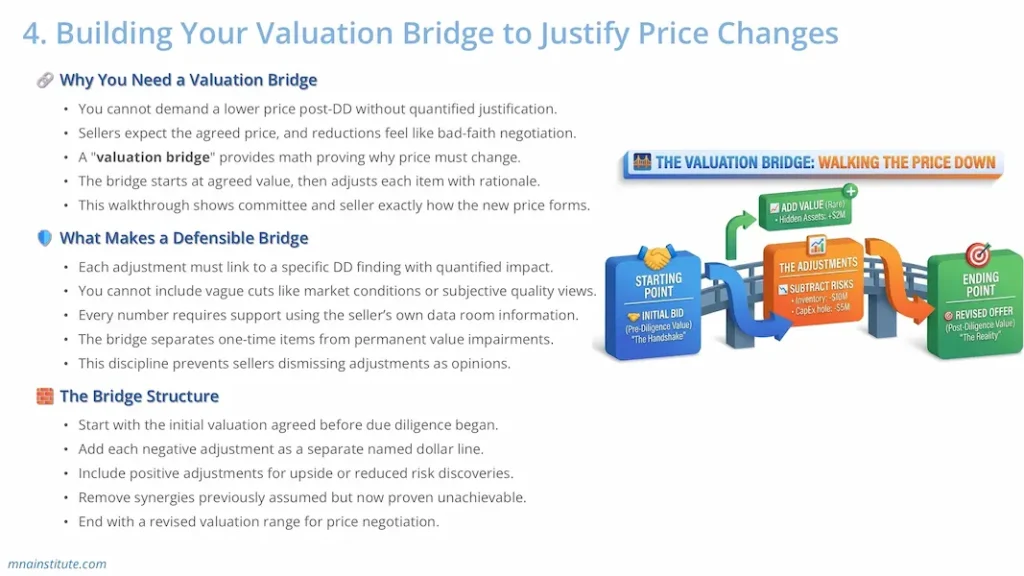

Strategic battle plan converting DD red flags into prioritized negotiation demands with financial impact, category classification, and fallback positions Four-category framework separating price reductions, balance sheet adjustments, legal protections, and conditions precedent Must-have versus tradeable ranking that aligns the deal team's M&A negotiation strategy before the first session begins - Valuation Bridge Model (Excel)

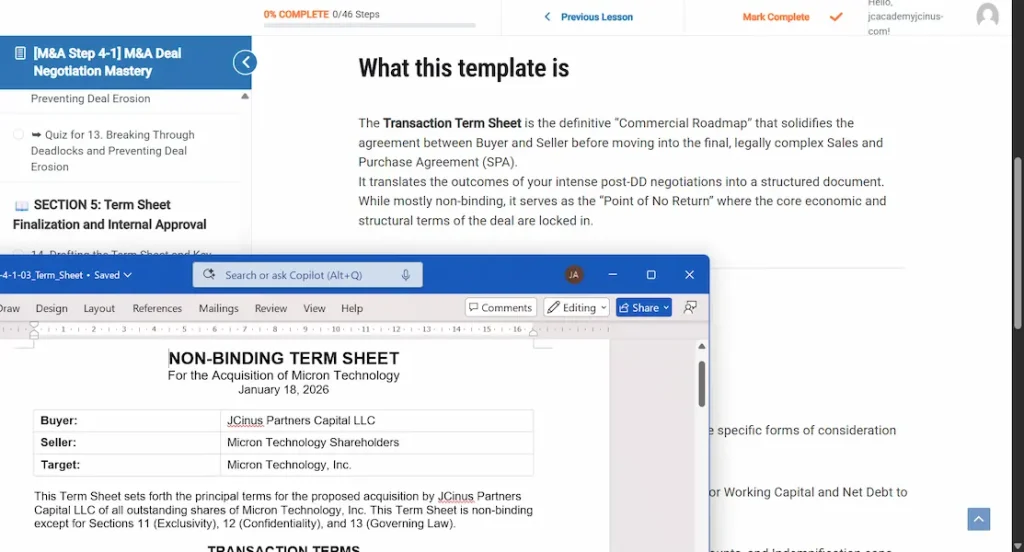

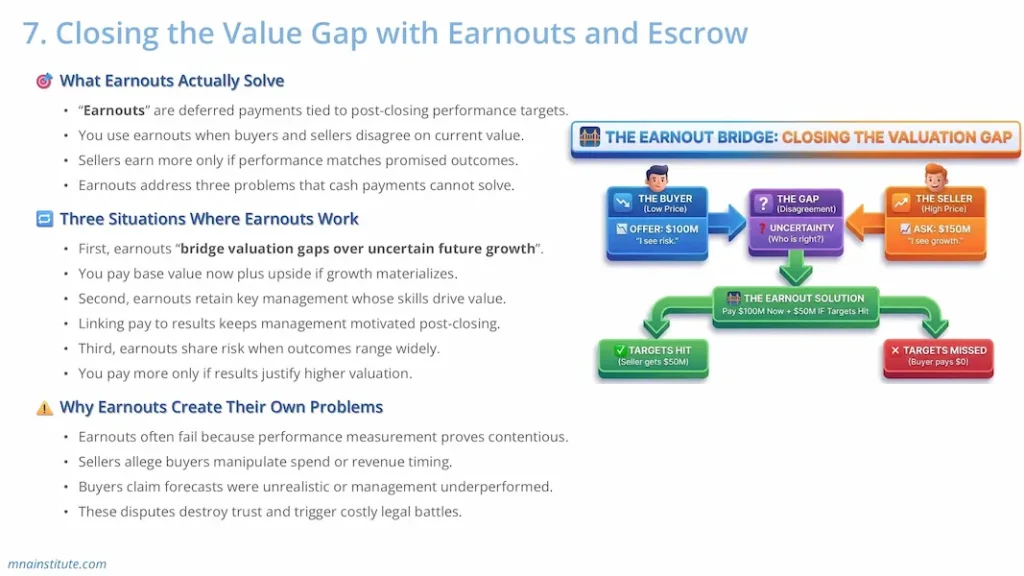

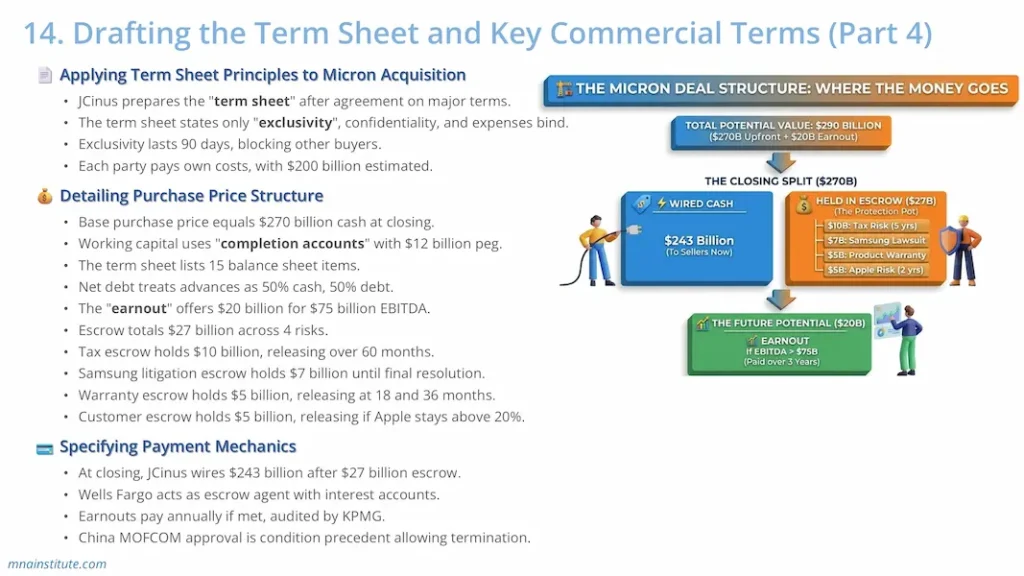

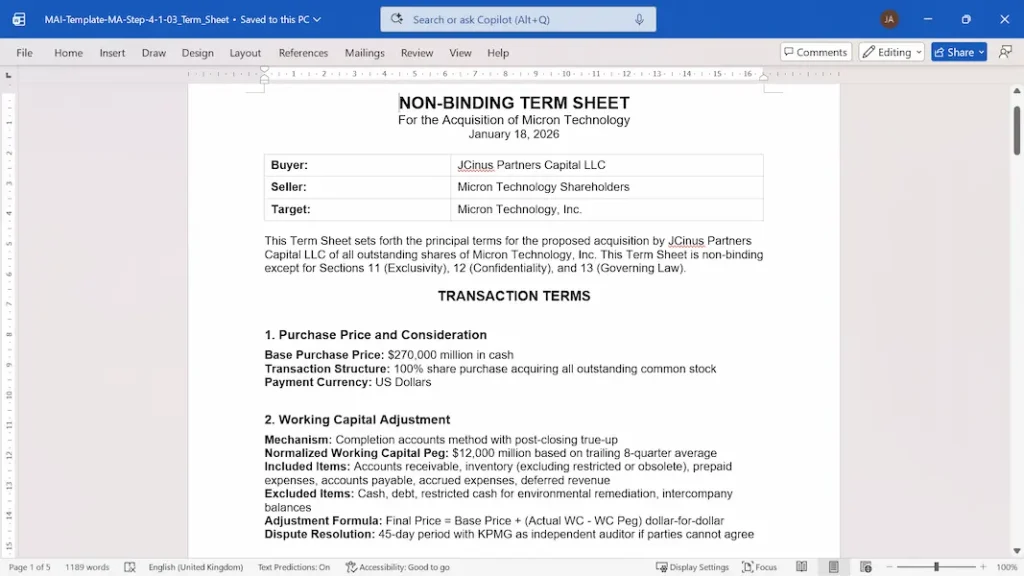

Quantitative price defense tool justifying the gap between pre-DD and post-DD valuation in three transparent adjustment tiers Normalized EBITDA, balance sheet true-ups, and synergy realignment built on DD findings — not arbitrary discounts Walk-away analysis integrated as a hard ceiling to enforce return discipline through the full M&A negotiation process - Transaction M&A Term Sheet

Commercial roadmap locking price, adjustment pegs, earnout triggers, escrow amounts, indemnification caps, and exclusivity before SPA drafting begins Binding exclusivity and confidentiality combined with non-binding commercial terms that frame the deal negotiation strategy for legal counsel Bridge document that converts negotiation outcomes directly into SPA drafting instructions, preventing deal drift in the final execution phase - Deal Committee Decision Memo

Internal persuasion tool proving deal viability to IC or Board through negotiated outcome comparison, risk and mitigant matrix, and downside scenario returns Formal authorization request built around fallback positions secured and must-have protections achieved during the M&A negotiation process Closing argument showing the deal meets minimum return hurdles even under stress scenarios approved in the original mandate

You will master the exact deal negotiation strategy architecture that prevents deal heat from overriding analytical discipline, protects enterprise value through structured risk-sharing, and documents every decision gate from DD findings through signed term sheet.

Advanced AI M&A Negotiation Simulation

Project Velocity: AI Tech Acquisition for a Legacy Manufacturer

This is an AI-powered role-play module where each scenario places you in a direct exchange with Chairman Arthur, testing your M&A negotiation strategy logic, deal structure judgment, and ability to defend positions under executive pressure.

You will act as Head of Corporate Development at Apex Motors, a $5B cash-rich manufacturer acquiring Neural Drive, an autonomous vehicle software startup with strong technology but high cash burn, open-source IP risk, and a founder determined to preserve independence.

You must navigate the complete M&A negotiation process across 10 progressive scenarios by:

- Justifying buy over build with growth gap quantification against a 3-year board mandate

- Designing deal structure, subsidiary versus merger, to protect talent retention and operational independence

- Applying asset versus stock purchase logic to isolate open-source litigation liability

- Building a valuation bridge that normalizes EBITDA and strips one-time items from the price base

- Structuring earnout, escrow, and SPA protections specifically against IP and cash burn risk

- Drafting the M&A term sheet framework and securing IC approval under walk-away discipline

Submit your response at each scenario and receive instant AI scoring

across theoretical accuracy, contextual relevance, and practical feasibility!

What You Will Gain from This M&A Negotiation Course

Run the full M&A negotiation process with the frameworks, templates, and judgment used in real deals.